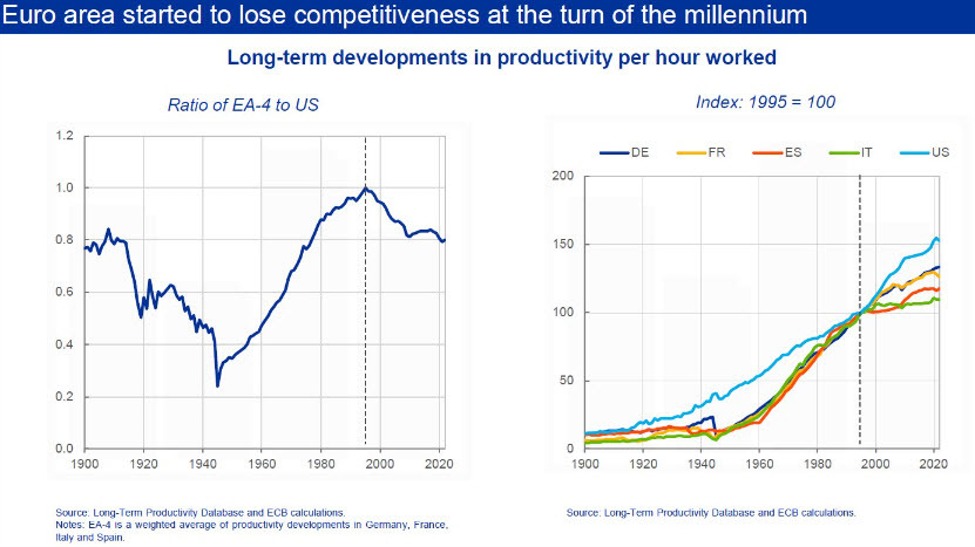

The euro hit a 20-year low in 2022 and the restoration since has been modest at greatest. In the event you have a look at fairness market efficiency, it is much more stark with the S&P 500 doubling the efficiency of the STOXX 600 from the monetary disaster lows.

Here is the issue, as highlighted by ECB Governing Council member Isabel Schnabel at the moment:

Europe vs US productiveness

She highlights a handful of causes and options:

- The US has invested much more closely in IT

- Excessive European obstacles to entry shield the rents of incumbents, cut back know-how diffusion and constrain the entry of youthful companies

- The dearth of enterprise capital

- Companies are smaller within the eurozone, and small companies make investments much less in IT

- “we need regulation that more strongly embraces and encourages competition”

- The only market permits companies to compete however integration stays disappointing, particularly in market providers. Monetary markets additionally stay segmented, contributing to capital misallocation

- we want extra public funding at nationwide and European ranges

Schnabel says that it is pressing to repair the issue, partly on account of power and demographic challenges in Europe, and I might argue it is the one strategy to spark a long-term flip within the euro.

Schnabel:

“Turning from laggard to leader requires a virtuous circle between investment and productivity growth. Governments need to strengthen competition, reduce bureaucracy and foster integration, channelling capital and labour towards their most productive uses.”