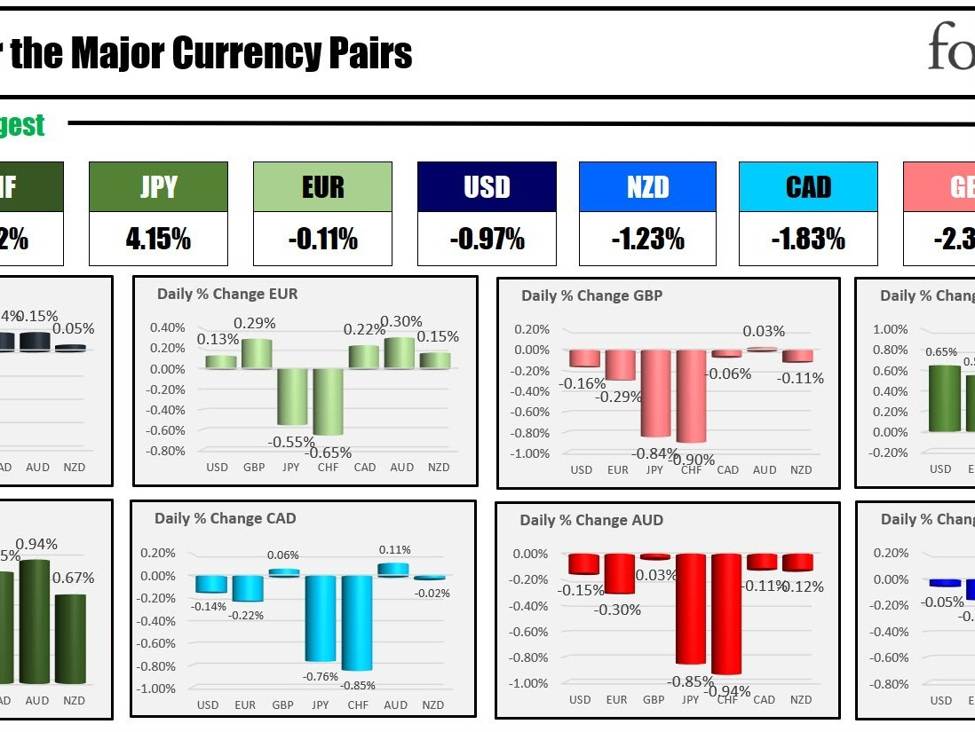

The strongest to the weakest of the key currencies

The CHF is the strongest and the AUD is the weakest because the NA session begins. The USD is combined to decrease due to declines vs the JPY and CHF. There are modest beneficial properties vs the GBP, CAD, AUD and NZD.

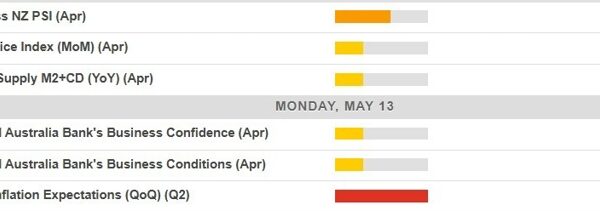

Right this moment, US preliminary jobless claims and US items commerce steadiness will probably be launched with preliminary wholesale inventories at 8:30 AM ET. Pending house gross sales will probably be launched at 10 AM ET.

US yields are modestly larger. US shares are combined after beneficial properties yesterday. The value of gold is buying and selling modestly decrease after closing at an all-time excessive yesterday.

A snapshot of the market at present reveals:

- Crude oil is $-0.83 or -1.16% at $3.25. At the moment yesterday, it was buying and selling at $74.49

- Gold is buying and selling down $-1.55 or -0.07% at $2076.04 . At the moment yesterday, it was buying and selling at $2068.10

- Silver is up 5.9 cents or 0.26% at $24.32. At the moment yesterday, it was buying and selling at $24.08.

- Bitcoin is buying and selling at $42,829. At the moment yesterday, it was buying and selling at $42,890

Within the premarket for US shares, the key indices are marginally combined. Yesterday the key indices all closed larger for the second day in row this week:

- Dow Industrial Common futures are implying a decline of -26 factors. Yesterday the index rose 111.19 factors or 0.30% at 37656.53

- S&P futures are implying a achieve of two.6 factors factors. Yesterday the index rose 6.85 factors or 0.14% at 478159. The all-time excessive closing degree at 4796.57.

- Nasdaq futures are implying a achieve of 53.25 factors. Yesterday the index rose 24.60 factors or 0.16% at 1509.18

Within the European fairness market, main indices are decrease:

- German DAX -0.22%

- France CAC -0.41%

- UK FTSE 100 -0.04%

- Spain’s Ibex -0.19%

- Italy’s FTSE MIB -0.23% (10 minute delay)

Within the Asian-Pacific market main indices had been combined:

- Japan’s Nikkei 225, -0.42%

- China’s Shanghai composite index rose 1.32%

- Hong Kong’s Dangle Seng index rose 2.52%

- Australia S&P/ASX +0.70%

Wanting on the US debt market, yields are decrease:

- 2-year yield 4.262% +2.0 foundation factors. Yesterday presently, the yield was at 4.282%

- 5-year yield 3.8.2 p.c +2.4 foundation factors. Yesterday presently, the yield was at 3.854%.

- 10-year yield 3.8.8 p.c +2.9 foundation factors. Yesterday presently, the yield was at 3.50%.

- 30-year yield 3.96% +2.5 foundation factors. Yesterday this time, the yield was at 4.001%

Within the European debt market, the benchmark 10-year yields are combined:

European benchmark 10-year yield