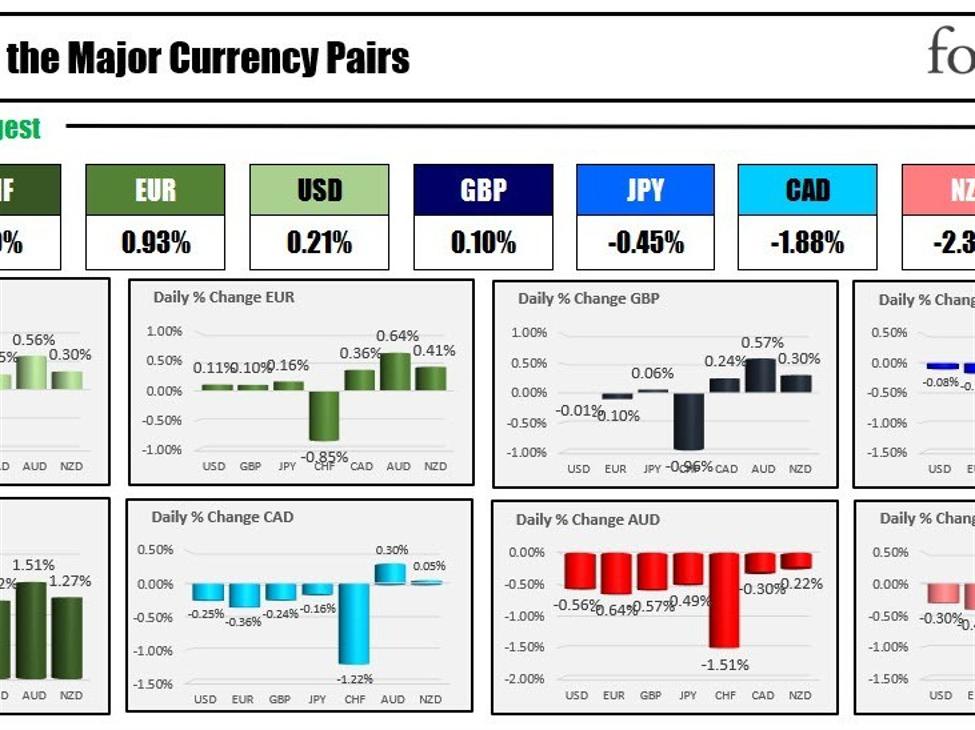

The strongest to weakest of the main currencies

Because the final buying and selling day of the yr commences, the CHF is the strongest and the AUD is the weakest. The USDCHF is buying and selling on the lowest stage since 2015. The EURCHF is on the lowest stage since at the least 1972 this week

The SNB sold foreign currency value round $45 billion within the third quarter of the yr, marking its second-largest foreign exchange sale since 2020. This transfer comes as a part of the SNB’s efforts to extend the worth of the Swiss franc to mitigate imported inflation.

Nonetheless, with Swiss inflation now inside the SNB’s goal vary under (falling to 1.4% in November), the current sale of foreign currency echange alerts a possible shift within the financial institution’s technique (why promote international forex and purchase CHF to decrease inflation if under the goal?).

Thomas Jordan, the Chairman of the SNB, indicated that the financial institution would not concentrate on international forex gross sales. This shift in technique follows a interval prior when the SNB actively purchased international forex (offered CHF) to counter the Swiss franc’s fast appreciation after which shifted to promoting in Q2 2022. Consequently, the Swiss franc has appreciated considerably towards the greenback and euro. The USDCHF reached its lowest stage since January 2015 (low reached 0.8300). The low at the moment reached 0.8332 earlier than rebounding and shutting at 0.8447 yesterday. The value of USDCHF is all the way down to 0.8377 at the moment with a low of 0.8356. The EURCHF is buying and selling on the lowest stage going again to 1972 (all the information I’ve).

The USD at the moment is combined/little modified with the dollar decrease vs the CHF and EUR, however increased vs the AUD, NZD and CAD at the moment. There aren’t any main financial releases at the moment.

The US inventory market is little modified because it strives for its ninth consecutive weekly rise. The Dow Industrial Common is up 0.87% for week, the S&P is up 0.60%, and the NASDAQ index is up 0.68%.

US yields are marginally increased. The ten-year yield yesterday moved to a low of three.789%. The closing stage for 2022 was at 3.886%. The present yield is just under that stage at 3.87%.

A snapshot of the markets presently exhibits:

- Crude oil is buying and selling up $0.50 or 0.70% at $72.27. At the moment yesterday, it was buying and selling at $73.25, earlier than promoting off into the shut.

- Gold is buying and selling down and greenback $0.99 or -0.1% at $2063.50. At the moment yesterday, it was buying and selling at $2076.04

- Silver is doing $0.28 or -1.12% $23.70. At the moment yesterday, it was buying and selling at $24.32.

- Bitcoin is buying and selling at $42,836. At the moment yesterday, it was buying and selling at $42,829

Within the premarket for US shares, the main indices are marginally combined. Yesterday the main indices closed combined with the Nasdaq index closing decrease. The S&P and Nasdaq index closed marginally increased:

- Dow Industrial Common futures are implying 15.25 factors. Yesterday, the index rose 53.58.40.14 p.c at 37710.10

- S&P futures are implying a decline of -0.10 factors. Yesterday, the index rose 1.77 factors or 0.04% at 4783.36. The index bought inside about three factors of the all-time excessive closing stage intraday, however backed off.

- Nasdaq futures are implying a decline of -14.97 factors. Yesterday the index fell -4.04 factors or -0.03% at 15095.14.

Within the European fairness market, main indices are decrease:

- German DAX +0.30%. For the shortened week the index is up 0.27%.

- France CAC +0.37%. For the week, the index is down -0.07%

- UK FTSE 100 +0.14%. For the week, the index is up 0.46%

- Spain’s Ibex +0.46%. For the week the index is up 0.21%.

- Italy’s FTSE MIB +0.39% (10 minute delay)

Within the Asian-Pacific market main indices have been combined:

- Japan’s Nikkei 225, -0.22%. For the week, the index rose 0.89%

- China’s Shanghai composite index , +0.60%. For the week, the index rose 2.06%

- Hong Kong’s Hold Seng index, +0.02%. For the week, the index rose 4.33%

- Australia S&P/ASX -0.31%. For the week, the index rose 1.20%

Wanting on the US debt market, yields are buying and selling increased:

- 2-year yield 4.291%, +1.0 foundation factors. Yesterday at the moment, the yield was at 4.262%

- 5-year yield 3.862% +1.6 foundation factors. Yesterday at the moment, the yield was at 3.820%

- 10-year yield 3.871% +2.4 foundation factors. Yesterday at the moment, the yield was at 3.88%

- 30-year yield 4.022% +3.3 foundation factors. Yesterday this time, the yield was at 3.96%

Within the European debt market, the benchmark 10-year yields are increased. This week German 10-year yields transfer to the bottom stage since December 13, 2022 at 1.877% earlier than rebounding again about 2% at the moment. Frances 10-year yield reached its lowest stage since January 18, 2023 close to 2.39% and bounced. UK 10-year yield’s moved to its lowest stage since April 2023 at 3.43%.

European benchmark 10-year yield’s