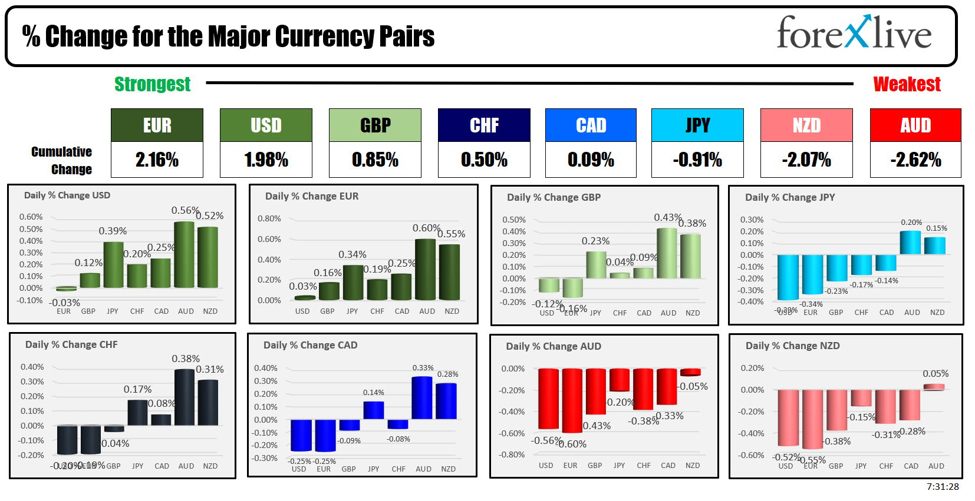

Because the North American session begins, the EUR is the strongest and the AUD is the weakest. The USD is stronger. US shares are marginally decrease. European shares are decrease as nicely. Yields are marginally larger.

In a single day, Australian retail gross sales got here in we will anticipated at -0.4% versus 0.2% anticipated. In China, Manufacturing and companies PMI got here in decrease than the earlier month.

- Manufacturing PMI got here in at 50.4, which is beneath the prior month worth of fifty.8.

- Non-Manufacturing PMI got here in at 51.2, which is beneath the prior month worth of 53.0.

The info helped to weaken the AUD and NZD who depend on China for development.

As we speak on the financial calendar in North America.

- Canada GDP MoM (8:30 AM ET). Estimate 0.3% versus 0.6% final month.

- US employment price index for the primary quarter (10 AM ET). 1.0% versus 0.9% final quarter

- US Case Schiller dwelling worth information for February will likely be launched (9 AM ET) with a acquire of 0.1% MoM and 6.7% YoY anticipated.

- US client confidence (10 AM ET). Estimate 104.0 versus 104.7 final month

Tomorrow is a much bigger day with the Federal Reserve charge choice at 2 PM. No change is predicted. Fed Chair Powell may have the muzzle taken off him (the quiet interval is over) and will likely be talking on his and the Feds newest projections for inflation/development/ employment and coverage when he holds his press convention at 2 PM ET.

The Fed choice will likely be adopted later this week by the US jobs report on Friday which is predicted to indicate one other sturdy acquire of 250K vs 303K final month. The unemployment charge is predicted at 3.8% (unchanged and nonetheless sturdy), and the typical hourly earnings are anticipated at 0.3%.

As we speak is an enormous day for earnings. Under are a abstract of the EPS and Revenues for among the main releases and a indication of in the event that they MISSED or BEAT expectations. There’s a completely different industries within the earnings at present with financials, manufacturing, meals and beverage, oil, industrial and healthcare all represented:

PayPal Holdings Inc (PYPL) MIXED

- Earnings: $1.08 (Missed expectations of $1.22)

- Income: $7.7 billion (Beat expectations of $7.51 billion)

Corning Inc (GLW) BEAT

- Earnings: $0.38 (Beat expectations of $0.35)

- Income: $3.26 billion (Beat expectations of $3.12 billion)

McDonald’s Corp (MCD) MIXED

- Earnings: $2.70 (Missed expectations of $2.72)

- Income: $6.17 billion (Beat expectations of $6.16 billion)

Archer-Daniels-Midland Co (ADM) MIXED

- Earnings: $1.46 (Beat expectations of $1.36)

- Income: $21.85 billion (Missed expectations of $22.27 billion)

Molson Coors Beverage Co (TAP) BEAT

- Earnings: $0.95 (Beat expectations of $0.74)

- Income: $2.60 billion (Beat expectations of $2.50 billion)

Coca-Cola Co (KO) BEAT

- Earnings: $0.72 (Beat expectations of $0.70)

- Income: $11.30 billion (Beat expectations of $11.01 billion)

Eli Lilly and Co (LLY) MIXED

- Earnings: $2.58 (Beat expectations of $2.46)

- Income: $8.768 billion (Missed expectations of $8.92 billion)

Marathon Petroleum (MPC) BEAT

- Earnings: $2.58 (Beat expectations of $2.42)

- Income: $33.2 billion (Beat expectations of $32.01 billion)

Eaton Company PLC (ETN) BEAT

- Earnings: $2.40 (Beat expectations of $2.29)

- Income: $5.943 billion (Beat expectations of $5.91 billion)

Restaurant Manufacturers Worldwide Inc (QSR) BEAT

- Earnings: $0.73 (Beat expectations of $0.72)

- Income: $1.74 billion (Beat expectations of $1.70 billion)

3M Co (MMM) BEAT

- Earnings: $2.39 (Beat expectations of $2.10)

- Income: $7.7 billion (Beat expectations of $7.63 billion)

Trane Applied sciences Inc (TT) BEAT

- Earnings: $1.92 (Beat expectations of $1.65)

- Income: $4.2 billion (Beat expectations of $4.1 billion)

GE Healthcare (GEHC) MISSED

- Earnings: $0.90 (Missed expectations of $0.91)

- Income: $4.6 billion (Missed expectations of $4.8 billion)

After the shut, it will get with Amazon, AMD, Tremendous Micro Computer systems and Starbucks all scheduled to launch. Apple will report their earnings after the shut on Thursday.

A snapshot of the opposite markets because the North American session begins presently exhibits.:

- Crude oil is buying and selling up by $0.46 at $83.11. At the moment yesterday, the worth was at $83.76

- Gold is buying and selling down $24.64 or -1.06% at $2310.90. At the moment yesterday, the worth was larger at $2337.11

- Silver is buying and selling down $0.60 or -2.25% at $26.52.. At the moment yesterday, the worth was at $27.33

- Bitcoin presently trades at $60,966 (and at session highs – the excessive worth attain $64,714). At the moment yesterday, the worth was buying and selling at $62,310

Within the premarket, the US main indices are buying and selling modestly larger after beneficial properties in coaching final week.

- Dow Industrial Common futures are implying a decline of -42.09 level. Yesterday, the index rose 146.43 factors or 0.38% at 38386.10

- S&P futures are implying a decline of -5.97 factors. Yesterday, the index rose 16.21 factors or 0.22% at 5116.16

- Nasdaq futures are implying a decline of -24.97 factors. Yesterday, the index rose 55.18 factors for 0.35% at 15983.08

The European indices are buying and selling largely decrease forward of the US inventory open (exception is a UK FTSE 100):

- German DAX, -0.39%

- France CAC , -0.19%

- UK FTSE 100, +0.50%

- Spain’s Ibex, -1.58%

- Italy’s FTSE MIB, -0.40% (delayed 10 minutes)

Shares within the Asian Pacific markets had been largely larger

- Japan’s Nikkei 225, +1.24%

- China’s Shanghai Composite Index, -0.26%

- Hong Kong’s Hold Seng index, +0.09%

- Australia S&P/ASX index, +0.35%

Wanting on the US debt market, yields are largely decrease after rising yesterday after the GDP information.

- 2-year yield 4.974%, +0.2 foundation factors. At the moment yesterday, the yield was at 4.978%

- 5-year yield 4.651% +1.3 foundation factors at the moment yesterday, the yield was at 4.653%

- 10-year yield 4.61%, +1.0 foundation factors. At the moment yesterday, the yield was at 4.623%

- 30-year yield 4.738%, +0.2 foundation factors. At the moment yesterday, the yield was at 4.737%

Wanting on the treasury yield curve spreads moved extra inverted:

- The two-10 yr unfold is at -35.3 foundation factors. At the moment yesterday, the unfold was at -35.5 foundation factors

- The two-30 yr unfold is at -23.3 foundation factors. At the moment yesterday, the unfold was at -24.2 foundation factors

European benchmark 10-year yields are larger:

European benchmark 10 yr yields