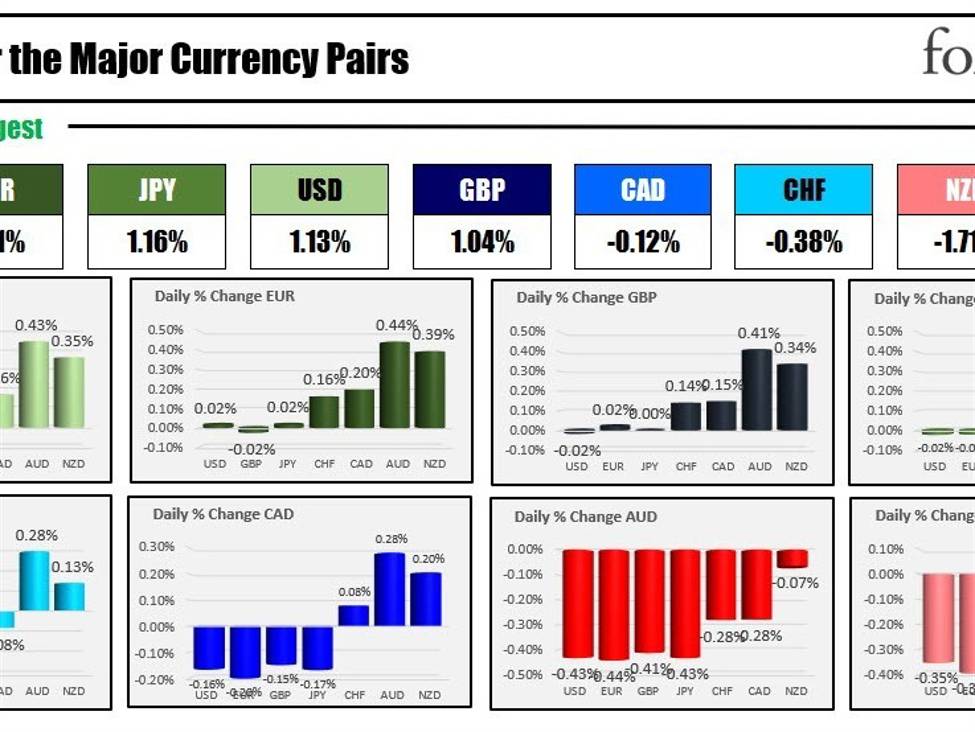

The strongest to weakest of the main currencies

Because the North American session begins, the EUR is the strongest and the AUD is the weakest. The USD is usually increased within the morning snapshot. Admittedly, the main currencies are largely scrunched collectively. The order can change rapidly.

On Friday, the US jobs report got here out stronger than anticipated. The Unemployment charge was decrease, the NFP knowledge was stronger for the month, the wages had been increased. Nonetheless, the main focus rapidly shifted to a different view. There was a bizarre shift within the participation charge which decrease the unemployment charge, the prior 2-months of NFP had been revised decrease by -71K, the ADP report on wages the day earlier than was displaying a slowing of wages over time, not the will increase seen within the BLS knowledge. I additionally heard rumblings that the info is turning into extra unreliable as reliability on surveys might be tough. Who picks up the cellphone from the BLS or the US authorities? Who picks up the cellphone from somebody they do not know?

Afterward Friday, the ISM companies index got here in a lot weaker than anticipated at 50.6 vs 52.5 estimate, with employment plunging to 43.3 – the bottom since July 2020 as Covid unfold. New orders fell to 52.8 vs 56.1 estimate. That contradicted any ideas of power from the US jobs report.

Over the weekend, the FAA grounded some Max 737 planes on account of the blowout of the a part of a aircraft in midair. Shares of Boeing are down about -$20 or -7.9% because of this. The

Optimistic information out of Washington was that the Dems and GOP reached a consensus to determine the 2024 fiscal yr’s federal spending cap at round $1.66 trillion. This settlement – because of “substantial compromises” – will facilitate crucial legislative measures. The agreed-upon spending plan nonetheless requires approval from each the Home and the Senate, adopted by President Joe Biden’s signature to turn out to be regulation (is predicted)

Crude oil costs are transferring decrease to start out the week after Saudi Arabia reduce costs for Asian crude exports. Focus returns to slower world demand. Saudi Arabia on the worth to the bottom degree in 27 months.

Atlanta Fed president Bostic speaks at 12 PM ET right now. Client credit score shall be launched at 3 PM.

This week within the US focus shall be on CPI on Thursday with expectations of 0.2% for the month/month headline. The Core measure can also be anticipated at 0.2%.. The YoY headline is predicted to return in at 3.2% vs 3.1% final month. A yr in the past, the MoM fell -0.1%. That can make a decline within the YoY tough this month. Nonetheless, the subsequent 2 months can have features of 0.5% and 0.4% roll off which ought to result in an extra decline within the YoY measures.

A snapshot of the markets because the North American session begins at the moment reveals:

- Crude oil is buying and selling down $2.13 or -2.89% at $71.68. Right now Friday, the worth was at $72.79

- Gold is buying and selling down $25.02 or -1.22% at $2020.50. Right now Friday, it was buying and selling at $2039.31

- Silver is buying and selling down $-0.29 or -1.29% at $22.86. Right now Friday, it was buying and selling at $23.00

- Bitcoin traded at $44,679. Right now Friday, the worth was buying and selling at $43,996. The excessive worth right now prolonged to $45,200. The value closed on Friday at $44,184

Within the premarket for US shares, the main indices are buying and selling combined after snapping 9-week successful streaks final week:

- Dow Industrial Common futures are implying a decline of -145 factors. On Friday, the index rose 25.77 factors or 0.07%

- S&P futures are implying a decline of -2.9 factors. On Friday, the index rose 8.54 factors or 0.18%

- Nasdaq futures are implying a acquire of 5.52 factors. On Friday,, the index rose 13.77 factors or 0.09%

Within the European fairness markets, the main indices are all buying and selling decrease:

- German DAX, 0.15%. On Friday the index fell -0.14%

- France CAC – 0.03%. On Friday, the index fell -0.40%

- UK FTSE 100 -0.22%. On Friday, the index fell -0.43%

- Spain’s Ibex -0.05%. On Friday, the index fell -0.18%.

- Italy’s FTSE MIB -0.16% (delayed by 10 minutes).

Shares within the Asian Pacific markets had been largely decrease:

- Japan’s Nikkei 225, +0.27%

- China’s Shanghai composite index , -1.42%

- Hong Kong’s Grasp Seng index, -1.88%

- Australia S&P/ASX, -0.50%

Wanting on the US debt market, yields are buying and selling marginally increased:

- 2-year yield 4.401% +1.1 foundation level. Yesterday presently, the yield was at 4.412%

- 5-year yield 4.029% +2.2 foundation factors. Yesterday presently, the yield was at 4.020%

- 10-year yield 4.062% +2.1 foundation factors. Yesterday presently, the yield was at 4.04%

- 30-year yield 4.218% +1.9 foundation factors. Yesterday presently, the yield was at 4.190%

- The two-10 yr unfold is at -34.1 foundation factors. Right now yesterday, the unfold was at -37.2 foundation factors

- The two-30 yr unfold is at -18.4 foundation factors. Right now yesterday, the unfold was at -22.3 foundation factors

Within the European debt market, the benchmark 10-year yields are increased:

European 10 yr yields