For decades, CPI was the standard U.S. inflation gauge, but in 2000 Alan Greenspan announced the Fed would instead rely on the Personal Consumption Expenditures (PCE) index, which provides a broader and more adaptive measure. Unlike CPI’s fixed basket, PCE adjusts weights more often, captures substitution effects, and places more emphasis on healthcare rather than heavily weighting shelter costs like CPI. This methodological gap means CPI usually runs about 0.4 percentage points higher, with the difference widening sharply in mid-2022.

Despite the Fed’s preference, markets remain fixated on CPI because of habit and timing. Traders stick to what everyone else reacts to, and CPI is released about two weeks earlier than PCE, making it the first mover for futures and pre-market positioning. This timing ensures CPI drives short-term volatility—equity market swings are roughly twice as large after CPI releases versus PCE.

For now, CPI dominates market psychology, while PCE lingers in the background—even though it matters more to Fed policy.

—

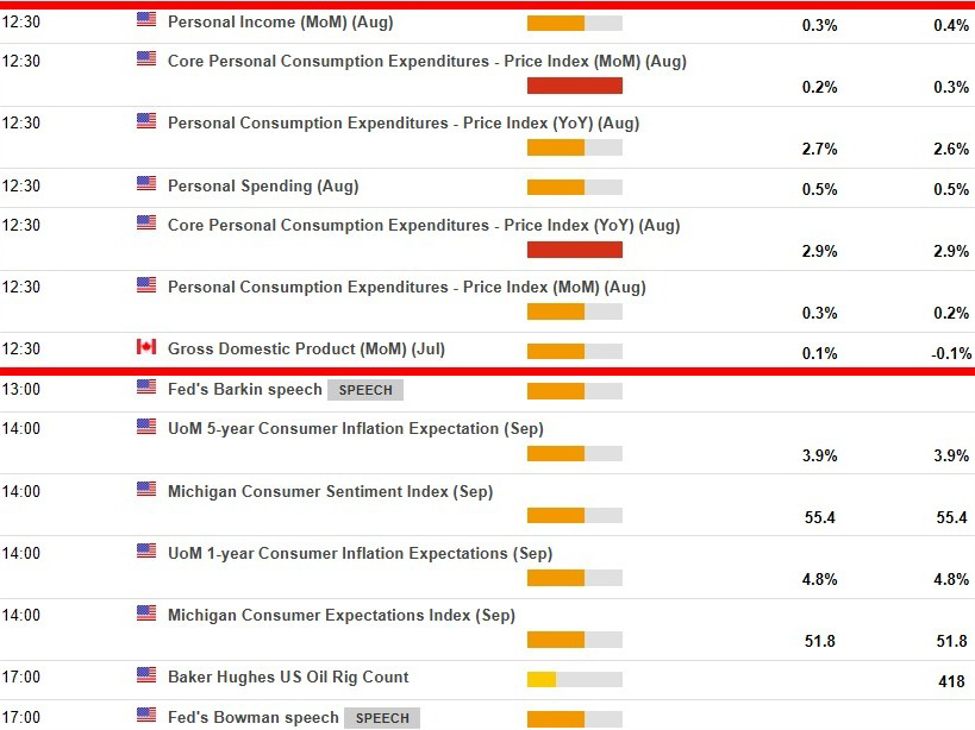

The August PCE report is due on Thursday, September 25, 2025 at 1230 GMT / 0830 US Eastern time.