The Federal Reserve’s early reappointment of its regional bank presidents took markets by surprise and eased concerns the central bank would soon lose its independence as President Donald Trump continues demanding steeper rate cuts.

On Thursday, the Fed announced 11 out its 12 bank presidents were re-upped, except for the Atlanta Fed chief role as Raphael Bostic had announced previously that he’s stepping down.

The presidents’ five-year terms were due to end in February, and prior reappointments have typically come closer to expiration dates as they historically have been routine affairs. But recent suggestions from the Trump administration that new conditions ought to be placed on the presidents raised concerns it was seeking a wider leadership shakeup.

Earlier this month, Treasury Secretary Scott Bessent floated a three-year residency requirement for Fed presidents. Days later, National Economic Council Director Kevin Hassett, who is the frontrunner to become the next Fed chair, endorsed the idea.

While Fed presidents are nominated by governing boards drawn from their respective districts, the Fed’s board of governors approve them. As a result, tipping the balance of power on the Fed board with Trump appointees could conceivably give them the ability to reshape the Fed presidents as well.

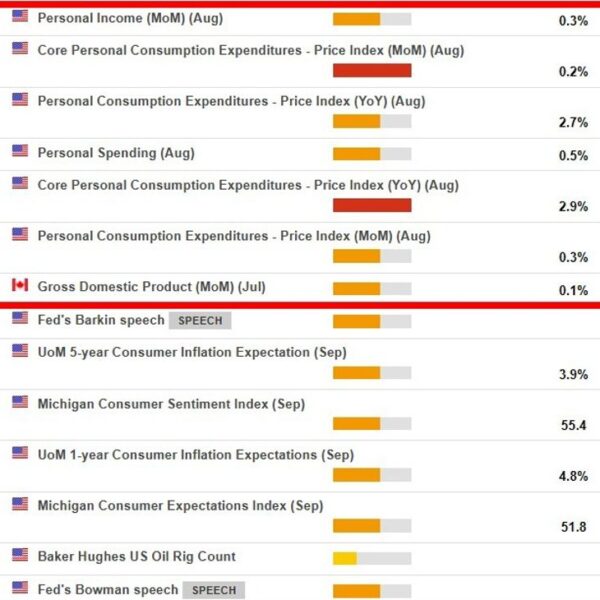

Meanwhile, the rate-setting Federal Open Market Committee is comprised of the seven members of the Fed board, plus five of the 12 Fed presidents, with four of them rotating on an annual basis. In recent FOMC meetings—including Wednesday’s—Fed presidents have been more resistant to rate cuts while Trump-appointed governors have been more aggressive in calling for cuts.

Deutsche Bank strategist Jim Reid pointed out in a note on Friday the 10-year Treasury yield edged higher after the Fed’s reappointment announcement, as bond investors priced in fewer rate cuts.

“The regional presidents’ current terms expire in February so the advance announcement suggests that the Board was united in wanting to avoid the risk that the reappointment process raises questions over Fed independence,” he added.

Justin Wolfers, a professor of public policy and economics at the University of Michigan, was more blunt about the Fed’s surprise news.

“If I’m reading this properly, they just Trump-proofed the Fed,” he wrote in a post on X.

What’s also notable about the reappointment is the unanimous decision to bring back the Fed presidents suggests the Trump-appointed governors went along with it as well.

That includes Stephen Miran, who is on leave as the White House’s chairman of the Council of Economic Advisers while filling a vacancy on the Fed.

Prior to joining the administration, he had urged an overhaul of the Federal Reserve to give at-will power to the U.S. president to fire Fed board members and Fed bank presidents; hand over control of the Fed’s operating budget to Congress; and shift the Fed’s regulatory responsibility over banks and financial markets to the Treasury.

The changes would diminish the Fed’s power in favor of the White House so much analysts at JPMorgan warned earlier this year Miran’s appointment “fuels an existential threat as the administration looks likely to take aim at the Federal Reserve Act to permanently alter U.S. monetary and regulatory authority.”