Westend61 | Westend61 | Getty Photos

The fourth-quarter estimated tax deadline is Jan. 16, and you can have a shock invoice or owe a penalty for those who do not ship a fee, in response to the IRS.

Whereas many employers withhold levies from each paycheck, different earnings — reminiscent of freelancing, small enterprise or funding earnings — requires a separate fee to the IRS.

Usually, you have to make quarterly estimated funds for this earnings for those who anticipate 2023 tax legal responsibility of $1,000 or extra.

In December, the IRS reminded such taxpayers to make a fourth-quarter tax fee on or earlier than Jan. 16 “to avoid a possible penalty or tax bill when filing in 2024.”

Extra from Private Finance:

Biden administration to forgive certain student loan borrowers’ balances early

What to know before adding bitcoin exchange-traded funds to your portfolio

Taxpayer advocate: Tax identity theft victims face ‘unconscionable’ IRS delays

“By making those payments, you avoid having to pay the IRS even more on April 15,” mentioned licensed public accountant Tom Wheelwright, CEO of WealthAbility.

For those who miss the estimated tax fee deadline, you could set off a late penalty of 0.5% of your unpaid steadiness per 30 days or partial month, as much as 25%, plus curiosity, which is currently 8%.

What to know concerning the ‘protected harbor’ guidelines

Filers can keep away from an underpayment penalty by following the “safe harbor” tips, in response to Mark Steber, chief tax info officer at Jackson Hewitt.

You meet the necessities by paying no less than 90% of the present yr’s tax legal responsibility or 100% of final yr’s taxes, whichever is smaller.

But when your 2022 adjusted gross earnings was $150,000 or extra, it’s worthwhile to pay the lesser of 90% of the present yr’s tax legal responsibility or 110% of final yr’s taxes to fulfill the protected harbor requirement for 2023. You could find adjusted gross earnings on line 11 of Form 1040 out of your 2022 tax return.

“A really good tax projection [for 2023] is something that you need to think about right now,” Steber added.

The right way to make quarterly estimated tax funds

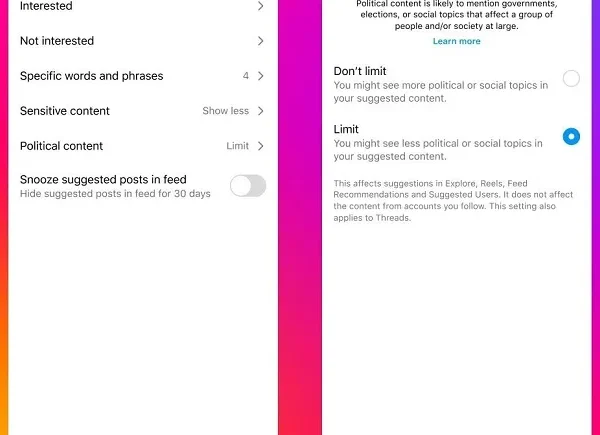

With restricted time till the deadline, “the fastest and easiest” possibility for remitting funds to the IRS is through digital funds, in response to the company. Listed here are your choices:

For those who pay by sending a verify within the mail, Wheelwright recommends sending it through licensed mail with a return receipt as a result of you could “have to prove that you made it on time.”

Do not miss these tales from CNBC PRO: