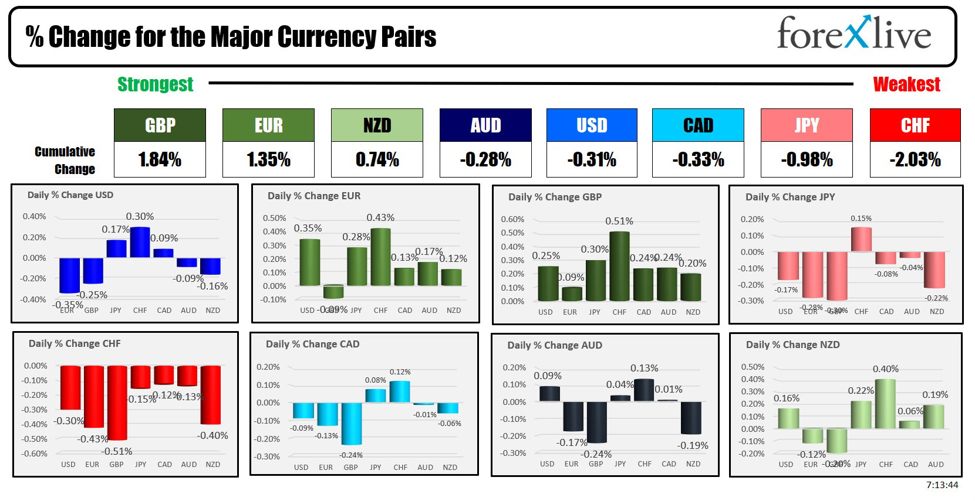

The strongest to weakest of the major currencies

As the NA session begins the GBP is the strongest and the CHF is the weakest.

The UK election is approaching on July 4 with Labour expected to win the majority. An exit poll will be released at 22:00 BST/5 PM EST, with expectations of a strong Labour majority. The outcome is largely priced in, so any GBP movement may be brief. Post-election focus will be on Labour’s budgetary measures, aiming for low taxes and economic stability. Markets doubt current spending plans are fully funded, suggesting possible tax rises in the Autumn budget. The election is not expected to affect the BoE’s rate easing plans. Other potential outcomes include a small Labour majority, a hung parliament, or an unlikely Conservative victory.

Over the weekend, France’s far-right National Rally party and its allies secured 33% of the vote in the first round of parliamentary elections, followed by the leftwing New Popular Front at 28% and President Emmanuel Macron’s centrist bloc at 20%. The euro and the CAC 40 index both rose in response to the results. The EURUSD rallied in response trading to the highest level since June 13, but has backed off over the last few hours of trading. .

Today, the PMI data out of Europe was mixed:

- Spanish Manufacturing PMI: Actual 52.3 vs. Estimate 53.1, Previous 54.0 (WORSE).

- Swiss Manufacturing PMI: Actual 43.9 vs. Estimate 45.2, Previous 46.4 (WORSE).

- Italian Manufacturing PMI: Actual 45.7 vs. Estimate 44.3, Previous 45.6 (BETTER).

- French Final Manufacturing PMI: Actual 45.4 vs. Estimate 45.3, Previous 45.3 (MET).

- German Final Manufacturing PMI: Actual 43.5 vs. Estimate 43.4, Previous 43.4 (MET).

- Eurozone Final Manufacturing PMI: Actual 45.8 vs. Estimate 45.6, Previous 45.6 (BETTER).

- UK Final Manufacturing PMI: Actual 50.9 vs. Estimate 51.4, Previous 51.4 (WORSE).

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $0.42 or 0.52% at $81.96. At this time Friday, the price was at $82.09

- Gold is trading up $11.57 or 0.50% at $2338. At this time Friday, the price was trading at $2335.32

- Silver is trading at $0.16 or 0.59% at $21.29. At this time on Friday, the price is trading at $29.48.

- Bitcoin trades sharply at $62,600. At this time Friday, the price was trading up at $61,314

- Ethereum is also trading at $3458.90. At this time Friday, the price was trading at $3436

In the premarket, the snapshot of the major indices are trading higher in premarket trading after small changes last week

- Dow Industrial Average futures are implying a gain of 68.14 points. On Friday, the Dow Industrial Average fell 45.20 points or -0.12% at 39118.87. The index fell -0.08%.

- S&P futures are implying a gain of 11.02 points points. On Friday, the S&P index closed down -22.3 nonpoint or -0.41% at 5460.49. The index rose 0.08% last week.

- Nasdaq futures are implying a gain of 37.90 points. On Friday, the NASDAQ index fell -126.08 points or -0.71% at 17732.60. The index rose 0.24% less food

European stock indices are trading higher in morning European trading to start the trading week:

- German DAX, 0.58%

- France CAC +1.73%

- UK FTSE 100, +0.41%

- Spain’s Ibex, +1.23%

- Italy’s FTSE MIB, +1.80% (delayed 10 minutes)..

Shares in the Asian Pacific markets were mixed

- Japan’s Nikkei 225, +0.12%

- China’s Shanghai Composite Index, +0.92%

- Hong Kong’s Hang Seng index, +0.01%

- Australia S&P/ASX index, -0.22%

Looking at the US debt market, yields are lower.

- 2-year yield 4.758%, +0.2 basis points. At this time Friday, the yield was at 4.681%

- 5-year yield 4.392%, +1.4 basis points. At this time Friday, the yield was at 4.271%

- 10-year yield 4.414%, +1.4 basis points. At this time Friday, the yield was at 4.269%

- 30-year yield 4.579%, +2.0 basis points. At this time Friday, the yield was at 4.414%

Looking at the treasury yield curve the spreads are steady

- The 2-10 year spread is at -34.4 basis points. At this time Friday, the spread was at -41.2 basis points.

- The 2-30 year spread is at -18.4 basis points. At this time Friday, the spread was at -26.2 basis points.