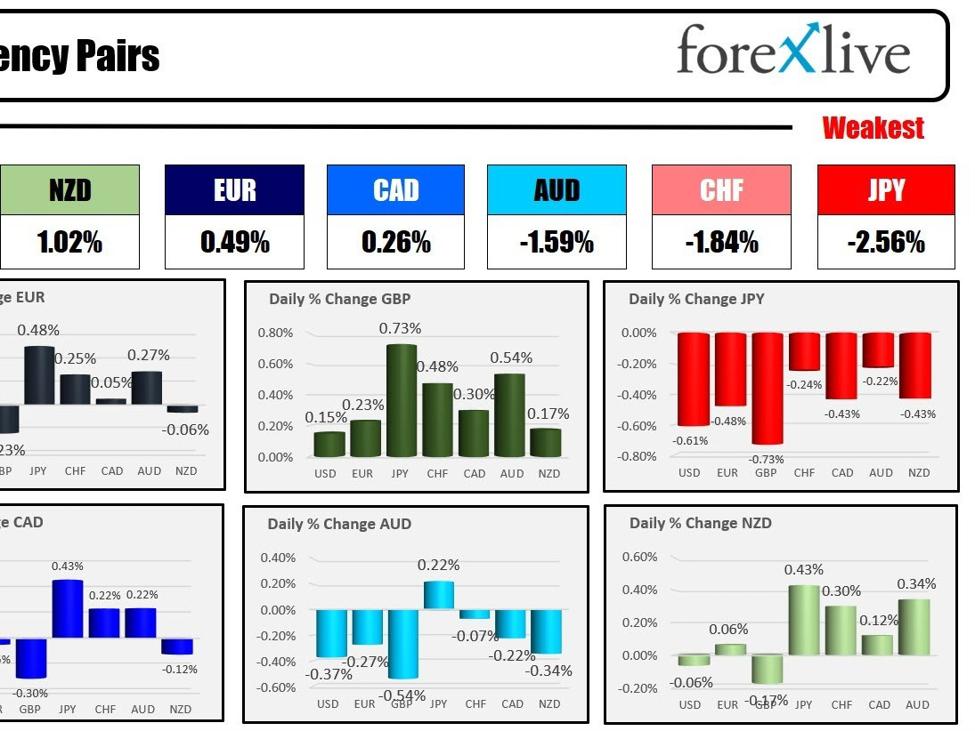

The strongest to the weakest of the most important currencies

The GBP is the strongest and the JPY is the weakest because the North American session begins. The USD is generally greater after it was the strongest of the most important currencies throughout buying and selling yesterday. US yields had been greater yesterday. They’re greater once more at the moment. The ten-year yield closed 2023 only a few foundation factors beneath the top of yr stage of three.886% (at 3.86%). Immediately, that yield is as much as 3.99%. The US shares began the yr with the Nasdaq tumbling -245.41 factors (or -1.63%). The Nasdaq at the moment is down about 1/2 that as implied by the futures. Keep in mind, the most important indices are engaged on a 9-week profitable streak. That streak is in danger within the holiday-shortened week (however we do have a key jobs report on Friday to mull over). Yesterday, shares had been influenced by a downgrade of Apple by Barclays forward of the open (Apple shares fell -3.64% yesterday and are down -0.57% in premarket buying and selling).

Immediately the Fed will launch the assembly minutes from the December assembly. That launch will happen at 2 PM ET. The Fed saved charges unchanged. Fed Powell’s feedback had been extra dovish. The Fed dot plot forecasts a decline in charges in 2024 to 4.6% from 5.40%. The markets took that concept a bit additional with expectations for about 160 pips of cuts. That concept could also be waning a bit, however focus can be on what’s forward economically, and the roles report on Friday can be a key indicator.

Along with the Fed minutes, at the moment the ISM manufacturing index can be launched with expectations of 47.1 versus 46.7 final month. The costs paid part is anticipated to say no to 47.5 from 49.9. Lastly, employment is anticipated to rise to 46.1 from 45.8 final month. Additionally at 10 AM, the JOLTs job openings are anticipated to return in at 8.850M vs 8.733M final month.

A snapshot of the markets because the North American session begins at the moment reveals:

- Crude oil is buying and selling up $0.42 or 0.60% at $70.79 after falling yesterday on issues about slower world progress. At the moment yesterday, the worth was at $73.08

- Gold is buying and selling down -$12.50 or -0.60% at $2046.51. At the moment yesterday, it was buying and selling at $2067.31

- Silver is buying and selling down -$0.33 or -1.42% at $23.30. At the moment yesterday, it was buying and selling at $23.88

- Bitcoin traded at . At the moment yesterday, the worth was buying and selling at $45,452.

Within the premarket for US shares, the most important indices are decrease after blended outcomes yesterday. The Dow Industrial Common rose modestly by 25.50 factors yesterday however the S&P and NASDAQ index assist with the NASDAQ the worst performer (-1.63%).

- Dow Industrial Common futures are implying a decline of -127 factors.. Yesterday the index rose 25.50 factors or .0.07%

- S&P futures are implying a decline of -20.58 factors.. Yesterday the index fell -27.00 factors or -0.57%

- Nasdaq futures are implying a decline of -112.65 factors. Yesterday, the index fell -245.41 factors or -1.63%

Within the European fairness markets, the most important indices are all buying and selling decrease:

- German DAX, -1.02%

- France CAC -1,46%

- UK FTSE 100 -0.64%

- Spain’s Ibex -0.92%.

- Italy’s FTSE MIB -1.32% main indices closed blended:

Shares within the Asian Pacific markets had been principally decrease:

- Japan’s Nikkei 225, -0.22%

- China’s Shanghai composite index , 0.17%

- Hong Kong’s Cling Seng index, -0.85%

- Australia S&P/ASX -1.37%

Wanting on the US debt market, yields are buying and selling greater for the 2nd day in a row

- 2-year yield 4.353% +2.5 foundation factors. Yesterday at the moment, the yield was at 4.316%

- 5-year yield 3.957% +3.5 foundation factors. Yesterday at the moment, the yield was at 3.92%

- 10-year yield 3.976% +3.2 foundation factors. Yesterday at the moment, the yield was at 3.9511%

- 30-year yield 4.121% +3.8 foundation factors. Yesterday at the moment, the yield was at 4.0972%

- The two-10 yr unfold is at -37.5 foundation factors

- The two-30 yr unfold is at -22.8 foundation factors.

Within the European debt market, the benchmark 10-year yields are blended:

European benchmark 10 yr yields