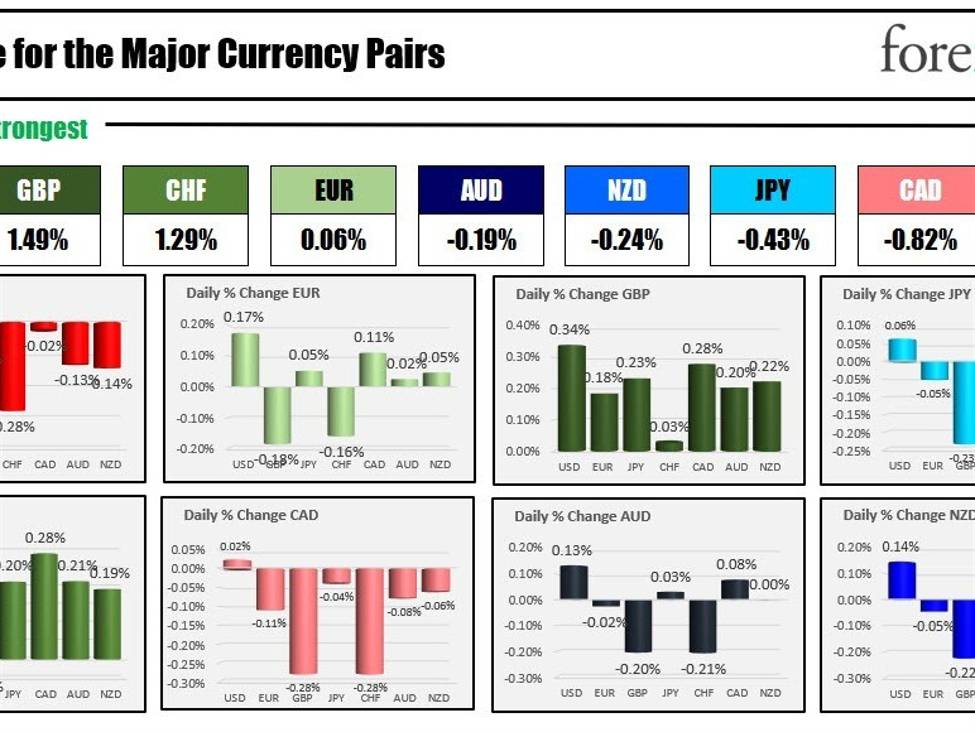

The strongest to the weakest of the foremost currencies

The GBP is the strongest and the USD is the weakest because the NA session begins. Admittedly, the modifications are comparatively modest with the foremost indices scrunched collectively. The ranges are additionally comparatively modest in comparison with the 22 day averages (a couple of month of buying and selling – see yellow space evaluating the vary to the ATR).

The ranges are modest in comparison with the 22 day averages

Twas the evening… effectively Friday earlier than Christmas and I can not actually say “not an economic data was stirring through the house”.

There’s a knowledge dump in the present day to frontload what might be a quiet week subsequent week because the 12 months involves an finish (I can even have the chance to relaxation and do away with this cough that has left me with no voice).

The information might be highlighted by the favored Fed measure of inflation – the Core PCE Worth Index. The expectation is for 3.3% for the YoY determine down from 3.5% final month. Nonetheless, there was chatter from some Fed officers in regards to the 6-month pattern. In case you add the final 6 months, the numbers whole 1.3% (2x = 2.6%). The expectations this month is for a 0.2% MoM enhance which might decrease that sum to 1.2% (or 2.4% sum). If it is available in lower than the 0.2%, take that off the two.4% quantity. In fact, whether it is greater, that isn’t good for that argument.

6 month sum of the Core PCE is 1.3% at present

A take a look at the calendar exhibits:

8:30 AM ET

-

GDP m/m (CAD)

- Forecast: 0.2%

- Earlier: 0.1%

-

Core PCE Worth Index m/m (USD)

- Forecast: 0.2%

- Earlier: 0.2%

- Core PCE Worth index y/y (USD)

- Forecast: 3.3%

- Earlier: 3.5%

- PCE Worth Index m/m (USD)

- Forecast 0.0%

- Earlier: 0.0%

- PCE Worth Index y/y (USD)

- Forecast:2.8%

- Earlier: 3.0%

-

Core Sturdy Items Orders m/m (USD)

- Forecast: 0.1%

- Earlier: 0.0%

-

Sturdy Items Orders m/m (USD)

- Forecast: 2.4%

- Earlier: -5.4%

-

Private Revenue m/m (USD)

- Forecast: 0.4%

- Earlier: 0.2%

-

Private Spending m/m (USD)

- Forecast: 0.3%

- Earlier: 0.2%

10:00 AM ET

The US inventory futures are implying decrease ranges in the present day after the rebound Thursday noticed the Nasdaq index rise 1.26% and the dow up 0.87%. After the shut yesterday, Nike introduced earnings and expectations of a waning client going ahead. Shares have tumbled -12.27% in pre-market buying and selling. US yields are decrease.

A snapshot of the markets to kickstart the North American session exhibits:

- Crude oil is buying and selling up $0.52 or 0.70% at $74.41. Yesterday at the moment, the worth was buying and selling at $73.31

- Spot gold is buying and selling up $15 or 0.73% at $2061.13. Yesterday at the moment the worth was buying and selling at $2037.49

- Spot silver buying and selling up seven cents or 0.30% at $24.46. Yesterday at the moment the worth was buying and selling at $24.23

- Bitcoin is buying and selling greater at $43,594. Yesterday, at the moment the worth was buying and selling at $44,049

Within the US inventory market, the foremost indices futures suggest a better opening after snapping the Dow and NASDAQ nine-day win streak yesterday

- Dow Industrial Common futures are implying a decline of -105 factors. Yesterday, the index rose 322.35 factors or 0.87%

- S&P index futures are implying a lack of -1 factors Yesterday, the index rose 48.42 factors or 1.03%.

- NASDAQ index futures are implying a decline of -13 factors. Yesterday, the index rose 185.92 factors or 1.26%

Within the European fairness markets, the foremost indices are modestly greater

- German DAX, +0.08%

- France’s CAC, +0.05%

- UK’s FTSE 100, +0.04%

- Spain’s Ibex, +0.20%

- Italy’s FTSE MIB, +0.09% (10 minute delay).

Within the Asia Pacific market, main indices closed largely decrease:

- Japan’s Nikkei index, rose 0.09%. For the week, the index rose 0.6%

- China’s Shanghais composite index, fell -0.13%. For the week, the index fell -0.944%

- Hong Kong’s Cling Seng index, fell -1.69%. For the week, the index fell -2.69%.

- Australia’s S&P/ASX index, fell -0.03%. For the week, the index rose 0.8%.

Within the US debt market, yields are decrease:

- US 2Y T-NOTE: 4.327% -2.2 foundation factors. At the moment yesterday, the yield was at 4.353%

- US 5Y T-NOTE: 3.849% -3.2 foundation factors. At the moment yesterday, the yield was 3.857%

- US 10Y T-NOTE: 3.855% -3.8 foundation factors. At the moment Friday, the yield was at 3.858%

- US 30Y BOND: 4.000%, -3.5 foundation factors. At the moment Friday, the yield was at 3.998%

- 2 – 10-year unfold is buying and selling at -47.3 foundation factors. Yesterday at the moment, the unfold was at -49.6 foundation factors

- 2 – 30 12 months unfold is buying and selling at -32.3 foundation factors. Yesterday this time the unfold was at -35.4 foundation factors

Within the European debt market, benchmark 10-year yields are buying and selling blended.

European 10 12 months yields are blended