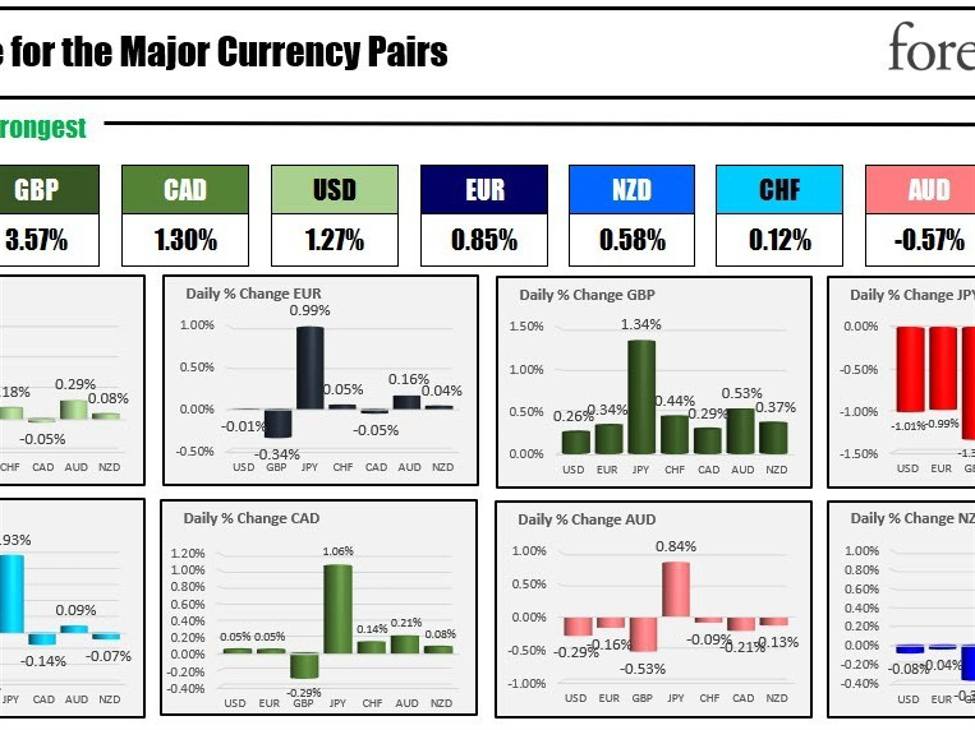

The strongest to weakest of the key currencies

The GBP is the strongest of main currencies whereas the JPY is the weakest. The USD is usually increased however largely beneficial properties cannot be attributed to the rise within the USDJPY.

The JPY is sharply decrease after a Reuters article additional debunked the concept that the BOJ was nearer to tightening coverage.The article highlighted a major concern among the many Financial institution of Japan (BOJ) policymakers concerning latest weak spot in consumption. This situation has emerged as a brand new issue which will affect the timing of the BOJ’s exit from adverse rates of interest. The article defined that the market’s interpretation of BOJ Governor Kazuo Ueda’s remarks, made in response to a query in regards to the challenges he has confronted since his appointment in April, led to expectations of an imminent coverage shift. Nonetheless, these remarks had been reportedly taken out of context, as there was no intention to sign an imminent coverage change.

Regardless of inflation operating above its 2% goal for greater than a 12 months, and rising prospects for sustained wage will increase, the timing for exiting adverse rates of interest stays unsure on account of Japan’s fragile financial system. The BOJ is especially involved about latest indicators of weak consumption.

IN different weekend information, financial information was highlighted by a major downturn in China’s Client Value Index (CPI), with a year-on-year lower of 0.5%, notably under the anticipated 0.1% drop. This decline was extra pronounced than the earlier -0.2% and contrasts with the month-on-month figures, which additionally fell by 0.5% in opposition to an anticipated 0.1% lower. This financial pattern suggests ample room for China to ease its financial coverage, highlighting the sluggishness of its post-COVID financial system. Concurrently, the sturdy demand for iron ore presents a paradox, notably given the obvious slowdown in development actions. This state of affairs provides to the enigma that usually surrounds China’s financial dynamics. Moreover, the Producer Value Index (PPI) additionally confirmed a extra vital than anticipated decline, recording a 3.0% year-on-year fall in comparison with the anticipated 2.8%, marking a steeper drop from the earlier 2.6% year-on-year decline.

The US treasury will public sale off 3 and 10 12 months coupon notes at the moment and 30-year bonds tomorrow. That’s forward of what’s regular (Tuesday, Wednesday and Thursday auctions). It’s prompted by the FOMC price resolution on Wednesday. The Treasury doesn’t wish to conduct auctions simply forward of a key price resolution.

The FOMC is predicted to maintain charges unchanged once they announce their resolution on Wednesday. Focus shall be on clues from the assertion, the financial projections together with the dot plot of price expectations and Fed Chair Powell’s feedback throughout his regular press convention. Forward of the speed resolution, the US CPI shall be launched on Tuesday with expectations of 0.3% and three.1% YoY (down from 3.2%).

The SNB, BOE and ECB may also announce their price resolution this week (on Thursday). No change is predicted for every with concentrate on the expectations for charges going ahead.

A snapshot of the markets to kickstart the North American session reveals:

- Crude oil is buying and selling down $0.47 or -0.68% at $70.76 . At the moment Friday, the worth was at $70.74

- Spot gold is buying and selling down $9.20 or -0.46% at $1995 . At the moment Friday, the worth is at $2027.45

- Spot silver is buying and selling down -$0.06 or -0.28% at $22.92. At the moment Friday, the worth was at $23.74

- Bitcoin is buying and selling at $42,287. At the moment Friday, the worth was buying and selling at $43,547

Within the US inventory market, the key indices are implying a combined opening after closing increased across-the-board on Friday. The foremost indices all closed final week increased for the six consecutive week acquire:

- Dow Industrial Common futures are implying a acquire of 18 3.factors. On Friday the Dow Industrial Common rose 130.49 factors or 0.36%. Final week, the index rose 0.01%.

- S&P index futures are implying a acquire of 0.13 factors. On Friday the S&P index rose 18.78 factors or 0.41%. Final week, the index is down -0.20%.

- NASDAQ index futures are implying a decline of -17.94 factors. On Friday the Nasdaq Index rose 63.98 factors or 0.45%. Final week, the index is up 0.69%

Within the European fairness markets, the key indices are buying and selling combined.

- German DAX, +0.01%

- France’s CAC, +0.28%

- UK’s FTSE 100, -0.52%

- Spain’s Ibex, -0.19%

- Italy’s FTSE MIB, unchanged (10 minute delay).

Within the Asia Pacific market, main indices had been combined.

- Japan’s Nikkei index, was 1.50%.

- China’s Shanghai Composite Index, was 0.74%

- Hong Kong’s Dangle Seng index, -0.1%.

- Australia’s S&P/ASX index, was 0.06%.

Within the US debt market, yields are buying and selling increased:

- US 2Y T-NOTE: 4.758%, +3.1 foundation factors. At the moment yesterday, the yield was at 4.630

- US 5Y T-NOTE: 4.284%, +3.0 foundation factors. At the moment yesterday, the yield was at 4.174%

- US 10Y T-NOTE: 4.273%, +2.9 foundation factors. At the moment yesterday, the yield was at 4.179%

- US 30Y BOND: 4.352% was 2.7 foundation factors. At the moment yesterday, the yield was at 4.277%

- 2 – 10-year unfold is buying and selling at -48.4 foundation factors. At the moment yesterday, the unfold was at -45.1 foundation factors

- 2 – 30 12 months unfold is buying and selling at -40.6 foundation factors. At the moment yesterday, the unfold was at -35.7 foundation factors

Within the European debt market, benchmark 10-year yields are buying and selling largely increased:

![Celebrities Who Earn the Most on Instagram [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/05/bG9jYWw6Ly8vZGl2ZWltYWdlL2lnX3RvcF9lYXJuZXJzMi5wbmc.webp-600x435.webp)