A bombshell hit the true property trade with the Nationwide Affiliation of Realtors’ latest $418 million settlement. The dimensions of the crater remains to be taking form.

Some analysts have suggested that it might lead to a 30% discount to the $100 billion that People pay annually in commissions; others have prompt that residence costs might drop. However what if it’s actually, actually unhealthy for homebuyers, the individuals who want probably the most assist amid an affordability disaster.

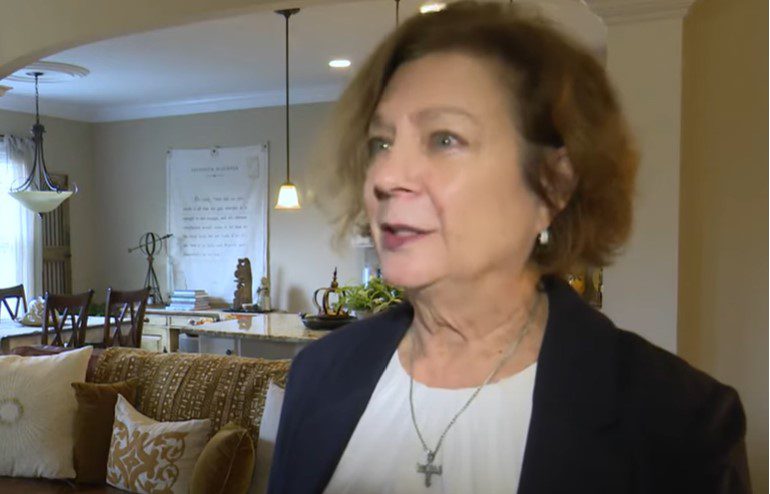

“There are winners and losers here,” Mark Karlan, a lecturer in finance, actual property, and legislation on the College of California, Los Angeles, advised Fortune. “This isn’t an unequivocal win across the board.”

Karlan, who has participated in billions of {dollars} price of actual property transactions, sees that 30% in financial savings hitting one facet of the market heavier than one other. “Sellers of the properties are probably going to be better off,” he stated, since they’re sure to pay 3% of the home-sale worth, as a substitute of 6%, like earlier than. Nevertheless, there might nonetheless be conditions the place sellers are paying what was the usual if they need an optimum expertise—paying consumers’ brokers would possibly imply they’ve a greater probability at discovering the perfect consumers, Karlan defined. Or possibly, if a vendor is paying 3%, the vendor’s agent will provide a purchaser’s agent 1%, even so, the proportion coming from the vendor isn’t altering. Or, sellers will merely pay their brokers 2% and overlook about consumers’ brokers.

Issues have been tough throughout for the final 12 months or so within the housing world, however sellers appear to have the higher hand due to how tight provide is. Residence costs haven’t dropped they usually’re nonetheless promoting rapidly, with a lot of competitors and a number of presents, typically. And people would possibly sound like small numbers, however they’re not. For those who had been to promote your property for one million {dollars} on a 2% fee, that’d be $20,000. Let’s say it’s a 6% fee, that’d be $60,000. I don’t must inform you how huge of a distinction that’s.

Now to consumers, who’re actually the losers on this situation. “Before this settlement, it was absolutely understood that the fee, 5% or 6%, was paid by whom? Entirely by the seller, which meant the buyer paid how much? Zero,” Karlan stated. The identical math applies. If somebody is buying one million greenback residence, on a 2% fee, they’d pay their agent $20,000. In earlier circumstances, while you’d pay nothing, $20,000 is quite a bit. To not point out, shopping for a house is already substantially more costly now than earlier than the pandemic. And if individuals are already scrambling to give you a down fee, and typically relying on the help of parents or different relations, it’s going to be extraordinarily tough to search out more money. And we’ll see consumers select to go unrepresented, he stated.

That brings us to a different loser: actual property brokers and brokers. Decrease commissions will translate to decrease incomes, Karlan stated—that would imply fewer actual property professionals. “With less revenue coming into the business, a number of people are going to have to drop out,” he stated. “They’re just not going to make a living.”

It’s necessary to notice that the settlement nonetheless wants approval, and wouldn’t take impact till this summer season. Even so, it’s going to take time for everybody to adapt, he defined; it’s not going to occur in a single day.