The RBI cut the repo rate by 25 bps as expected today leaving the door open for further easing amid record low inflation. In the press conference, Governor Malhotra signalled the intention to diminish the central bank’s intervention in the market to stop the rupee depreciation.

History teaches that it’s useless for a central bank to intervene in the market as long as the fundamentals remain against a currency. In fact, the fundamentals continue to point to further depreciation amid RBI’s rate cuts and the limited progress on the US-India trade talks front.

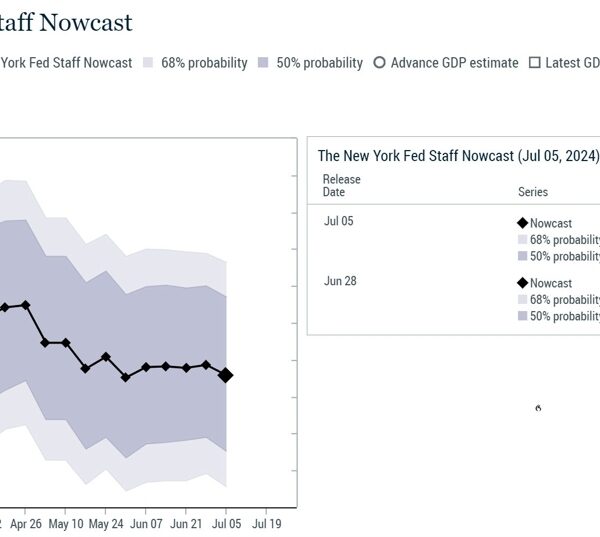

In the USD/INR chart above, we can see that the pair recently pulled back into the 89.70 support and bounced today following the RBI’s rate cut. We now have a minor resistance zone around the 90.00 handle.

A break above the resistance should see the pair extending the move into a new all-time high (all-time low for the INR). On the other hand, a break below the 89.70 support, will likely lead to a deeper pullback into the 89.00 handle.