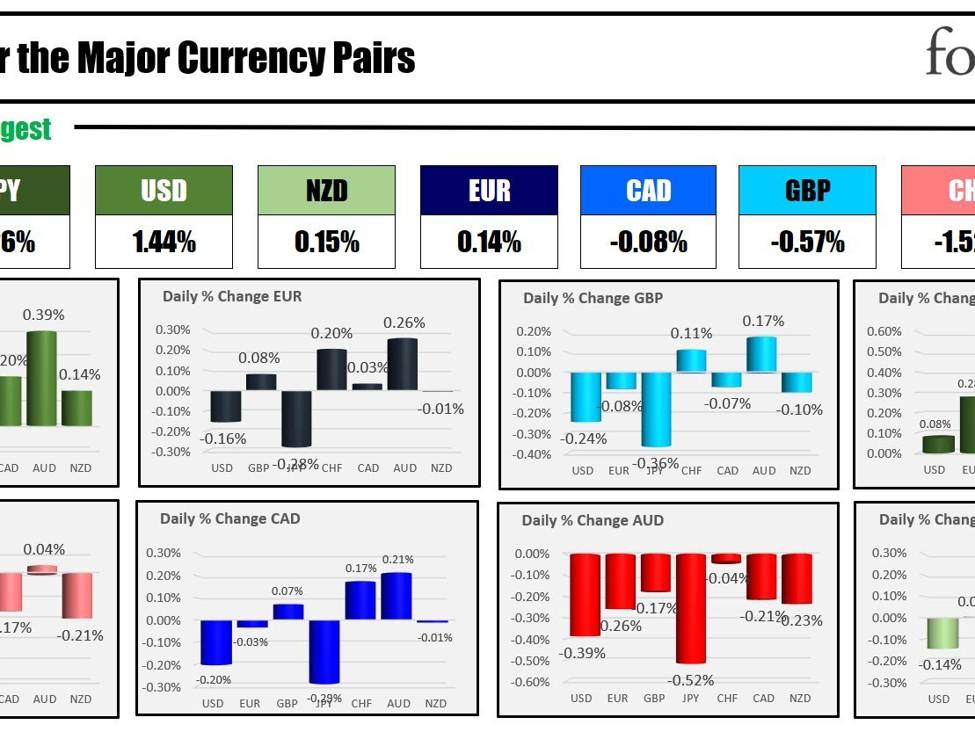

The JPY is the strongest and the AUD is the weakest

Because the North American session begins, the JPY is the strongest and the AUD is the weakest. The USD is stronger with solely a modest decline vs the JPY within the morning snapshot. To start out the US session, the value motion dynamics are following the equation for 2024 thus far. Yields within the US are larger, shares are decrease and that has the US greenback transferring to the upside as nicely. Yesterday the dynamics had been the precise reverse helped by a decrease inflation survey expectations launched from the New York Fed. The survey confirmed the one-year inflation expectations at 3% versus 3.4% within the prior month. That was the bottom degree since January 2021. The three-year inflation expectations fell to 2.6% from 3.0%

Yesterday the NASDAQ index had its finest day since November 14. The transfer took the value above its 200-hour transferring hour at 14624.69, however remained under its 100-hour transferring common at 14877.97. That 100-hour transferring common stays a key hurdle to get above if the patrons are to take extra management. Yesterday, Boeing shares fell -8.1% as a result of cabin panel falling off the aircraft in mid flight over the weekend. Its shares are presently down -0.71%.

From the Fed yesterday, late yesterday Fed’s Michelle Bowman, usually recognized for her hawkish stance within the Federal Open Market Committee (FOMC), took a extra balanced, maybe barely dovish perspective on financial coverage in her feedback. Bowman recommended that sustaining the present coverage charge for a interval may additional cut back inflation, signaling that the prevailing coverage stance is sufficiently restrictive. She acknowledged the potential of decreasing the Fed’s coverage charge ought to inflation method the two% goal. Bowman additionally famous an improved steadiness within the labor market between provide and demand. Whereas recognizing ongoing dangers to inflation, together with geopolitical elements and potential easing of monetary situations, she maintained a cautious method to modifying the Fed coverage charge. Open to the thought of accelerating the speed in future conferences if inflationary progress stalls or reverses, she additionally expressed issues about banking regulators’ local weather steering doubtlessly distracting from core monetary dangers. This shift in her tone signifies a readiness to adapt to evolving financial situations, balancing between warning and responsiveness (see feedback from Eamonn’s put up here).

Earlier within the day, Atlanta Atlanta Fed Pres. Bostic’s feedback introduced a cautiously optimistic view of the present financial state of affairs. He believes that any rise in unemployment on account of inflation discount might be much less extreme than typical. Bostic asserted that the Federal Reserve is in a robust place, with its restrictive insurance policies successfully slowing down inflation in an orderly method. He noticed that households are regularly adjusting to previous value hikes, and the impression of upper costs is lessening, which ought to enhance public sentiment. He acknowledged that whereas items inflation has returned to pre-pandemic ranges, companies inflation is reducing extra slowly, with out vital drops anticipated. Bostic famous that many financial indicators are actually much like these earlier than the pandemic, emphasizing the significance of short-term inflation measures, which presently present constructive traits.

Regardless of these optimistic indicators, Bostic maintains a stance of vigilance, not but able to declare victory over inflation. He acknowledged the robust job numbers, declaring that the expansion is concentrated in a small sector of the financial system, which suggests broader financial slowing. He anticipates two quarter-percent charge cuts by yr’s finish (the Fed sees 80 foundation factors of minimize of their dot plot), however emphasised the necessity for continued restrictive coverage even then. Bostic stresses the significance of being completely sure of inflation management earlier than making vital coverage adjustments and stays alert to the potential of inflation rebounding, underlining the need for the Fed to remain attentive.

Right now, Germany introduced a lot weaker than anticipated manufacturing. That degree got here in at -0.7% versus expectations of 0.4%. That was the seventh consecutive month-to-month decline and has helped to weaken the EUR vs the buck. The not-so-bad information from the EU is that the Unemployment charge throughout the EU did fall to six.4% from 6.5% final month, and from expectations of 6.5%.

Right now, the NFIB enterprise optimism index for December got here in larger 91.9 versus 90.6 final month. Right now US commerce knowledge might be launched at 8:30 AM. Canada constructing allow century knowledge can even be launched at 8:30 AM ET. US CPI launched on Thursday which represents the largest financial launch this week. The expectations are for 0.2% month on month achieve for each the headline and the core measure.

A snapshot of the markets because the North American session begins presently exhibits:

- Crude oil is buying and selling up $1.77 or 2.5% at $72.53. At the moment yesterday, the value was at $71.68

- Gold is buying and selling up $8.23 or 0.40% at $2036.09. At the moment yesterday, it was buying and selling at $2020.50

- Silver is buying and selling up seven cents or 0.31% at $23.14. At the moment yesterday, it was buying and selling at $22.86

- Bitcoin traded at $46,241 right now yesterday, the value was buying and selling at $44,679. The excessive value as we speak prolonged to $47,179. Yesterday the excessive value reached a brand new cycle excessive of $47,281 (highest since April 2022)

Within the premarket for US shares, the main indices are buying and selling larger after beginning the week with strong good points on Monday:

- Dow Industrial Common futures are implying a decline -132 factors. Yesterday, the index rose 216.90 factors or 0.58%

- S&P futures are implying a decline of -17.2919 factors. Yesterday, the index rose 66.32.2 or 1.41%

- Nasdaq futures are implying a consumer of -78 factors. Yesterday,, the index rose 319.69 factors or 2.20%

Within the European fairness markets, the main indices are all buying and selling decrease:

- German DAX, -0.36%. Yesterday, the index rose 0.74%

- France CAC Melissa 0.37%, . Yesterday, the index rose 0.40%

- UK FTSE 100 -0.02%. Yesterday, the index rose 0.06%

- Spain’s Ibex -1.91%. Yesterday, the index rose 0.44%

- Italy’s FTSE MIB -0.64% (delayed by 10 minutes). Yesterday the index rose 0.42%

Shares within the Asian Pacific markets had been principally decrease:

- Japan’s Nikkei 225, was 1.16%

- China’s Shanghai composite index , was 0.20%

- Hong Kong’s Cling Seng index, -0.21%

- Australia S&P/ASX, +0.93%

Trying on the US debt market, yields are buying and selling larger:

- 2-year yield 4.376% +3.2 foundation factors. Yesterday right now, the yield was at 4.401%

- 5-year yield 3.95% +3.0 foundation factors. Yesterday right now, the yield was at 4.029%

- 10-year yield 4.034% +3.2 foundation factors. Yesterday right now, the yield was at 4.062%

- 30-year yield 4.200% +2.6 foundation factors. Yesterday right now, the yield was at 4.218%

- The two-10 yr unfold is at -33.3 foundation factors. At the moment yesterday, the unfold was at -34.1 foundation factors

- The two-30 yr unfold is at -17.2 foundation factors. At the moment yesterday, the unfold was at -18.4 foundation factors

Within the European debt market, the benchmark 10-year yields are larger:

European benchmark 10 yr yields