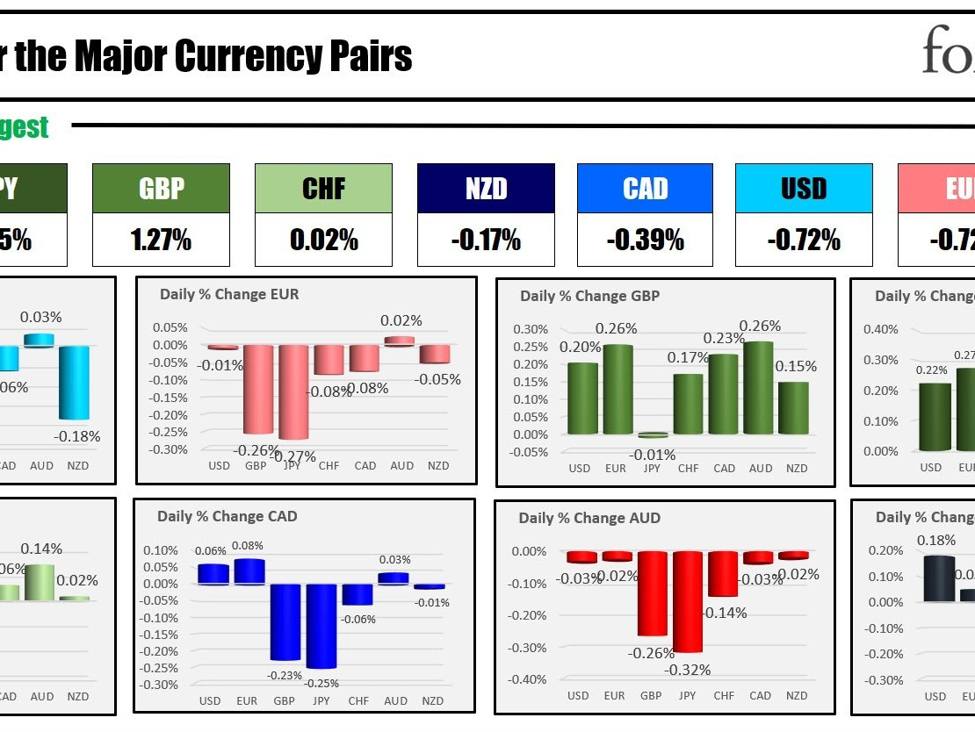

The JPY is the strongest and the AUD is the weakest because the North American session begins. The USD is generally – however modestly – weaker because the session and week begins with yields decrease and shares increased.

US shares closed sharply increased on Friday with the S&P index closing at a brand new report stage and above the 4800 stage for the primary time ever..

This week, the earnings for the fourth quarter begin to kick in with some large-cap movers together with Tesla, ServiceNow, Intel, IBM and Netflix. Beneath is a sampling of a few of these earnings releases:

Monday, January 22

Tuesday, January 23

- Verizon

- 3M

- GE

- Johnson & Johnson

- Halliburton

- Procter & Gamble

- Netflix

- Intuitive Surgical

- Texas Devices

Wednesday, January 24

- AT&T

- Tesla

- IBM

- servicenow

- Lam Analysis

Thursday, January 25

- American Airways

- Southwest Airways

- Dow

- Intel

- Visa

- T-Cell

Friday, January 26

- American Specific

- Colgate-Palmolive

Taking a look at this week’s financial calendar, key occasions and releases embrace:

Tuesday:

- Financial institution of Japan interest-rate determination

Wednesday:

- New Zealand CPI quarter on quarter 0.5% anticipated reaches 1.8% final quarter

- Germany, France, UK flash manufacturing and companies PMI information

- Financial institution of Canada interest-rate determination. No change anticipated

- US flash manufacturing and companies PMI

Thursday

- ECB price determination. No change anticipated

- US superior GDP. 2.0 anticipated. Atlanta Fed GDPNow estimate 2.4%

- US unemployment claims

Friday

- US PCE information. The expectations are for a modest 0.2% achieve.

Immediately, the Convention Board Main index will likely be launched and can announce a decline for the umpteenth month in a row. The Convention Board launch of the LEI, doesn’t report what number of months the index has been destructive now. This index is designed to foretell the course of the economic system, nevertheless it tends to have a muted affect as a result of a lot of the indicators used within the calculation are launched beforehand.

A snapshot of the markets because the North American session begins at present exhibits:

- Crude oil is buying and selling up $0.17 or 0.23% at $73.43 Presently Friday, the worth was at $73.95

- Gold is buying and selling down -$0.30 or -0.02% at $2029.19. Presently Friday, it was buying and selling at $2033.40

- Silver is buying and selling down -$0.38 or -1.69% at $22.23. Presently Friday, it was buying and selling at $22.79

- Bitcoin traded at $40846. Presently Friday, the worth was buying and selling at $41,314. Over the weekend and into at present, the worth traded with a excessive of $41,854 and a low of $40,345.

Within the premarket for US shares, the key indices are buying and selling increased. Yesterday, all of the indice moved increased. The S&P index in premarket buying and selling is buying and selling above the all-time excessive shut of 4796.57. For the week, the key indices are blended utilizing the closes from yesterday:

- Dow Industrial Common futures are implying a achieve of 200.1 factors. Friday, the index rose 395.19 factors or 1.05%. For the week, the index rose 0.35%

- S&P futures are implying a achieve of 26 factors. Friday, the index rose 58.87 factors or 1.23%. For the week, the index is rose 1.84%.

- Nasdaq futures are implying a achieve of 134 factors. Friday, the index rose 255.32 factors or 1.70%.. For the week the index is up 3.09%

Within the European fairness markets, the key indices are buying and selling blended after

- German DAX, +0.39%. Final week the index fell -0.89%

- France CAC +0.32%. Final week the index fell -1.25%

- UK FTSE 100 -0.01%. Final week the index fell -2.14%

- Spain’s Ibex +0.73%. Final week the index fell -2.34%

- Italy’s FTSE MIB -0.45% (delayed by 10 minutes).

Shares within the Asian Pacific markets have been blended. Shares for the week noticed good points in Japan, however China, Hong Kong and Australia all declined.

- Japan’s Nikkei 225, +1.62%

- China’s Shanghai composite index , -2.68%

- Hong Kong’s Hold Seng index,-2.27%

- Australia S&P/ASX, +.75%.

Wanting on the US debt market, yields are buying and selling blended with the shorter paint increased within the water and a decrease.

- 2-year yield 4.397% -1.1 foundation factors. Friday presently, the yield was at 4.356%

- 5-year yield 4.031% -3.9 foundation factors. Friday presently, the yield was at 4.043%

- 10-year yield 4.097% -4.8 foundation factors. Friday presently, the yield was at .134%

- 30-year yield 4.306% -4.8 foundation factors. Friday presently, the yield was at 4.359%

- The two-10 12 months unfold is at -29.1 foundation factors. Presently Friday, the unfold was at -24.1 foundation factors

- The two-30 12 months unfold is at -8.5 foundation factors. Presently Friday, the unfold was at -1.7 foundation factors. At at session highs final week, the unfold acquired to +7.5 foundation factors

Within the European debt market, the benchmark 10-year yields are decrease to begin the buying and selling week :

European 10 12 months yields