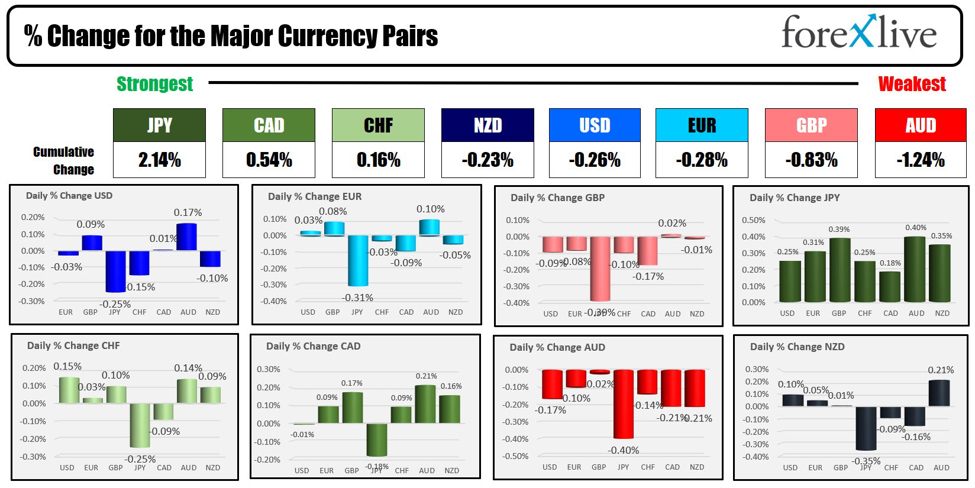

The JPY is the strongest and the AUD is the weakest because the NA session begins. The USD is in the midst of the desk with a blended image to begin the buying and selling day and the week.

The ranges are very slender to begin the week and effectively under the 22-page common :

- EURUSD 16 pips/30% of regular

- NZDUSD 16 pips/34% of regular

- AUDUSD 21 pips/44% of regular

- USDCAD 24 pips/39% of regular

- USDCHF 27 pips/53% of regular

- GBPUSD 31 pips/47% of regular

Within the EU at the moment, ECB’s Kažimír has advocated for a cautious method to financial coverage changes, suggesting that the European Central Financial institution ought to wait till June earlier than contemplating its first charge lower. He emphasizes that hurrying into a choice would neither be sensible nor advantageous, particularly on condition that upside dangers to inflation stay important and current. Kažimír factors out the need for extra concrete proof relating to the inflation outlook and believes that solely by June will the ECB attain a adequate degree of confidence to make an knowledgeable resolution on charge cuts. Nonetheless, he additionally notes that it is necessary to start discussions on potential easing measures now, indicating that the approaching weeks might be used to organize for such deliberations. Expectations available in the market are for a lower in June.

Over the weekend, the weekend report highlights that the Bank of Japan is contemplating ending its yield curve control program, as reported by Bloomberg primarily based on Japan’s JiJi media outlet. The Financial institution is contemplating a shift in technique from focusing on the yield of benchmark 10-year authorities bonds to round 0%, to as a substitute specifying upfront the quantity of presidency bonds it intends to purchase. This transfer is a part of the Financial institution’s efforts to normalize its financial coverage. The brand new method would give attention to the amount of bond purchases fairly than focusing on particular yield ranges. Moreover, there may be hypothesis that the Financial institution will resolve on ending each the yield curve management program and its adverse rate of interest coverage within the upcoming coverage assembly, which is scheduled to conclude on March 19. This means a big shift in Japan’s financial coverage technique, aimed toward transferring in the direction of a extra conventional financial framework. Final week the JPY rose 2.07%, which was its largest achieve since July 2023.

Searching for US Fed feedback at the moment? The Fed is now within the blackout interval with the assembly scheduled for March 19-20.

Shares are decrease now. US yields are little modified. Bitcoin is greater with the worth extending to a brand new all time excessive at $72,306 helped by Pres. Trump feedback that there’s a lot of excellent use for it and would go away it alone. PS Trump talked negatively about Fb and Meta shares at the moment are down -1.51% ins premarket buying and selling.

A snapshot of the markets because the North American session begins presently reveals:

- Crude oil is buying and selling down $-0.31 or -0.40% at $77.68. At the moment yesterday, the worth was at $78.29

- Gold is buying and selling close to unchanged at $2178.30. At the moment Friday, the worth was at $2166.34.

- Silver is buying and selling up two cents or 0.13% at $24.34. At the moment Friday, the worth was at $24.45

- Bitcoin presently trades at $71701. At the moment yesterday, the worth was buying and selling at $67559.

Within the premarket, the US shares, the foremost indices are buying and selling decrease. On Friday, main indices fell was led by the NASDAQ with a decline of -1.16%

- Dow Industrial Common futures are implying a lack of -62.50 factors. On Friday, the index fell -68.66 factors or -0.18% at 38722.70

- S&P futures are implying a lack of -9.19 factors. On Friday, the index fell -33.67 factors or -0.65% at 5123.68

- Nasdaq futures are implying a lack of -51.95 factors. On Friday, the index fell -188.26 factors or -1.16% at 16085.11

Within the European fairness markets, the foremost indices are buying and selling blended. Yesterday each the German DAX and France CAC closed at file ranges:

- German DAX, -0.61%.

- France CAC -0.26%.

- UK FTSE 100, -0.49%.

- Spain’s Ibex, -0.03%.

- Italy’s FTSE MIB, -0.39% (delayed by 10 minutes).

Shares within the Asian Pacific markets had been blended:

- Japan’s Nikkei 225, -2.19%.

- China’s Shanghai Composite Index, +0.74%.

- Hong Kong’s Cling Seng index, +1.43%.

- Australia S&P/ASX, -1.82% .

Wanting on the US debt market, yields are marginally greater:

- 2-year yield 4.498% +1.2 foundation factors.. At the moment yesterday, the yield was at 4.492%

- 5-year yield 4.053% -0.8 foundation factors. At the moment yesterday, the yield was at 4.060%

- 10-year yield 4.071% -1.7 foundation factors. At the moment yesterday, the yield was at 4.073%

- 30-year yield 4.242% -2.0 foundation factors. At the moment yesterday, the yield was at 4.229%

- The two-10 yr unfold is at -42.5 foundation factors. At the moment yesterday, the unfold was at -41.9 foundation factors

- The two-30 yr unfold is at – -25.7 foundation factors. At the moment yesterday, the unfold was at -26.3 foundation factors

European benchmark 10-year yields are blended:

European yields are subsequent