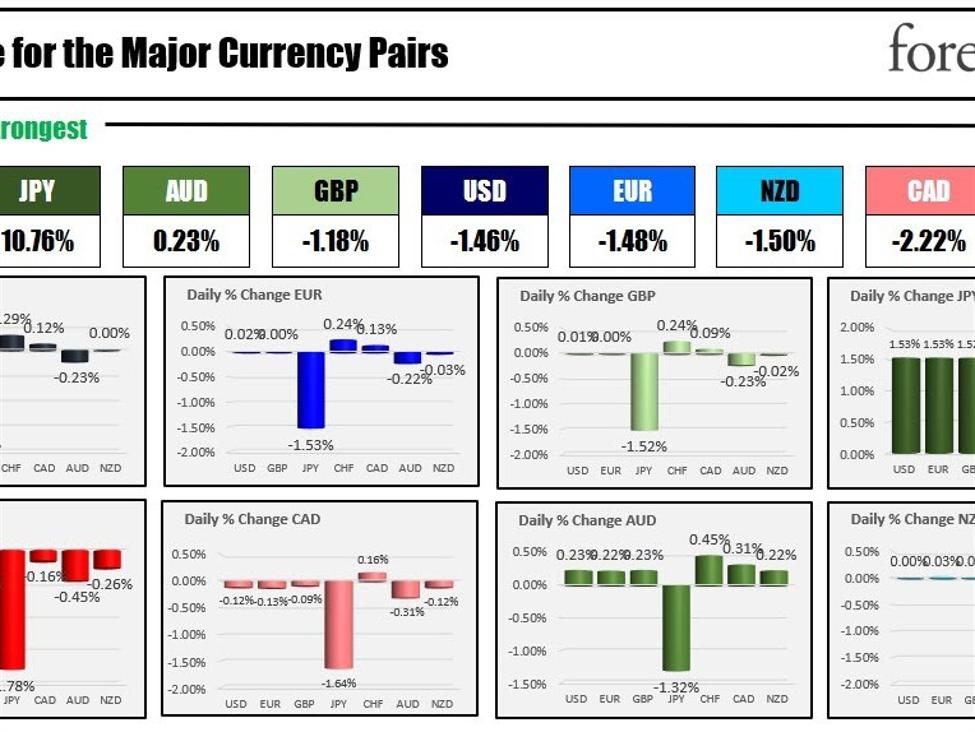

The strongest to weakest of the most important currencies

The JPY is the strongest and the CHF is the weakest because the North American session begins

Financial institution of Japan’s Ueda spoke and the JPY soared as markets and to hurry and shift and 2024 of DOJ coverage. A number of the themes gleaned from the headlines are outlined under:

-

Present Financial Help: Ueda highlights that Japan’s financial system is at the moment being supported by accommodative monetary circumstances and financial stimulus measures. This help is anticipated to proceed, serving to the financial system to get well reasonably.

-

Excessive Uncertainty: He acknowledges that there’s extraordinarily excessive uncertainty surrounding Japan’s financial system, emphasizing the necessity for shut monitoring of the impression of economic and overseas change markets.

-

Financial Coverage Stance: The BOJ plans to proceed its financial easing coverage below Yield Curve Management (YCC) to help financial exercise and encourage a cycle of wage development. Nevertheless, Ueda notes that Japan has not but reached a degree the place it might obtain its value goal (presumably the two% inflation goal) sustainably, stably, and with ample certainty.

-

Challenges Forward in 2024: Ueda predicts that Japan will face much more difficult financial circumstances in 2024.

-

Uncertainty on Curiosity Price Coverage: The BOJ has not but determined which rate of interest to focus on after ending its adverse rate of interest coverage. Choices embody elevating the speed utilized to monetary establishments’ reserves or reverting to a coverage focusing on the in a single day name fee. The specifics of fee will increase and the tempo of short-term fee hikes post-negative fee coverage are depending on financial and monetary developments.

-

Standards for Attaining Inflation Goal: Ueda defines reaching 2% pattern inflation as a state the place, absent new shocks, the financial system can maintain inflation round 2% with wage development barely above this degree.

-

Troublesome Selections Forward: Because the exit from stimulus approaches, Ueda acknowledges the problem in selecting which financial coverage instruments to mobilize.

-

Collaboration with Authorities: The BOJ intends to work carefully with the federal government whereas monitoring forex and monetary market actions.

-

Present Financial Traits: There’s a reasonable enhance in service spending, and a vital issue shifting ahead is for wages to proceed rising to help consumption.

The market can be specializing in the US preliminary claims information this morning. The expectations are for for 221K vs 218K final week. Additionally on the schedule at this time is the Canadian constructing permits (1.1% vs -6.5% final month). At 10 AM the ultimate US Wholesale inventories are anticipated to stay at -0.2%.

A snapshot of the markets to kickstart the North American session reveals:

- Crude oil is buying and selling up $0.40 or 0.56% at $69.80 . Presently yesterday, the value was at $71.73

- Spot gold is buying and selling up $6.89 or 0.34% at $2032.15 . Presently yesterday, the value is at $2026.23

- Spot silver is buying and selling unchanged at $23.89 . Presently yesterday, the value was at $24.12

- Bitcoin is buying and selling at $43,292. Presently yesterday, the value was manner down at $44,080

Within the US inventory market, the most important indices are implying a blended opening after closing decrease across-the-board yesterday. Every of the most important indices gave up earlier positive aspects yesterday to finish the day decrease

- Dow Industrial Common futures are implying a lack of -34 factors . Yesterday the Dow Industrial Common fell -70.13 factors or -0.19%

- S&P index futures are implying a acquire of 4.4 factors. Yesterday the S&P index fell -17.82 factors or -0.39%

- NASDAQ index futures are implying a acquire of fifty factors. Yesterday the Nasdaq Index fell -83.21 factors or -0.58%

Within the European fairness markets, the most important indices are buying and selling decrease. German DAX comes off file ranges.

- German DAX, -0.24%. Yesterday the German DAX rose 0.75% and closed at a file excessive of 16656.45

- France’s CAC, -0.20%. Yesterday France CAC rose 0.66%.

- UK’s FTSE 100, -0.06% . Yesterday UK’s FTSE 100 rose 0.34%

- Spain’s Ibex, -1.25%. Yesterday Spain’s Ibex rose 0.19%

- Italy’s FTSE MIB, -0.41% (10 minute delay). Yesterday Italy’s FTSE MIB rose 0.81%

Within the Asia Pacific market main indices have been decrease:

- Japan’s Nikkei index,-1.76%

- China’s Shanghai Composite Index, -0.09%

- Hong Kong’s Dangle Seng index, -0.71%

- Australia’s S&P/ASX index, -0.07%

Within the US debt market, yields are buying and selling larger/decrease :

- US 2Y T-NOTE: 4.617%, +1.4 foundation factors. Presently yesterday, the yield was at 4.609%

- US 5Y T-NOTE: 4.152%% +2.9 foundation factors. Presently yesterday, the yield was at 4.173%

- US 10Y T-NOTE: 4.192% +3.6 foundation factors. Presently yesterday, the yield was at 4.195%

- US 30Y BOND: 4.262% +3.8 foundation factors. Presently yesterday, the yield was at 4.319%

- 2 – 10-year unfold is buying and selling at -46.0 foundation factors. Presently yesterday, the unfold was at -41.4 foundation factors

- 2 – 30 yr unfold is buying and selling at -35.6 foundation factors. Presently yesterday, the unfold was at -28.8 foundation factors

Within the European debt market, benchmark 10-year yields are buying and selling largely decrease (the UK 10-year yield is the exception):

European benchmark 10-year yield’s