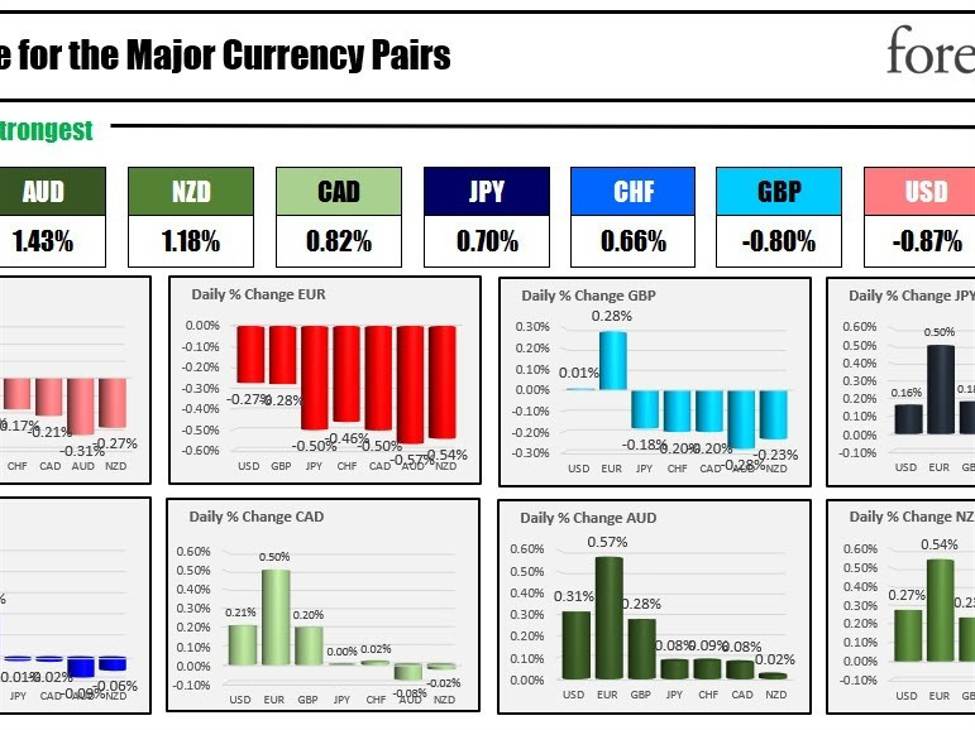

The strongest to the weakest of the key currencies

The JPY is the strongest and the EUR is the weakest because the North American session begins. The USD is generally however reasonably decrease. The buck is just increased vs the EUR and GBP. Yesterday, the EURUSD moved increased on comply with by shopping for after the FOMC charge resolution. The ECB didn’t thrill to the dovish aspect nor did the BOE. The flash PMI knowledge in the present day was a bit weaker than expectations with lots of numbers within the 40s indicative of contracting manufacturing and companies. The weaker numbers helped to push the EURUSD decrease. ECBs Villeroy added to the bearish concept by saying the subsequent coverage transfer ought to be reducing charges barring any stunned. There was no dialogue of charge cuts on the assembly yesterday for the ECB. The BOE story was extra bearish with 3 members voting for a hike of 25 foundation factors.

Key occasion in the present day: NY Fed Pres. John Williams might be interviewed on CNBC at round 8:30 AM ET. What’s the Fed member ideas of the market strikes after the FOMC charge resolution and extra dovish feedback from Fed Chair Powell. .

US shares are increased for the seventh consecutive day. The Dow Industrial Common closed at a file degree yesterday led by Caterpillar, and interest-rate delicate inventory rising $17.20 or 6.42%. On the opposite finish of the spectrum, the riskier small-cap shares rose 53.0 factors or 2.72% to 2000.51. They too profit from decrease rates of interest. Cathie Wooden’s Ark Innovation ETF – one other measure of small-cap high-risk shares – rose $1.85 or 3.69% (it’s up 0.79% in premarket buying and selling in the present day). Lastly, Costco shares are up $11.02. Earnings had been launched yesterday and got here in higher than anticipated. Additionally they declared a one-time $15 dividend.

US rates of interest proceed their transfer to the draw back in the present day. 10-year yield’s this week are decrease by -33 foundation factors.

Crude oil is buying and selling increased on tempo for its first acquire after eight straight weeks of declines.

A snapshot of the markets to kickstart the North American session reveals:

- Crude oil is buying and selling up $0.88 or 1.22% at $72.45. Presently yesterday, the value was at $70.76. For the week, crude oil is up $1.21

- Spot gold is buying and selling up $7.61 or 0.3% at $2043.85. Presently yesterday, the value is at $2037.87. For the week, the value is up $39.59.

- Spot silver buying and selling up 9 cents or 0.36% at $24.24. Presently yesterday, the value was at $24.09. For the week the value is up $1.26

- Bitcoin is buying and selling at $42,741. Presently yesterday, the value was buying and selling at $43,181. For the week the value is down -$1044

Within the US inventory market, the key indices futures suggest the next opening after closing increased across-the-board yesterday. All three indices closed yesterday on the highest ranges for 2023 (as soon as once more). Shares are up for six consecutive days:

- Dow Industrial Common futures are implying a acquire of 97 factors factors. Yesterday, the Dow Industrial Common rose 158.11 factors or 0.43% at 372482.36. The Dow Industrial Common closed yesterday at an all-time file excessive. For the week, the index is up 2.76%..

- S&P index futures are implying a acquire of 9.7 factors. Yesterday, the S&P index rose 12.46 factors or 0.26% at 4719.54. For the week, the index is up 2.50%.

- NASDAQ index futures are implying 41 factors. Yesterday, the Nasdaq Index rose 27.59 factors or 0.19% at 14761.56. For the week, the index is up 2.48%

Within the European fairness markets, the key indices are buying and selling increased following the US inventory tire:

- German DAX, +0.34. For the buying and selling week, the index is on tempo for a acquire of 0.28%

- France’s CAC, +0.56%. For the buying and selling week, the index is up 1.21%.

- UK’s FTSE 100, -0.55%. For the week, the index is up 0.68%..

- Spain’s Ibex, -0.88%. For the week, the index is down -1.42%

- Italy’s FTSE MIB,+0.47% (10 minute delay).

Within the Asia Pacific market, main indices closed combined

- Japan’s Nikkei index, was a 0.87%. For the week, the index rose 2.05%..

- China’s Shanghai Composite Index, -0.56%. For the week, the index the index fell -0.90%.

- Hong Kong’s Cling Seng index, +2.38%. For the week, the index rose 2.80%.

- Australia’s S&P/ASX index, +0.88%. For the week, the index is up 3.40%

Within the US debt market, yields are buying and selling decrease. Yields are down sharply.:

- US 2Y T-NOTE: 4.371% -2.8 foundation factors. Presently yesterday, the yield was at 4.333%. For the week, the yield is down -35.2 foundation factors

- US 5Y T-NOTE: 3.874% -3.6 foundation factors. Presently yesterday, the yield was at 3.885%. For the week the yield is down -37.0 foundation factors

- US 10Y T-NOTE: 3.899% -3.0 foundation factors. Presently yesterday, the yield was at 3.946%. For the week, the yield is down -33 foundation factors

- US 30Y BOND: 4.022%, -2.5 foundation factors. Presently yesterday, the yield was at 4.111%. For the week, the yield is down -27.8 foundation factors

- 2 – 10-year unfold is buying and selling at -47.3 foundation factors. Presently yesterday, the unfold was at -39.5 foundation factors

- 2 – 30 12 months unfold is buying and selling at -34.2 foundation factors. Presently yesterday, the unfold was at -23.1 foundation factors

Within the European debt market, benchmark 10-year yields are buying and selling decrease.