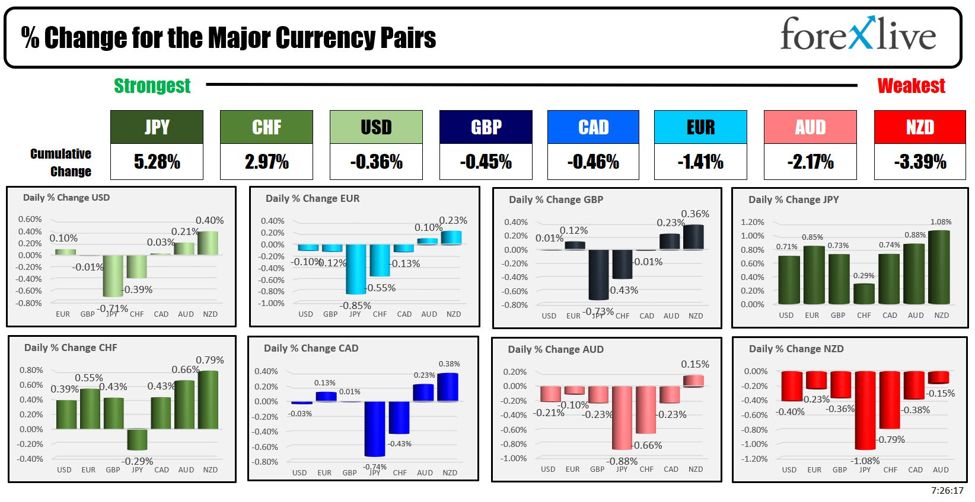

The strongest to the weakest of the major currencies

As the North American session begins, the JPY is the strongest and the NZD is the weakest. The USD is mixed with decline vs the JPY and CHF and gains vs the continued weak NZD and AUD the biggest movers.

The CAD is also mixed ahead of its interest rate decision at 9:45 AM ET. The Macklem press conference will be start at 10:30 AM. The BOC is expected to cut rates by 25 basis points to 4.50% from 4.75%. The mean from the Reuters poll of 30 economist is 4.57%. So some see no cut.

Reuters was out with a report today, that the Bank of Japan (BoJ) is considering a rate hike next week and has a detailed plan to halve its bond-buying in the coming years. The BoJ intends to taper its bond purchases gradually, in line with market consensus, to avoid any spike in yields. The decision on the rate hike in July is a close call, with the consumption outlook being a key factor; it’s described as a judgment call on whether to act now or later in the year. The BoJ sees no compelling reason to rush the decision, as price rises remain moderate and inflation expectations are stable. Following the reports, the USD/JPY continued its move on the day lower. The price had already moved below the 100 day MAa at 155.368. Its further fall took the price below a swing area between 154.52 and 154.878, to the 50% midpoint. The low reached 154.26 vs the 50% midpoint at 154.209.

In Europe, flash PMI data was released with most missing expectations. French services PMI and UK manufacturing were the only ones that BEAT expectations.

- French Flash Manufacturing PMI: Actual: 44.1, Forecast: 45.8 – MISSED, Previous: 45.44

- French Flash Services PMI: Actual: 50.7, Forecast: 49.7 – BEAT, Previous: 49.64

- German Flash Manufacturing PMI: Actual: 42.6, Forecast: 44.1 – MISSED, Previous: 43.54

- German Flash Services PMI: Actual: 52.0, Forecast: 53.2 – MISSED, Previous: 53.14

- Eurozone Flash Manufacturing PMI: Actual: 45.6, Forecast: 46.0 – MISSED, Previous: 45.84

- Eurozone Flash Services PMI: Actual: 51.9, Forecast: 52.9 – MISSED, Previous: 52.84

- UK Flash Manufacturing PMI: Actual: 51.8, Forecast: 51.1 – BEAT, Previous: 50.94

- UK Flash Services PMI: Actual: 52.4, Forecast: 52.5 – MISSED, Previous: 52.14

US stocks are down sharply in pre-market trading. The Nasdaq is down -232 points in pre-market trading. Alphabet and Tesla reported after the close yesterday. Alphabet missed on YouTube revenues although they beat on the top and bottom lines. The stock is still down -3.6% in pre-market trading. Share of Tesla are also lower (-8.32%) after they missed on EPS but beat on revenues. Below is a summary of the earnings of each.

Tesla Inc (TSLA) Q2 2024 (USD): Shares are trading down -5.22% after trading down -2.04% during the day today

- Adj. EPS: $0.52 (exp. $0.62) MISS

- Revenue: $25.5B (exp. $24.77B) BEAT

Alphabet Inc (GOOGL) Q2 2024 (USD): Shares of Alphabet are down -0.38% in after hours trading.

- EPS: $1.89 (exp. $1.84) BEAT

- Revenue: $84.742B (exp. $84.18B) BEAT

- Google Advertising Revenue: $64.6B (exp. $64.4B) BEAT

- Google Cloud Revenue: $10.35B (exp. $10.158B) BEAT

- Google Search & Other Revenue: $48.51B (exp. $47.65B) BEAT

- YouTube Ads Revenue: $8.66B (exp. $8.9B) MISS

- Google Network Revenue: $7.44B (exp. $7.87B) MISS

- Google Subscriptions, Platforms and Devices Revenue: $9.31B (exp. $9.38B) MISS

- Google Services Revenue: $73.93B (exp. $73.58B) BEAT

In earnings releases this morning:

-

Nextera Energy Inc (NEE) Q2 2024 (USD):

- Adj. EPS: 0.96 versus expectations 0.98 – MISSED

- Revenue: 6.07 bln versus expectations 7.36 bln – MISSED

-

International Paper Co (IP) Q2 2024 (USD):

- Adj. EPS: 0.55 versus expectations 0.41 – BEAT

- Net Income: 498 mln versus expectations 143.8 mln – BEAT

- Revenue: 4.73 bln versus expectations 4.78 bln – MISSED

-

CME Group Inc (CME) Q2 2024 (USD):

- EPS: 2.42 versus expectations 2.53 – MISSED

- Revenue: 1.5 bln versus expectations 1.53 bln – MISSED

-

Fiserv (FISV) Q2 2024 (USD):

- Adj. EPS: 2.13 versus expectations 2.10 – BEAT

- Revenue: 5.107 bln versus expectations 4.82 bln – BEAT

-

General Dynamics Corp (GD) Q2 2024 (USD):

- EPS: 3.26 versus expectations 3.27 – MET

- Revenue: 11.98 bln versus expectations 11.44 bln – BEAT

-

Old Dominion Freight Line Inc (ODFL) Q2 2024 (USD):

- EPS: 1.48 versus expectations 1.45 – BEAT

- Revenue: 1.498 bln versus expectations 1.5 bln – MISSED

-

Roper Technologies Inc (ROP) Q2 2024 (USD):

- EPS: 4.48 versus expectations 4.46 – BEAT

- Revenue: 1.72 bln versus expectations 1.73 bln – MISSED

-

AT&T Inc (T) Q2 2024 (USD):

- Adj. EPS: 0.57 versus expectations 0.57 – MET

- Revenue: 29.8 bln versus expectations 29.92 bln – MISSED

-

Boston Scientific Corp (BSX) Q2 2024 (USD):

- Adj. EPS: 0.62 versus expectations 0.58 – BEAT

- Revenue: 4.12 bln versus expectations 4.02 bln – BEAT

-

GE Vernova Inc (GEV) Q2 2024 (USD):

- EPS: XX versus expectations 0.73

- Revenue: 8.20 bln versus expectations 8.26 bln – MISSED

-

Otis Worldwide Corp (OTIS) Q2 2024 (USD):

- EPS: 1.06 versus expectations 1.03 – BEAT

- Revenue: 3.60 bln versus expectations 3.73 bln – MISSED

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $0.94 or 1.22% at $77.90. The price been down for four consecutive days. At this time yesterday, the price was at $77.89.

- Gold is trading down up $9.20 or 0.39% at $2417.72. At this time yesterday, the price was trading at $2408.10

- Silver is trading up $0.12 or 0.43% at $29.33. At this time yesterday, the price is trading at $29.05

- Bitcoin trading modestly higher at $66,461. At this time yesterday, the price was trading at $66,770

- Ethereum is also trading lower at $3465.40 at this time yesterday, the price was trading at $3519.20

In the premarket, the snapshot of the major indices are trading lower with the declines led by the NASDAQ index.

- Dow Industrial Average futures are implying a loss of -173 point. Yesterday, the Dow Industrial Average fell -57.35 points or -0.14% at 40358.10

- S&P futures are implying a loss of -43 points. Yesterday, the S&P index closed lower by -8.65 points or -0.16% at 5555.75.

- Nasdaq futures are implying a decline of -230 points points. Yesterday, the index closed lower by -10.22 points or -0.06% at 17997.35

- Yesterday, the Russell 2000 index rose 22.61 points or 1.02% at 2243.26

European stock indices are trading mostly lower across the board:

- German DAX, -0.71%

- France CAC -0.90%

- UK FTSE 100, unchanged

- Spain’s Ibex, -0.07%

- Italy’s FTSE MIB, -0.42% (delayed 10 minutes).

Shares in the Asian Pacific markets closed mostly lower:.

- Japan’s Nikkei 225, -1.11%

- China’s Shanghai Composite Index, -0.46%

- Hong Kong’s Hang Seng index, -0.91%

- Australia S&P/ASX index, -0.90%

Looking at the US debt market, yields are trading makes:

- 2-year yield 4.420%, -2.5 basis points. At this time yesterday, the yield was at 4.516%

- 5-year yield 4.1301%, -1.9 base points. At this time yesterday, the yield was at 4.161%

- 10-year yield 4.231%, -0.8 basis points. At this time yesterday, the yield was at 4.233%

- 30-year yield 4.472%, +0.3 basis points. At this time yesterday, the yield was at 4.450%

Looking at the treasury yield curve, it is a steepening. The two – 30 year spread move back into positive territory.

- The 2-10 year spread is at -18.5 basis points. At this time yesterday, the spread was at – -28.2 basis points.

- The 2-30 year spread is +5.6 basis points. At this time yesterday, the spread was at -645 basis points

In the European debt market, the benchmark 10 year yields are little changed: