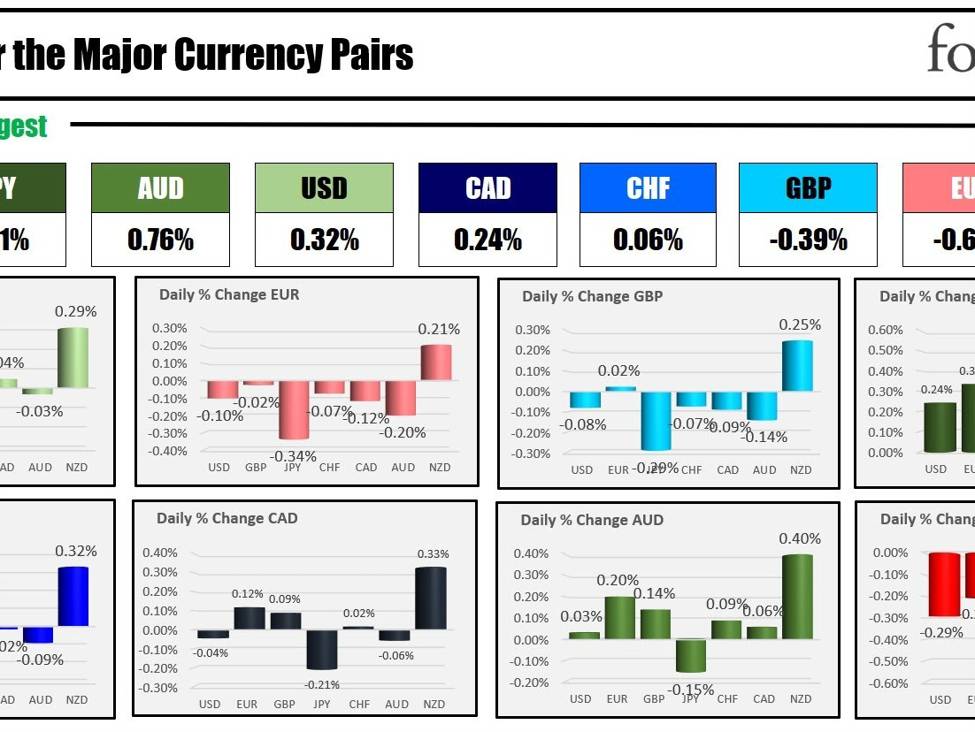

The strongest to weakest of the main currencies

The JPY is the strongest and the NZD is the weakest because the North American session begins. The USD is combined with modest adjustments vs the EUR, GBP, CHF, CAD and AUD.

US shares are little modified. On Friday, the S&P index closed above the 5000 ever, closing at a file degree. US/European yields are decrease. Final week the U.S. Treasury efficiently distributed 3, 10, 30-year coupon points largely supported by worldwide demand

The crude oil market is buying and selling decrease to begin the US day. The Saudi Power Minister indicated OPEC’s readiness to regulate provide. Geopolitical tensions continued with Houthi forces focusing on a ship within the Crimson Sea, ongoing Israeli offensive operations.

RBNZ’s Orr said that inflation remains too high. Final week ANZ stated they now count on 2 extra price hikes in 2024.In the present day, the forex is correcting decrease.

Kansas Metropolis Chiefs (and Taylor Swift) win the Tremendous Bowl over the SF 49ers in time beyond regulation. Usher halftime present was a thumbs up. An estimated 155M world viewers. By comparability, Manchester Metropolis vs Milan? 450M world which dwarfs US counterpart. You win. WickedMovie was some of the “engaged” adverts. Our son (the agency he works for) helped launch the location to coincide with the Tremendous Bowl advert. That is stress (think about if it crashed).

The scheduled Fed converse in the present day contains:

Michelle Bowman, Federal Reserve Board Governor: Scheduled to talk on “Defining a Bank” earlier than the American Bankers Affiliation Convention for Neighborhood Bankers at 9:20 AM ET native time).

Thomas Barkin, Federal Reserve Financial institution of Richmond President: Set to talk earlier than the Atlanta Economics Membership at 11:30 AM ET

Neel Kashkari, Federal Reserve Financial institution of Minneapolis President: Will take part in a dialog hosted by the Financial Membership of Minnesota at 1 PM ET

Again of England’s Bailey is scheduled to talk at 1 PM ET. This week, the financial calendar is highlighted by the US CPI

- Monday: BOE Gov. Bailey speaks

- Tuesday:NZ inflation expectations, UK Employment, US CPI

- Wednesday:UK CPI,UK Gov. Bailey speaks

- Thursday:AUD employment,UK GDP, US Retail Gross sales, US unemployment claims

- Friday: UK Retail gross sales,US PPI, US Michigan Client Sentiment.

On the earnings calendar subsequent week, Shopify, Coca Cola, AIG, Cisco and Coinbase are firms of curiosity. The Massive Daddy of maybe the complete earnings season can be launched on February 21, when Nvidia is scheduled to report. The destiny of AI and Ai shares rests with the chip provider:

- Tuesday: Shopify,Coca Cola, Marriott, Lyft, AIG

- Wednesday:Kraft Heinz,Albemarle,Twillio,Cisco

- Thursday:,John Deere,Coinbase

A snapshot of the markets because the North American session begins at the moment exhibits:

- Crude oil is buying and selling $-0.85 or -1.11% at $75.99. At the moment Friday, the worth was buying and selling at $76.20

- Gold is buying and selling down $3.19 or -0.16% at $2021. At the moment Friday, the worth was buying and selling at $2029.69

- Silver is buying and selling up $0.34 or 0.51% at $22.93. At the moment Friday, the worth was buying and selling at $22.59

- Bitcoin trades at $47,940. At the moment on Friday, the worth was buying and selling at $47,415. The excessive in the present day of $48,814 which was the excessive over the weekend (till now). The low was on Saturday at $47,720.

Within the premarket for US shares, the main indices are buying and selling close to unchanged. The S&P index closed above 5000 for the primary time on Friday (at a file degree). Main indices closed increased for the fifth consecutive week, and closed increased for the 14th of final 15 buying and selling weeks.

- Dow Industrial Common futures are implying a decline of -22.69 factors. On Friday, the index fell 54.64 factors or -0.14% at 38671.72

- S&P futures are implying a decline of -0.86 factors. On Friday, the index rose 28.70 factors or 0.57% at 5026.62. There was a file shut

- Nasdaq futures are implying a file of -2.9 factors. On Friday, the index rose 196.95 factors or 1.25% at 15990.66

Within the European fairness markets, the main indices are buying and selling increased:

- German DAX, +0.36%

- France CAC +0.38%

- UK FTSE 100, -0.06%

- Spain’s Ibex, +0.57%

- Italy’s FTSE MIB, +0.57% (delayed by 10 minutes).

Shares within the Asian Pacific markets had been combined.

- Japan’s Nikkei 225, closed for vacation

- China’s Shanghai composite index , closed for vacation

- Hong Kong’s Hold Seng index, closed for vacation

- Australia S&P/ASX, -0.83%.

Wanting on the US debt market, yields are decrease.

- 2-year yield 4.416% -2.7 foundation factors. At the moment yesterday, the yield was at 4.490%

- 5-year yield 4.119% -3.2 foundation factors. At the moment yesterday, the yield was at 4.145%

- 10-year yield 4.159% -2.7 foundation factors.. At the moment yesterday, the yield was at 4.179%

- 30-year yield 4.364% -1.6 foundation factors. At the moment yesterday, the yield was at 4.375%

- The two-10 yr unfold is at -30.3 foundation factors. At the moment yesterday, the unfold was at -30.9 foundation factors

- The two-30 yr unfold is at -9.6 foundation factors. At the moment yesterday, the unfold was at -11.0 however foundation factors.

Within the European debt market, the benchmark 10-year yields are decrease:

European 10 yr yields are decrease