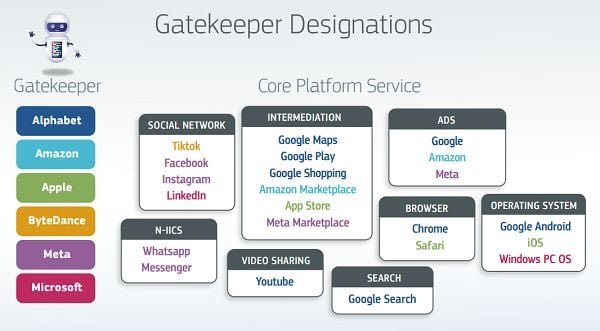

NZD/USD daily chart

That is putting a major drag on NZD/USD, which is down over 1% to near 0.6000 currently. Given the more dovish signals, traders are now pricing in ~107 bps of rate cuts by year-end. There’s still just three meetings to go, in September, November, and December. While the “expectation” is for the RBNZ to stay on hold today, traders were pricing in a ~70% probability of a rate cut. Otherwise, the damage to the kiwi would’ve been a lot worse.

Going back to NZD/USD, the fall comes as sellers are also able to lean on the 200-day moving average (blue line) as a key risk defining area. That now marks a drop back below the 100-day moving average (red line) as well. And that puts sellers back in control, after the rebound to start August trading.

The day isn’t over yet though. The dollar side of the equation is going to factor in quite heavily later today. We will be getting the US CPI report and that is the main event for markets this week. As evident from the PPI data yesterday, traders will be waiting to pounce; that especially if it works out in favour of risk trades again.