Final week noticed one of many extra terrifying crypto business hacks in current reminiscence, threatening not only a single protocol or utility, however an untold variety of apps that trusted one piece of infrastructure. And it may have been prevented with safety practices which are second nature in additional mature industries.

It occurred in the dark U.S. time on Dec. 14. That’s when an attacker injected malicious “drainer” code into Ledger’s Join Package, a broadly used software program element maintained by the {hardware} pockets maker. For a number of hours earlier than it was patched, the malicious code snatched digital belongings proper out of wallets related to companies via Join Package. One commentator, solely barely hyperbolically, described the hack as compromising “all web3 websites in the world.”

Fortunately, the injury to crypto customers hasn’t been as catastrophic because it simply may have been. However the hack has devastating implications for Ledger itself, above all as a result of it was 100% preventable—if solely a painfully easy code-update-monitoring course of had been in place. The truth that the compromised code was first detected by the third-party firm Blockaid, using a version of that update-monitoring process, somewhat than by Ledger itself, makes the failure much more damaging.

However related failures are frequent throughout cryptocurrency and blockchain tasks—and for related causes. Particularly, many crypto tasks have immature or underfunded safety stances, often overwhelmingly targeted on looking out particular items of code for vulnerabilities.

The Ledger hack exhibits simply how restricted this strategy is, for the reason that vulnerability was not within the code in any respect. As an alternative, it was within the strategy of managing the code. To forestall such inner course of failures, crypto tasks have to reorient their safety requirements round extra sturdy safety evaluations frequent in—to select a very ironic instance—the banking sector.

Plumbing downside

Join Package acts as a sort of plumbing for an prolonged universe of distributed apps. In principle, Join Package permits Ledger pockets customers to rigorously management third-party apps’ entry to cryptocurrency saved utilizing Ledger’s {hardware} dongles. Compromising Join Package amounted to compromising all of these related companies.

It was a brand new iteration of a basic “supply-chain attack,” which gained notoriety with the Russian-backed Solarwinds hack, which equally compromised behind-the-scenes infrastructure software program and will have brought about as a lot as $100 billion in injury to a broad array of companies and entities in 2020. The Ledger Join Package hack was caught and stuck inside hours, and now appears to have value customers less than half a million dollars in crypto.

However autopsies of the assault have uncovered deep issues with how Ledger managed its software program—software program with which the overriding pitch to customers is that it’s hyper-secure.

Right here’s what occurred, not less than so far as we all know proper now. In response to Ledger, the preliminary compromise was a phishing assault that gained entry to the accounts of a former Ledger worker. Whereas it’s unimaginable to say for certain, evidently providing higher anti-phishing coaching might need prevented this primary obvious course of failure.

However far worse, the previous worker nonetheless had entry to a Ledger JavaScript package managed utilizing a third-party service known as NPM. That’s the second course of failure: All former staff’ entry to code ought to, clearly, be instantly revoked upon their departure.

However even that wasn’t the actually cardinal sin. It was apparently routine for adjustments to that NPM-hosted Javascript bundle for use to replace the Join Package code in actual time, with seemingly no human overview or sign-off. That’s the third course of failure—and it’s notably dire.

Automated updating from a dwell database of code is also known as “load from CDN [content delivery network]”. It permits an utility to be up to date quickly, incessantly, and without having a person’s interplay. However the methodology additionally, not less than as carried out for Join Package, created a significant vulnerability, as a result of there was no human examine to verify adjustments had been supposed and official.

As soon as the hacker was contained in the JavaScript bundle on NPM, there was successfully nothing in any respect between them and the code controlling customers’ wallets. Ethereum developer Lefteris Karapetsas of Rotki pulled no punches, describing the usage of this dwell replace methodology as “insane.”

(Notably, nevertheless, some observers have laid blame on the toes of NPM itself for its failure to implement better version control natively.)

These are exactly the sorts of failures {that a} safety overview targeted solely on code wouldn’t catch—as a result of they’re not within the code.

Auditing audits

That’s why the language of safety “audits,” so incessantly invoked by blockchain corporations, can generally be deceptive.

A proper monetary audit is not only a matter of creating certain all of a agency’s cash is the place it’s presupposed to be at one explicit second. Relatively, an accounting audit is a whole, end-to-end overview of a agency’s general money-handling practices. A CPA performing a monetary audit doesn’t simply have a look at financial institution statements and income numbers: They’re additionally required, as laid out by the AICPA, to judge “a business’s internal controls, and assess fraud risk.”

However an audit in cybersecurity doesn’t have the identical complete, formal that means because it does in accounting. Many safety audits quantity principally to point-in-time code evaluations—the equal of a monetary audit that merely reviewed present financial institution balances. Code evaluations are clearly essential, however they’re solely the start of actual safety, not the tip.

To actually match the rigor of a monetary audit, a cybersecurity overview must assess a agency’s whole improvement lifecycle via a proper, structured course of that makes certain nothing falls via the cracks. That features reviewing the varied phases of the event lifecycle, together with high quality assurance, and it means creating a risk evaluation that identifies seemingly dangers. It consists of inner safety evaluations, on issues like phishing prevention. And it features a overview of change-management processes—notably related within the Ledger case.

If there’s a silver lining right here, it’s that it doesn’t imply crypto is inherently or essentially unimaginable to correctly safe. It will probably actually appear that approach, with the constant drumbeat of hacks, vulnerabilities, and collapses. However the issue isn’t blockchain’s uncommon structure—it was a sequence of compromises on rigorous and standardized safety.

Because the crypto business matures, the businesses that spend money on assembly these requirements will reap the advantages via offering belief and longevity. And the remaining will likely be left behind, stained by avoidable failures.

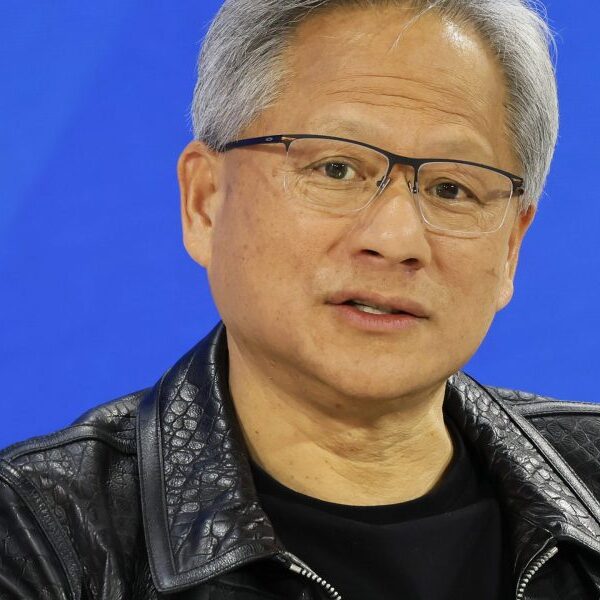

David Schwed, a foremost skilled on digital asset safety, is COO of the blockchain safety agency Halborn and the previous world head of digital asset expertise at BNY Mellon. The opinions expressed in Fortune.com commentary items are solely the views of their authors and don’t essentially mirror the opinions and beliefs of Fortune.