This has gotten out of hand — The speed lower pricing simply will not cease.

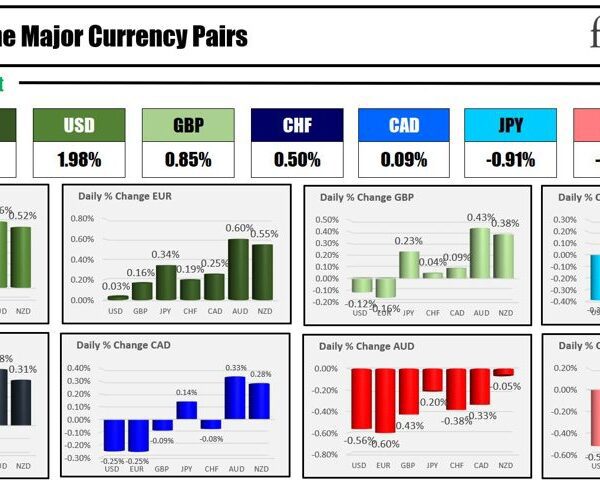

US 2s are down 15.6 bps to 4.55% and Fed funds futures are pricing in 132 bps of cuts subsequent 12 months. Pricing for the primary lower on March 20 is now at 73%.

It is powerful to sq. this with a sequence of Fed officers saying they’re nonetheless extra prone to hike charges and that it is too early to desert the hawkish bias. If you’re to take them at their phrase, we should not even be speaking about cuts till H2.

And that is how markets used to work but it surely’s modified. Ten or 15 years in the past, the market parsed Fed feedback after which leaned a method or one other.

Right this moment, markets count on Fed officers to know precisely what’s priced in by way of the Fed funds futures market. As an alternative of watching what Fed officers say, it is all about what they do not say. The market has been pricing in cuts and ready for the Fed to pushback, as a substitute, it was Waller this week (a hawk) got here out and said there are good arguments that if inflation continues falling for a number of extra months that you possibly can decrease the coverage fee.

That led to the market pricing in much more easing and nonetheless, no Fed official supplied a tough pushback and Barkin handle markets instantly saying:

“Market bets on 4 rate cuts next year might be based on expectations for soft landing. I hope they are right”

The market is working with that now the Fed is headed right into a blackout till December 13.