Bonnie Cash/Getty Images News

Traders are increasingly betting that the Federal Reserve will launch its rate-cutting cycle with an outsized 50 bps cut this week. Current market pricing indicates a roughly 60% chance of a jumbo-sized 50 bps Fed cut this week. But as recently as last week, the market priced an 85% chance of a 25 bps cut. The degree of uncertainty over what the Fed is looking to do will likely fuel market volatility during and after this week’s FOMC meeting. Additionally, the potential for a huge rate cut shortly before November’s U.S. presidential election will certainly raise some eyebrows at home and abroad. So far, stocks are near flat to start the week, while volatility is up. However, I think the market is ahead of itself. For reasons I’ll get into, I don’t expect the Fed to cut by 50 bps.

Why Does The Market Think The Fed Will Cut By 50 bps?

The market seems to be getting this idea from a recent WSJ piece by Fed confidant Nick Timiraos, a well-known economics reporter who also wrote Jerome Powell’s biography. Lots of people are parroting the idea that the Fed will cut by 50 bps, but few people know where the idea came from, and even fewer bothered to read the WSJ piece. Like the old schoolyard game of telephone, by the time the information in a paywalled article on Fed policy makes it to a realtor podcast or the local bar, there’s bound to be a lot lost in translation.

My take on the overall tone of the WSJ piece is that the Fed intends to cut by 25 bps, but that some Fed economists would favor a 50 bps cut. That’s really it.

A few quotes from the piece:

Given the Fed’s preference to build a broad consensus and the challenge of explaining a larger rate cut right before the election, starting with a 0.25-point cut offers the path of least resistance. “25 is easy at the start,” said Esther George, who was Kansas City Fed president from 2011 until 2023. “You could say, ‘We can either keep this up for a while or if it looks like things are weaker, we can go harder.’”

Ms. George also hedges a bit and goes on to say that she could get on board with a larger rate cut as well. To this point, there are some legitimate worries that sources close to the Fed have on the economy.

From later in the piece:

The housing market has been soft in recent months, and while the construction sector added jobs in August, declines in new residential construction point to another source of potential weakness ahead for hiring. Businesses and financial companies that cater to low- and middle-income consumers are pointing to signs of greater strain, and the personal savings rate fell to 2.9% in July, near its lowest level since 2007. While the economy has been growing at a reasonably solid pace this year, “we have supported this growth by doing less and less saving, and more and more borrowing. That’s not sustainable,” said Donald Kohn, a former Fed vice chair.

To be fair, current and former Fed officials are communicating some serious concerns over the labor market and over the use of credit and savings to support consumption spending. That’s the case for 50 bps. But had the Fed wanted to get interest rates lower sooner, it had a clear chance in July to cut by 25 bps that they didn’t take.

To hold rates steady in July and then come out with 50 bps now risks making it look to Wall Street and the public like the Fed isn’t on top of things and isn’t competent – or worse, that they’re trying to influence the election. Some backstory here – one of the loudest voices currently calling for a 50 bps cut is former New York Fed president Bill Dudley who previously suggested in 2019 after his retirement that the Fed should work against Trump’s 2020 reelection. To this point, Democrat leadership in the Senate is calling for a 75 bps cut before the election. Central bank policy is about economics, but it’s also highly political. This is precisely the reason why well-run countries have independent central banks. Otherwise, incumbent politicians would use monetary policy as a political weapon. No matter which party is in power, it’s best for the long-run success of America if the Fed is independent and not beholden to either political party.

If the Fed is wise, they’ll want to sidestep the political chaos and not make a previously unsignaled jumbo-sized rate cut immediately before the election. Because the difference between 25 bps and 50 bps initially is rather small, it helps the Fed save face and avoid controversy by starting with 25 bps and going to 50 bps if they think the data supports it after the election. This one point probably is more important than all the other economic analyses out there on what the Fed should do this week.

How High Should Interest Rates Be?

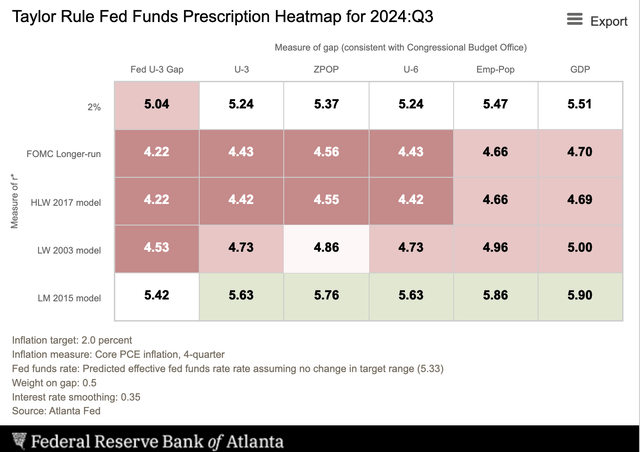

Based on the current labor market and levels of inflation, most models I’m seeing are calling for a Fed funds rate between 4.5% and 5.5%. Doing some quick modeling with the Taylor Rule suggests that the Fed is right to cut interest rates. However, some models suggest that the Fed should hold interest rates steady and a few are even suggesting that the Fed should continue to hike.

Taylor Rule Utility (Atlanta Fed)

Given the uncertainty here, I think the case for an immediate 50 bps cut is not as strong as some economists would like to believe. Unless the Fed’s access to confidential banking data and economic data is telling them that the economy is hitting a brick wall, starting with a 25 bps cut is a much more flexible move. For example, it would be quite bad if the Fed were to cut by 100+ bps in the next few months, and then core inflation starts shooting up again. The Fed could have trouble in such a scenario where they’re still battling inflation as unemployment rises. Inflation is still above target, and this is largely why these economic models are still indicating that interest rates should still be elevated. If the labor market continues to weaken, the Fed could respond in kind by cutting interest rates in larger increments.

What Does This Mean For Stocks?

Stocks have had some wild swings since the start of August, but the situation is roughly the same as it’s been all year. Large-cap US stocks are trading near the peak valuations seen in 2021 and the 1990s dot-com bubble (to surpass the dot-com bubble we’d only need the S&P to trade about 10% higher). Personal savings rates are still hovering near record lows. Consumer loan defaults are rising every month and are much higher than pre-pandemic. Broad measures of the unemployment rate continue to rise across the globe. Berkshire Hathaway Inc. (BRK.B) is methodically selling stocks.

The most anticipated recession in history is still coming. But for now, stocks still trade near their all-time peak valuations. Historically, buying at these kinds of valuations leads to low or negative returns over the following 10-plus years once the momentum burns out. Will this time be different? I doubt it, but time will tell.

Another interesting question about the Fed and the potential for a 50 bps cut – would it actually be good for stocks? It’s well known that monetary policy works with a lag. One reason why this is – consumers and corporate borrowers in the US largely have long-term fixed-rate loans, while cash rates respond immediately to Fed hikes. This meant that net interest expense for large corporations and wealthy households actually decreased when the Fed started jacking up interest rates.

Put another way, Fed hikes helped Corporate America and affluent households with fixed-rate mortgages by putting more money in their pockets. Now, the effect of cutting interest rates is likely to work with a lag, and for similar reasons. If cutting interest rates decreases the incomes of affluent households and big companies, then a 50 bps cut (with more to follow) might hurt the labor market, stock market, and economy for the next 12-24 months.

Another idea worth watching – if the Fed goes 50 bps and signals more cuts, could it cause overleveraged traders in Asia to be forced to sell stocks? A popular trend over the past few years was to borrow in Yen and buy US stocks without respect to price or value. But if the Fed cuts interest rates sharply, the Yen will strengthen and force some of these loans to get called. The unwinding of the Yen carry trade caused volatility in early August, and the Fed cutting interest rates further might cause a bout of forced selling in US stocks.

Bottom Line

The perception is that the Fed sharply cutting interest rates would temporarily juice the economy, help Kamala Harris’ election chances, and send stocks soaring. But in reality, the cause and effect of these isn’t so clear. In fact, a 50 bps cut might weaken the labor market further by removing the new demand created by interest income from the economy. Ditto for big tech stocks that have seen their massive cash hoards suddenly earning close to 5.5% interest. Will the Fed go 50 bps this week? I argue that there are plenty of reasons not to, and doing so might not have the effect that they’re looking for. With markets currently pricing nearly a 60% probability of a 50 bps rate cut this week, I’d take the under. The Fed should go with a 25 bps cut on Wednesday.