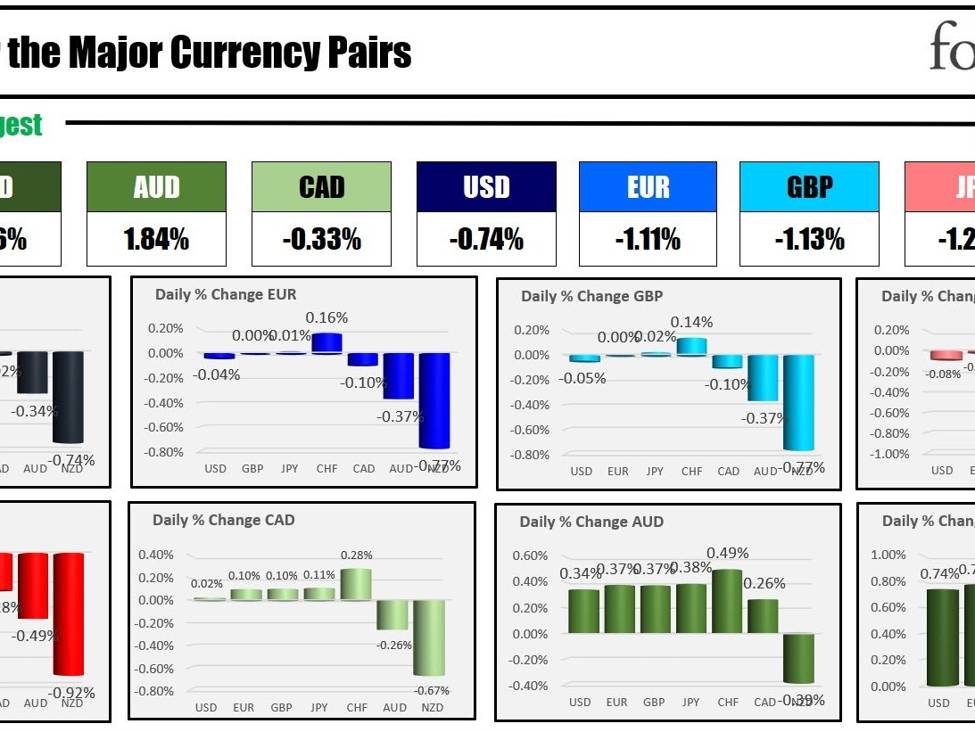

The strongest to the weakest of the main currencies

The NZD is the strongest and the CHF is the weakest because the North American session begins with the NZD being the large transfer on the day.

The catalyst for the transfer within the NZD was a report that ANZ now predicts that the Reserve Financial institution of New Zealand (RBNZ) will enhance the Official Money Fee (OCR) by 25 foundation factors in each February and April, bringing it to a complete of 6%, which deviates from the consensus view. This forecast is predicated on a sequence of small, however unwelcome surprises in financial knowledge, main ANZ to imagine that the RBNZ is not going to really feel assured that it has sufficiently met its inflation targets. The OCR is at the moment at 5.5%, and whereas the market is basically anticipating the RBNZ to keep up charges within the upcoming February assembly, with a 90% anticipation of a maintain resolution, ANZ stands out by anticipating price hikes in each the February 28 and April 10 conferences.

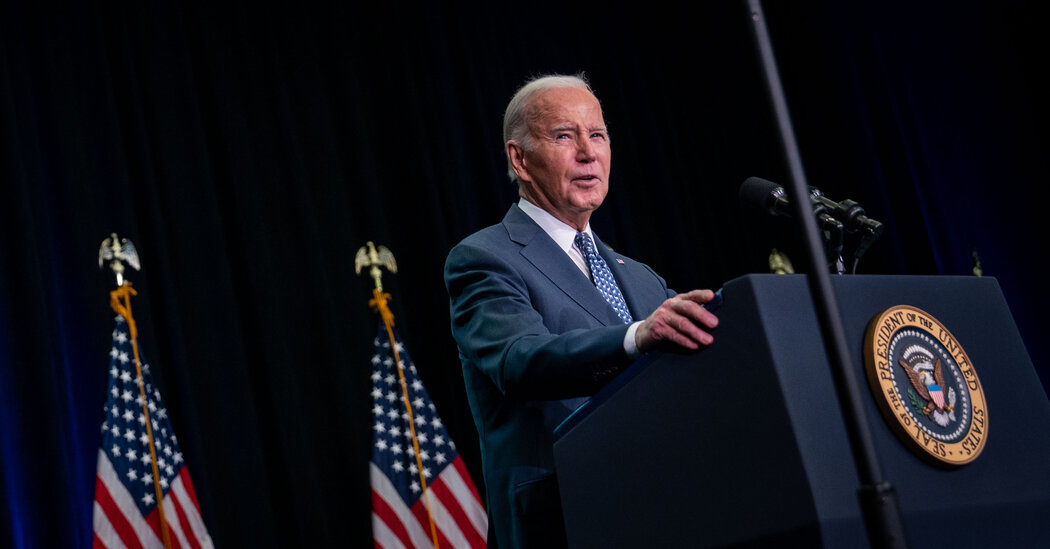

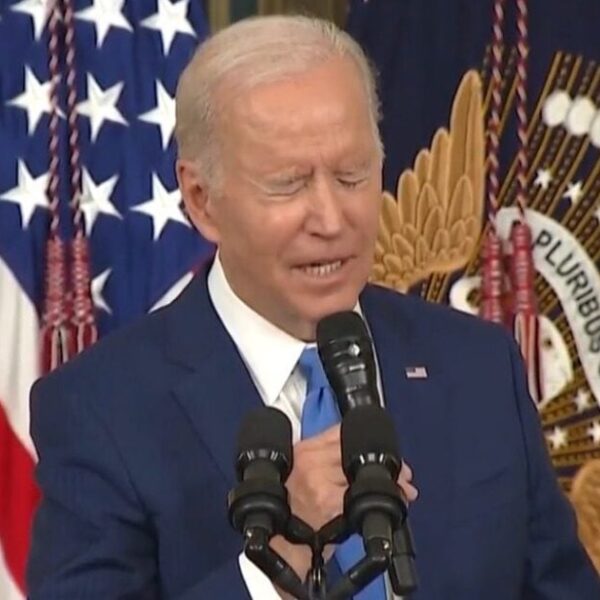

US CPI seasonal CPI revisions will likely be launched at 8:30 AM ET (from 2019 to 2023). Fed’s Waller in January emphasised the significance of the upcoming CPI revisions, indicating that these revisions, notably for 2023, might considerably alter the understanding of inflation tendencies. He expressed a cautious optimism, hoping the revisions would validate the noticed progress in controlling inflation. Nevertheless, he additionally careworn that coverage choices ought to be data-driven quite than primarily based on hope, highlighting the Fed’s dedication to reply adaptively to new data. Fed Powell’s response to a query concerning the CPI revisions and their impression on his confidence within the inflation trajectory was non-committal, indicating a wait-and-see strategy. He acknowledged the significance of the revisions however kept away from speculating on their impression, referencing the unpredictability marked by earlier surprises.

Canada’s employment knowledge will likely be launched at 8:30 AM as properly. Employment change is predicted at 15.0 Ok versus 0.1 Ok final month. The unemployment price is predicted to five.9% versus 5.8%. There are not any US knowledge releases at the moment.

US inventory futures are larger in premarket buying and selling after document closes once more within the Dow Industrial Common and a S&P index yesterday. Yields are blended with the shorter and better within the longer finish decrease. The coupon auctions this week have been profitable with the 30-year distributed with a -2.0 foundation level tail.

A snapshot of the markets because the North American session begins at the moment exhibits:

- Crude oil is buying and selling close to unchanged at $76.20. Right now yesterday, the worth was buying and selling at $74.65

- Gold is buying and selling down -$3.87 or -0.19% at $2029.69. Right now yesterday, the worth was buying and selling at $2026

- Silver is buying and selling up 4 cents or 0.20% at $22.59. Right now yesterday, the worth was buying and selling at $22.29

- Bitcoin is constant its run to the upside. The present value trades at $47,415. Right now yesterday, the worth was buying and selling at $44,704

Within the premarket for US shares, the main indices are buying and selling larger. The S&P and Dow Industrial Common closed at document ranges yesterday. The S&P index rose modestly yesterday and surpassed the 5000 stage for the primary time at 5000.40, however backed off modestly into the shut. The index is on tempo for a opening above the 5000 stage in buying and selling at the moment.

- Dow Industrial Common futures are implying a achieve of 45.67 factors. Yesterday, the index rose 48.97 factors or 0.13% at 38726.34. That was a brand new all-time document shut

- S&P futures are implying a achieve of 10.3 factors. Yesterday, the index rose 2.87 factors or 0.06% at 4997.92. That additionally was a brand new all-time document shut

- Nasdaq futures are implying a achieve of 62.08 factors. Yesterday, the index rose 37.07 factors or 0.24% at 15793.71

Within the European fairness markets, the main indices are buying and selling larger:

- German DAX, +0.16%. For the week the index is up 0.42%.

- France CAC +0.01%. For the week index is up 0.97%

- UK FTSE 100, +0.17%. For the week the index is down -0.10%

- Spain’s Ibex,+ 0.06%. For the week the index is down -1.50%

- Italy’s FTSE MIB, +0.35% (delayed by 10 minutes).

Shares within the Asian Pacific markets have been blended.

- Japan’s Nikkei 225, +0.09%. For the week the index rose 2.04%.

- China’s Shanghai composite index , +1.28%. For the week the index rose 4.97%..

- Hong Kong’s Grasp Seng index, -0.83%. For the week the index rose 1.37%

- Australia S&P/ASX, +0.07%. For the week the index fell -0.70%

Trying on the US debt market, yields are blended.

- 2-year yield 4.49%, +3.2 foundation factors. Right now yesterday, the yield was at 4.437%

- 5-year yield 4.145% +2.2 foundation factors. Right now yesterday, the yield was at 4.090%

- 10-year yield 4.179% +0.9 foundation factors.. Right now yesterday, the yield was at 4.138%

- 30-year yield 4.375% -0.5 foundation factors. Right now yesterday, the yield was at 4.343%

- The two-10 12 months unfold is at – -30.9 foundation factors. Right now yesterday, the unfold was at -29.8 foundation factors

- The two-30 12 months unfold is at -11.0 foundation factors. Right now yesterday, the unfold was at -8.4 however foundation factors.

Within the European debt market, the benchmark 10-year yields are little modified:

Europe 10 12 months yields

: