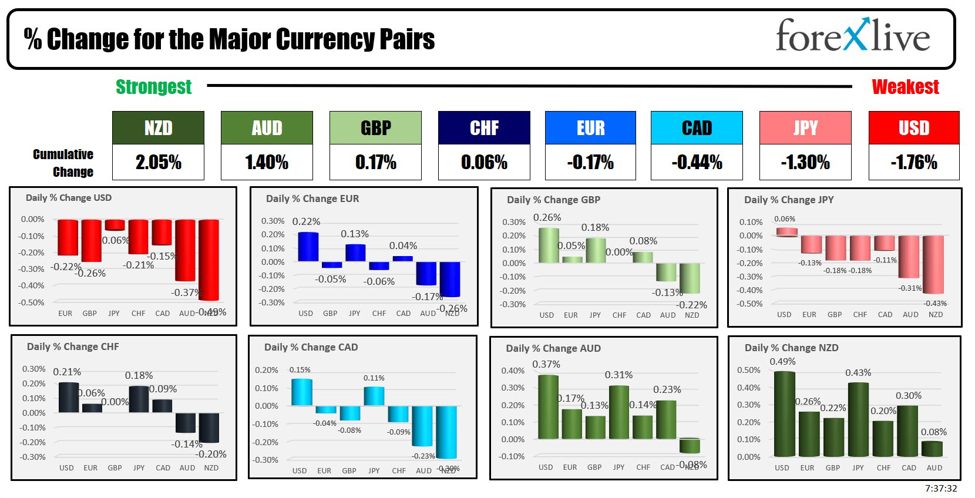

The NZD is the strongest and the USD is the weakest because the North Ameican session begins.

Yesterday, Chair Powell (and Fed Gov. Jefferson) declined to state that price cuts had been more likely to be applicable this 12 months (omitting is simply nearly as good as saying it), which was a shift within the mindset of the Fed. The Chair and Vice Chair said that inflation was not exhibiting enchancment. The market now has September because the month that the Fed might lower charges.

Within the European morning session at the moment, the U.Okay.’s shopper value inflation fell to three.2% YoY, marking the bottom price in over two years, and decrease than February’s 3.4%. The discount was primarily as a consequence of a slower rise in meals costs in comparison with the earlier 12 months. Nevertheless, gasoline costs did enhance. Core inflation additionally declined to 4.2% from February’s 4.5%. Earlier this week, employment information confirmed a slowdown in core wage development. The Financial institution of England has stored its rates of interest at their highest since 2008. BOEs Bailey not too long ago mentioned that the U.Okay. financial system is nearing a stage the place rates of interest might start to be decreased, observing sturdy indicators of disinflation at full employment.

The weekly US mortgage information was launched. Purposes (and all the different elements) rose regardless of larger charges:.

- Mortgage Refinance Index: Elevated to 500.7 from 498.3 (Stronger)

- Buy Index: Rose to 145.6 from 138.7 (Stronger)

- US Mortgage Market Index: Grew to 202.1 from 195.7 (Stronger)

- Mortgage Purposes: Jumped to three.3% from 0.1% (Considerably stronger)

- 30-Yr Mortgage Price: Elevated to 7.13% from 7.01%

Affordability is at its lowest degree since 1980.

US shares are larger. US yield are little modified.

In Israel, there was quiet. Yesterday, threats had been made by Israel of a retaliatory strike in some type or style towards Iran.

Crude oil at the moment is decrease. The personal stock information launched late yesterday confirmed a stronger than anticipated builder 4.09M barrels, however gasoline and distilates each confirmed declines. The EIA will launch their stock information at 10:30 AM with expectations of a buildup of 1.373M crude oil shares. Gasoline is anticipated to indicate a drawdown of -0.889M. The personal information yesterday got here at:

A snapshot of the opposite markets because the North American session begins presently exhibits.:

- Crude oil is buying and selling down $0.57 or -0.67% at $84.80. At the moment yesterday, the value was at a $84.96

- Gold is buying and selling up $5.16 or 0.21% at $2387.80. At the moment yesterday, the value was $2372.82

- Silver is buying and selling up $0.40 or 1.41% at $28.46. At the moment yesterday, the value was at $28.26.

- Bitcoin presently trades at $62,846 – not far off of the extent presently yesterday. At the moment yesterday, the value was buying and selling at $62,980

Within the premarket, the main indices are buying and selling larger:

- Dow Industrial Common futures are implying a achieve of 85.03 factors. Yesterday, the index gained 63.86 factors or 0.17% at 37798.98 (due to a 6% achieve in UnitedHealth).

- S&P futures are implying a achieve of 15.34 factors. Yesterday, the index fell minus 10.41.4 -0.21% at 505140

- Nasdaq futures are implying a achieve of 45.10 factors. Yesterday, the index fell -19.77 factors or -0.12% at 15865.25

The European indices are buying and selling larger:

- German DAX, +0.47%

- France CAC , +1.29%

- UK FTSE 100, was 0.66%

- Spain’s Ibex, +1.34%

- Italy’s FTSE MIB, +1.07% (delayed 10 minutes)

Shares within the Asian Pacific markets had been largely decrease:

- Japan’s Nikkei 225, however is 1.32%

- China’s Shanghai Composite Index, +2.14%

- Hong Kong’s Grasp Seng index, +0.02%

- Australia S&P/ASX index, -0.09%

Trying on the US debt market, yields are marginally larger. Yesterday yields moved larger on the again of flight to security flows reversal, after which stronger retail gross sales

- 2-year yield 4.964%, unchanged. At the moment Friday, the yield was at 4.944%

- 5-year yield 4.674%, -0.7 foundation factors. At the moment Friday, the yield was at 4.658%

- 10-year yield 4.651%, -0.6 foundation factors. At the moment Friday, the yield was at 4.682%

- 30-year yield 4.757% unchanged. At the moment Friday, the yield was at 4.752%

Trying on the treasury yield curve spreads, the yield curve assertion during the last 24 hours:

- The two-10 12 months unfold is at -31.1 foundation factors. At the moment Friday, the unfold was at -30.1 foundation factors

- The two-30 12 months unfold is at -20.8 foundation factors. At the moment Friday, the unfold was at -19.2 foundation factors

European benchmark 10-year yields are larger: