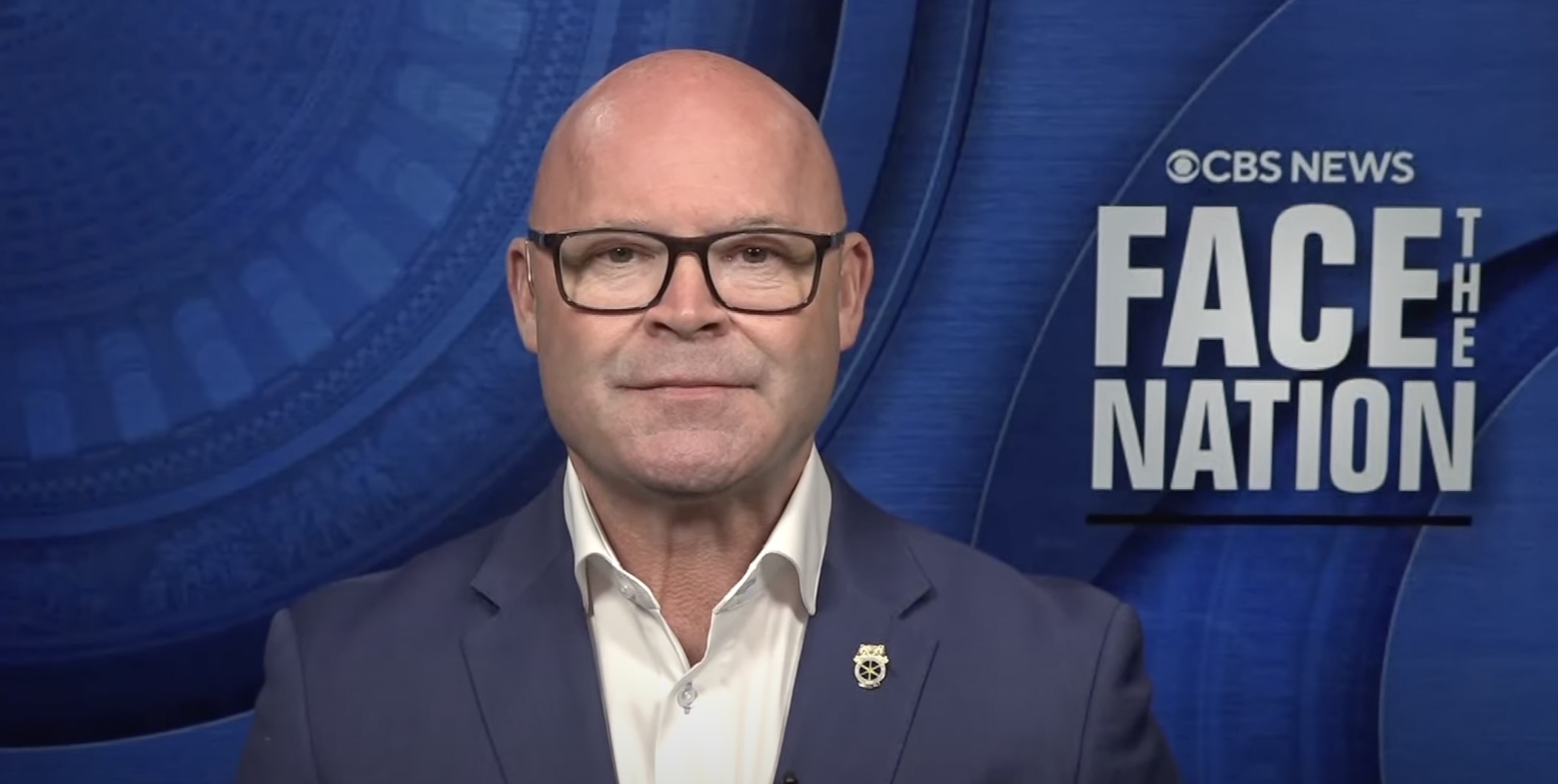

A trader works on the floor of the New York Stock Exchange on Aug. 23, 2024.

Bloomberg | Bloomberg | Getty Images

Central banks around the world are set to kick off or continue interest rate cuts this fall, bringing an end to an era of historically high borrowing costs.

In September, the U.S. Federal Reserve is all but guaranteed to join the European Central Bank, the Bank of England, the People’s Bank of China, the Swiss National Bank, Sweden’s Riksbank, the Bank of Canada, the Bank of Mexico and others in cutting key rates, which have been held at levels not seen since before the Financial Crisis of 2007-2008.

Money markets had already fully priced in a rate cut from the Fed, but last week investors gained even more confidence in the path of easing ahead.

At the annual Jackson Hole symposium, Fed Chair Jerome Powell not only said the “time has come for policy to adjust,” but that the central bank could now equally focus on doing “everything” it can to keep the labor market strong and continue progress on inflation.

Current pricing suggests high expectations for three 25 basis point cuts by the Fed before the end of the year, according to CME’s FedWatch tool. That will keep the Fed roughly in-line with its peers, despite it moving later.

The European Central Bank is seen cutting rates by 25 basis points at least three times in total this year; and the Bank of England by the same increment a total of three times, according to LSEG data. All three central banks are seen further continuing monetary easing at least in early 2025, even as stickiness in services inflation continues to trouble policymakers.

For the global economy, that means a broadly lower-rate environment next year, along with significantly reduced pressures from inflation. In the U.S., a recent spike in recession fear has largely abated, and despite where there is weakness in big manufacturing-oriented economies such as Germany, the likes of the more services-focused U.K. are recording solid growth.

What all that means for markets is less clear. European stocks, as measured on the regional Stoxx 600 index, rebounded in 2023 from a downturn in 2022 and gained nearly 10% in the year-to-date to reach an intraday record high on Friday. On Wall Street, the S&P 500 index is 17% higher so far in 2024.

The VIX volatility index — which spiked amid the global equities downturn at the start of August — is back below average, Beat Wittmann, chairman and partner at Porta Advisors, told CNBC’s “Squawk Box Europe” on Thursday.

“The market, in terms of price momentum, in terms of valuations, of sentiment, has pretty much recovered, and we are going into the seasonally weak September, October period here. So I would expect choppy markets driven by various factors, geopolitics, corporate earnings, bellwethers like from the AI sector,” Wittmann said.

Choppiness will also be due to an “overdue consolidation correction” and some sector rotation occuring; but “the asset class of choice here very clearly for the rest of this year, and then especially for ’25 and beyond, is equities,” Wittmann added.

Even if recent Fed commentary appears supportive for stocks, data from the U.S. jobs market — with the next key report due Sept. 6 — remains important to watch, Manpreet Gill, chief investment officer for Africa, Middle East and Europe at Standard Chartered, told CNBC’s “Capital Connection” on Monday.

“Our baseline is still very much that a [U.S.] soft landing is achievable… It almost becomes a little bit more binary, because as long as we avoid that downside risk, equity earnings growth is still very supportive, and we’ve had sort of the positioning clean out in the recent pullback,” Gill said.

“And I think rate cuts, or at least expectation of those, really was the last piece markets were looking for. So on balance, we think it’s a positive outcome,” Gill said, referring to the risk of U.S. economic data causing volatility in the coming months.

Arnaud Girod, head of economics and cross asset strategy at Kepler Cheuvreux, told CNBC Tuesday that bonds have had a strong summer and equities have recovered; but that investors must now take a “leap of faith” on where the U.S. economy is heading and the pace of rate cuts.

“I truly think that the more rate cuts you get, the likelihood that [these cuts are] coming with negative data and hence weakening earnings momentum is very high. So it’s difficult, I think, to be too optimistic,” he said.

The stock market has meanwhile shown that there is an element to which it “couldn’t care less about interest rates,” Girod added, since Big Tech has rallied across the peak rate months — which conventional wisdom states should harm growth and technology stocks. That will keep events such as Nvidia earnings as the key ones to watch, according to Girod.

FX focus on rates

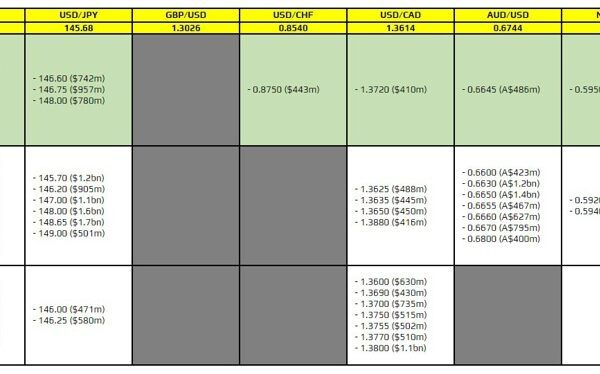

In currency markets, attention will remain on the interplay between inflation, rate expectations and economic growth, Jane Foley, head of foreign exchange strategy at Rabobank, told CNBC by email.

If the euro rises significantly against the dollar, “the disinflationary implication may have some impact on market expectations regarding the timing of the ECB rate cuts,” she said.

Stateside, Foley continued, “the result of the U.S. election will have implications for the Fed. If Trump wins, he could use an executive order to increase tariffs fairly quickly which would spur inflation risk and could cut the Fed’s easing cycle short.”

Rabobank currently sees four Fed rate cuts between September and January and then a hold for the rest of 2025, providing the U.S. dollar with the potential to strengthen into the spring.

“The BOE’s hand will likely remain constrained by services sector inflation, which is a function of wage inflation. This could limit the pace of BOE rate cuts to once a quarter,” Foley added.