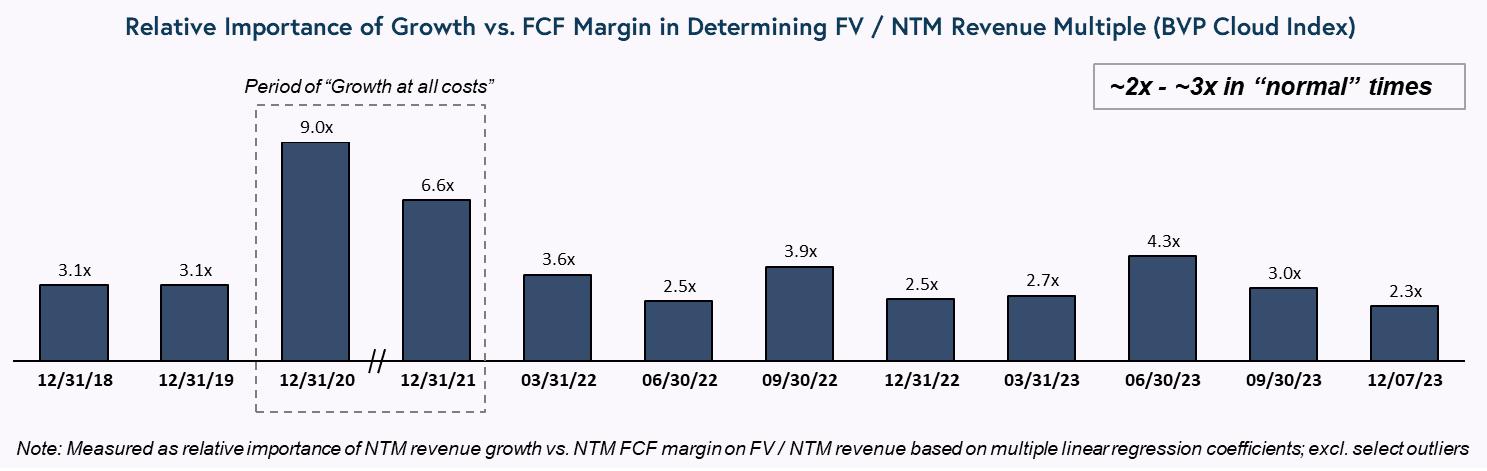

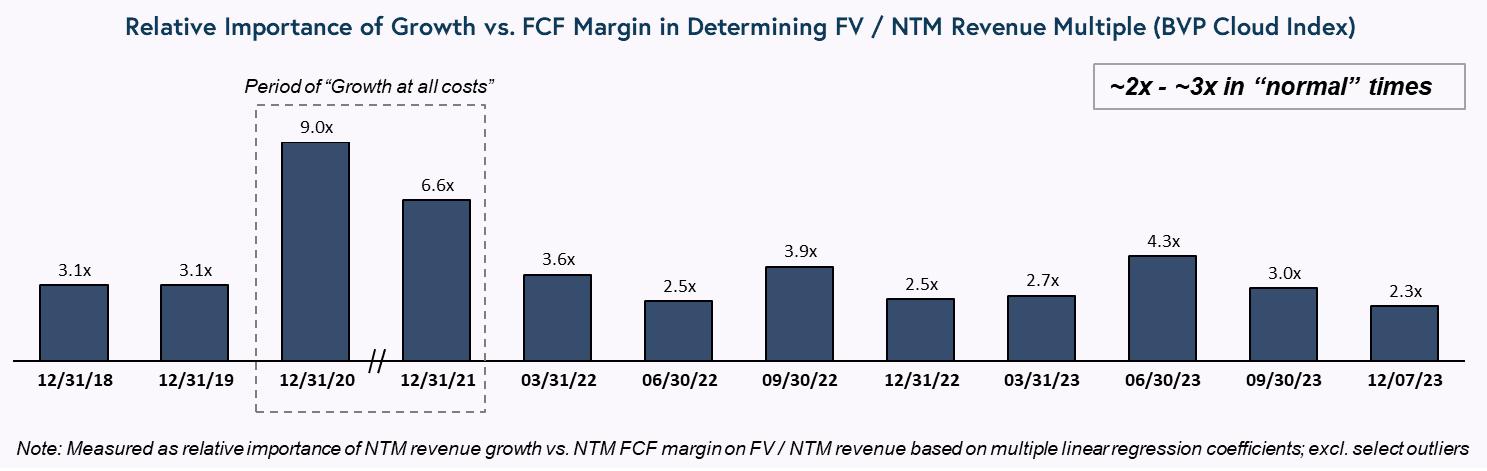

As rates of interest have returned to historic norms, the world has returned its focus to value of capital and free money move technology. Companies are working onerous to evolve to conventional heuristics like Rule of 40 (i.e., the concept that the sum of income development and revenue margin ought to equal 40%+, a metric that Bessemer helped popularize). Executives of each non-public and public cloud corporations usually imagine free money move (FCF) margins are simply as vital as (if no more vital than) development and that the trade-off is 1:1. Many finance executives love the Rule of 40 for its readability, however assigning equal weight to development and profitability for late-stage companies is flawed and has precipitated misguided enterprise selections.

Our take

Development wants to stay the first precedence for companies with sufficient FCF margins. Whereas the concentrate on effectivity is well-founded, the standard Rule of 40 math is lifeless improper as you strategy breakeven and switch free money move constructive.

The world has over-rotated into an FCF margin mindset over a development mindset, which is backward for rising environment friendly companies. Lengthy-term fashions present that even in tight markets, development ought to be valued not less than ~2x to 3x greater than FCF margin.

Assigning equal weight to development and profitability for late-stage companies is flawed and has precipitated misguided enterprise selections.

Why?

Whereas a margin improve has a linear impression on worth, a development price improve can have a compounding impression on worth. We present the detailed math beneath, and it’s confirmed by public market valuation correlations whenever you backtest the relative significance of development versus FCF margin. The precise ratio fluctuates massively within the short-term — starting from ~2x to ~9x prior to now handful of years — however over the long-term, the ratio usually settles at 2x to 3x extra worth for development over profitability.

We advocate that even essentially the most conservative monetary planners can safely use a ratio of ~2x development over profitability for late-stage non-public companies; public corporations with decrease prices of capital can use a ~2 to 3x a number of (so long as the expansion is environment friendly).

Picture Credit: Bessemer Enterprise Companions