Igor Kutyaev/iStock by way of Getty Photos

The Sound Shore Fund Investor Class (MUTF:SSHFX) and Institutional Class (MUTF:SSHVX) superior 12.43% and 12.50%, respectively, within the fourth quarter of 2023, forward of the Russell 1000 Worth Index (Russell Worth) which superior 9.50%. As of December 31, 2023, the three 12 months annualized advances for SSHFX of 9.12% and for SSHVX of 9.34% had been additionally forward of the Russell Worth’s 8.86%. As long-term traders, we spotlight that Sound Shore’s 35 12 months annualized returns of 10.14% and 10.43%, for SSHFX and SSHVX, respectively, as of December 31, 2023, had been forward of the Russell Worth at 9.94%. For the Fund’s most up-to-date standardized efficiency data, click here.

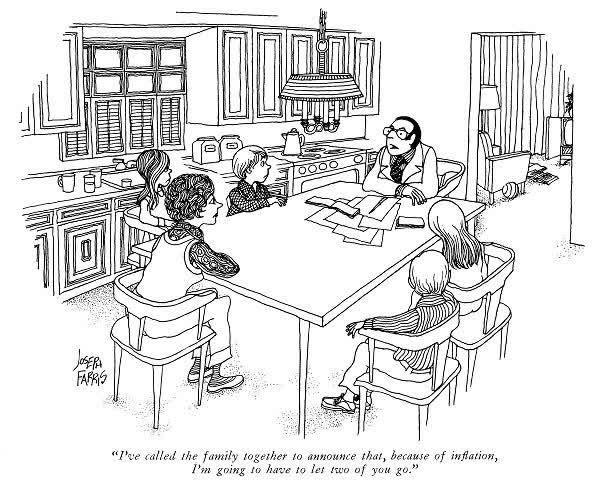

It was a superb 12 months for Sound Shore’s portfolio, gaining 17.42% for SSHFX and 17.67% for SSHVX in 2023, each effectively forward of the Russell Worth’s return of 11.46%. We started the 12 months with a whole lot of hand wringing on Wall Road as geopolitical tensions flared and the macro outlook was as unsure as ever. The Federal Reserve took traders on a curler coaster journey of recession fears that ebbed and flowed. All year long, inflationary strain on the economic system and markets remained entrance and middle and a few of us introduced this cartoon house on the holidays. Adults across the desk all appeared to take pleasure in a superb snicker out of it. The kids…not a lot.

Regardless of the market narrative typically dominated by fascination with the “Magnificent Seven” mega-cap progress shares that led the Customary & Poor’s 500 Index (SP500, SPX) returns, underneath the hood there was loads of alternative. Given greater rates of interest and the adjustment to COVID’s increase and bust affect on numerous industries, there was numerous dispersion within the fairness market. And so, forty years after the discharge of The Police’s ultimate studio album, Synchronicity, we discover ourselves in a interval of a-synchronicity. In different phrases, what we prefer to check with as “mini-cycles” inside and between industries and geographies, at totally different time limits. As correlations got here down and with quite a few shares buying and selling for very engaging valuation ranges, the chance set for our basic worth technique improved, as evidenced by our sturdy return within the fourth quarter.

Attire maker PVH led all contributors for the quarter and was certainly one of our greatest performers for 2023. As we mentioned in our letter on the finish of final 12 months, the inventory bought off within the second quarter of 2022 because it fell on shopper spending considerations and regardless of the corporate’s core enterprise persevering with to develop. We believed that with main manufacturers equivalent to Tommy Hilfiger and Calvin Klein, together with a robust steadiness sheet to resist a gross sales slowdown, PVH was executing effectively in a difficult surroundings. We added to our place on the time and our conviction has been rewarded. This 12 months, margins have improved as the corporate centered on bettering the standard and price construction of their finest promoting merchandise. This has allowed earnings to develop in opposition to a difficult retail backdrop. PVH’s administration group has focused even greater margin enchancment which might result in earnings energy (‘EPS’) of greater than $18 per share, in comparison with the present EPS of $11.

Lengthy-term holding Capital One (COF) was additionally certainly one of our higher performers this quarter. The corporate boasts a diversified deposits base with about 80% FDIC insured, effectively above {industry} common. It’s the solely main financial institution 100% within the cloud, which permits higher underwriting and faster response to modifications within the surroundings. This know-how additionally helps cut back working and fraud value whereas releasing up money circulate for reinvestment in advertising to develop merchandise (Enterprise X card) and construct its model. Intervals of stress, like we noticed within the banking sector throughout March, are a reminder of the underwriting acumen and prime quality deposits of Capital One. We added to our place after the fallout, understanding that the corporate’s seasoned administration group had steered capably by means of earlier cycles. Right this moment, as bank card delinquencies have risen to extra regular ranges, Capital One is already reporting a slowing in delinquency progress. Conversely, some friends noticed prior underwriting missteps start to floor in 2023. At the moment buying and selling at 9 occasions 2024 consensus earnings and round guide worth, we stay enthusiastic concerning the funding.

Worth investing typically requires persistence, and the passing of legendary worth investor and Berkshire Hathaway’s Vice Chairman, Charlie Munger, reminded us of certainly one of his extra insightful quotes…“It’s waiting that helps you as an investor and a lot of people just can’t stand to wait.” Healthcare holding Organon offers an analogous situation right now. The inventory lagged within the fourth quarter and for 2023 as a consequence of considerations about long-term income drivers. Non-operational elements (forex, rates of interest and separation expenses) have masked progress that has exceeded expectations. A by-product from Merck (MRK), Organon (OGN) has a really regular pharmaceutical enterprise and is investing to develop its ladies’s well being franchise. Buying and selling for simply 4 occasions earnings, the corporate is rising steadily, investing in its analysis & growth pipeline and producing ample money circulate to repay its debt. Regardless of near-term weak spot, we expect Organon is a sexy alternative for affected person, long-term traders like Sound Shore.

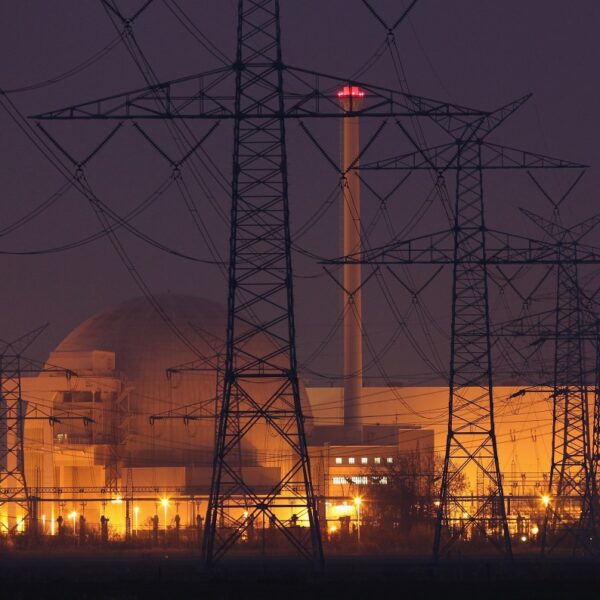

For the 12 months, we had quite a few shares up 50% or extra and the checklist features a numerous set of industries equivalent to homebuilding, heavy truck manufacturing, and semiconductor capital tools. We want to spotlight one excellent contributor for the 12 months, electrical energy generator and marketer Vistra Corp. (VST), a low-cost supplier with a wholesome steadiness between technology and retail. Demand for electrical energy is rising and notably, load peaks are altering as effectively. Because the nation brings on extra renewables and adjusts to larger demand later within the day as a consequence of elevated use of electrical warmth pumps and electrical automobile charging, dependable clear energy is at a premium. Vistra is effectively positioned with diversified gas sources together with photo voltaic, pure fuel, coal, nuclear and battery energy storage services, together with a advertising division to handle value volatility. The corporate will quickly be closing its accretive acquisition of service provider energy generator, Vitality Harbor, and the deal will make Vistra the second largest carbon free, nuclear electrical energy supplier behind Constellation Vitality, one other portfolio holding. Vistra CEO Jim Burke, leads a veteran utility administration group that’s dedicated to transitioning the corporate’s portfolio to a sustainable footprint by closing older fossil gas crops and growing the renewables portfolio. They’ve additionally been an essential voice to advocate for modifications that can speed up the worldwide transition to a clear, renewable vitality future, whereas sustaining satisfactory near-term provide. Vistra has a robust steadiness sheet that permits the corporate to spend money on innovation and operational enhancements. Moreover, administration is utilizing extra money circulate to purchase 40% of the excellent shares over a 5 12 months interval and they’re greater than half approach by means of that course of. At the moment valued at 9 occasions earnings with a 17% free money circulate yield and a 2.3% dividend, the inventory stays a full place. As you may see from the chart beneath, Vistra’s efficiency was fairly totally different than many different electrical energy suppliers and offers additional proof of the disparate efficiency that may typically be discovered inside a sector.

VISTRA CORP. vs UTILITIES INDEX vs RUSSELL 1000 VALUE INDEX

Detractors for the 12 months included a few of our healthcare holdings, which underperformed together with the sector as the joy for weight reduction medicine appeared to siphon a whole lot of capital away from different components of the healthcare {industry}. One instance is healthcare options supplier Centene; one other place we initiated earlier this 12 months when it was buying and selling at a beneath regular 9 occasions earnings. Whereas the inventory is up from buy, it has underperformed the general market. Up to now, the corporate’s Medicaid enterprise is performing as anticipated. In the meantime, a brand new administration group, led by Sarah London, previously of United Healthcare, is in its second 12 months of turning across the enterprise. We have now been impressed with the preliminary success the corporate has proven streamlining its enterprise and bettering working efficiency and the inventory stays a full place.

Over 45 years and quite a few market cycles and durations of uncertainty, we’ve discovered that conviction, judgement and inventory choosing are what ship outcomes. This 12 months once more offered affirmation that our technique doesn’t want a value-driven market to supply engaging returns. Sound Shore’s portfolio holdings responded effectively to company-specific drivers of efficiency, signaling a extra balanced market with decrease correlations. In the meantime, we’re constantly researching shares which are low-cost versus their historic norms and the market, the place worth is constructing forward of expectations. Within the present surroundings, our emphasis on stock-specific sources of outperformance ought to show as related as ever, regardless of an extended checklist of considerations concerning the economic system and market volatility.

We word that as of December 31, 2023, Sound Shore’s portfolio had a ahead price-earnings a number of of 11.1 occasions consensus estimates, a significant low cost to the S&P 500 Index at 19.5 occasions and the Russell 1000 Worth Index at 14.7 occasions. It’s our perception that the Sound Shore portfolio has large worth.

We’ve lately participated in interviews on common, investment-focused digital platforms, together with a podcast discussing Vistra Corp., participation in a Worth Equities panel, and a quick interview about what we see in right now’s market. Please click here for the interviews.

Thanks to your funding alongside ours in Sound Shore.

|

Vital Data An funding within the Fund is topic to threat, together with the attainable lack of principal quantity invested. Mid Cap Threat: Securities of medium sized firms could also be extra unstable and tougher to liquidate throughout market downturns than securities of enormous, extra broadly traded firms. International Securities Threat: The Fund could spend money on international securities primarily within the type of American Depositary Receipts. Investing within the securities of international issuers additionally includes sure particular dangers, which aren’t sometimes related to investing in U.S. dollar-denominated securities or quoted securities of U.S. issuers together with elevated dangers of opposed issuer, political, regulatory, market or financial developments, modifications in forex charges and in trade management laws. The Fund can be topic to different dangers, together with, however not restricted to, dangers related to worth investing. The Adviser analyzes threat on a company-by-company foundation. The Adviser considers governance in addition to environmental and social elements (ESG) as applicable. Whereas valuation, governance, environmental and social elements are analyzed, the analysis of all key funding concerns is industry- and company-specific. Consequently, nobody subject essentially disqualifies an organization from funding and no particular person attribute have to be current previous to funding. Diversification doesn’t guarantee a revenue or shield in opposition to a loss in a declining market. The Dow Jones U.S. Utility Index, a member of the Dow Jones International Indices® household, is designed to measure the inventory efficiency of U.S. firms within the utilities {industry}. Efficiency information quoted represents previous efficiency and isn’t any assure of future outcomes. Present efficiency could also be decrease or greater than the efficiency information quoted. Funding return and principal worth will fluctuate in order that an investor’s shares, when redeemed, could also be value roughly than their unique value. The views on this letter had been these of the Fund managers as of 12/31/23 and will not essentially mirror their views on the date this letter is first revealed or anytime thereafter. This commentary could comprise discussions about sure investments each held and never held within the portfolio. Present and future portfolio holdings are topic to threat. For the Fund’s Prime 10 Holdings click here. It’s best to think about the Fund’s funding goal, dangers, expenses and bills fastidiously earlier than investing. The abstract prospectus and/or the prospectus comprise this and different details about the Fund and can be found out of your monetary middleman or www.soundshorefund.com. The summary prospectus and/or prospectus ought to be learn fastidiously earlier than investing. Distributed by Foreside Fund Companies, LLC. |

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.