Kwarkot

REIT Efficiency

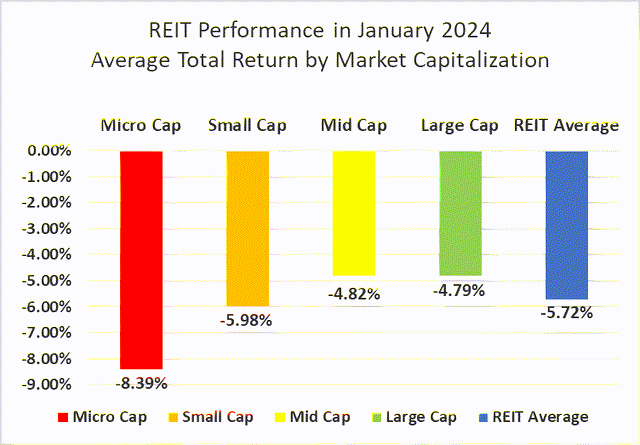

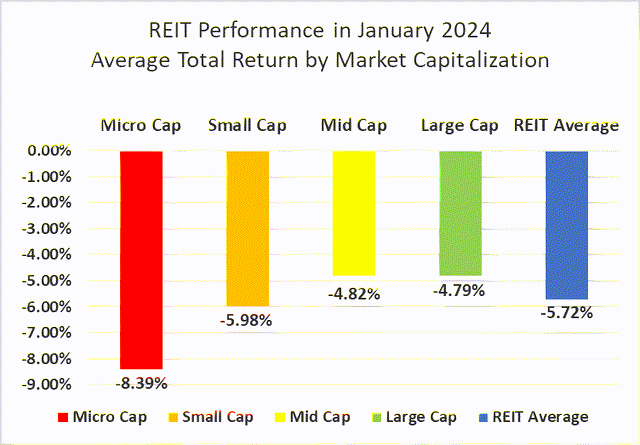

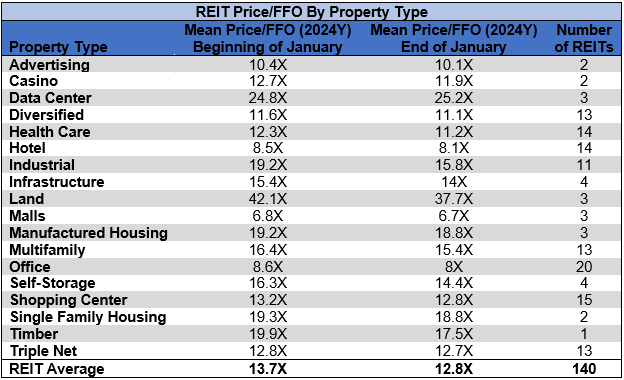

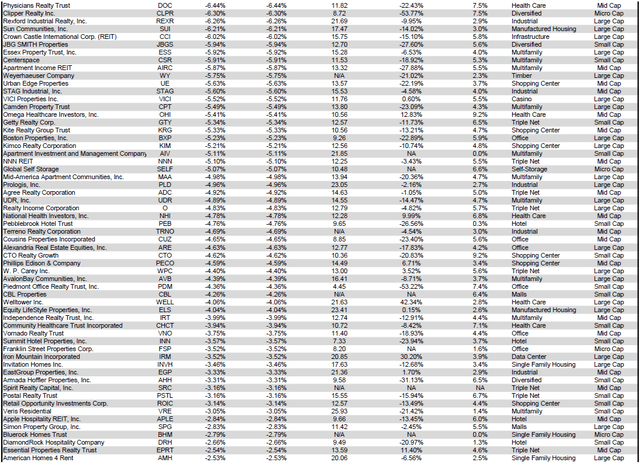

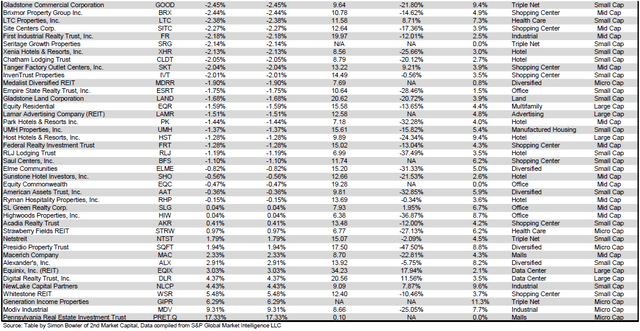

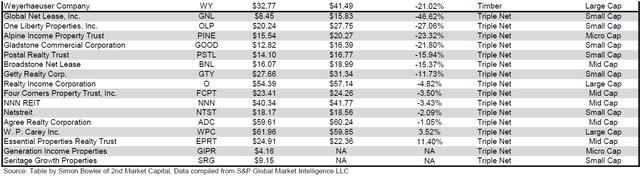

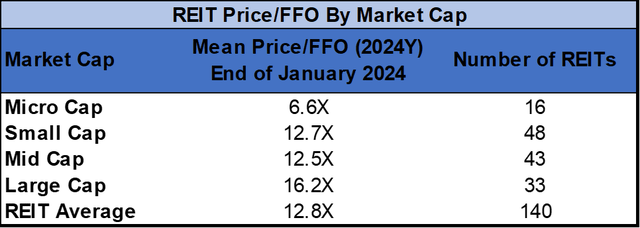

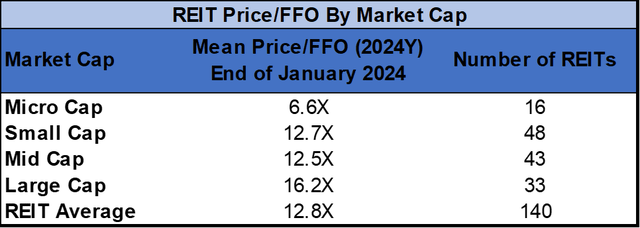

The REIT sector’s sturdy efficiency in November and December to shut out 2023 didn’t proceed into January. Fairness REITs averaged a -5.72% whole return over the primary month of 2024, badly underperforming the broader market because the NASDAQ (+1.0%), Dow Jones Industrial Common (+1.3%) and S&P 500 (+1.7%) all completed the month within the black. The market cap weighted Vanguard Actual Property ETF (VNQ) barely outperformed the common REIT in January (-5.06% vs. -5.72%). The unfold between the 2023 FFO multiples of enormous cap REITs (17.0x) and small cap REITs (12.7x) narrowed once more in January, as multiples contracted 0.8 turns for giant caps and 0.6 turns for small caps. Traders at present have to pay a median of 27.6% extra for every greenback of FFO from massive cap REITs relative to small cap REITs. On this month-to-month publication, I’ll present REIT information on quite a few metrics to assist readers establish which property varieties and particular person securities at present provide one of the best alternatives to realize their funding objectives.

Supply: Graph by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

In January, massive cap (-4.79%) and mid cap REITs (-4.82%) outperformed their smaller friends with smaller destructive common whole returns. Micro caps (-8.39%) and small caps (-5.98%) underperformed firstly of the yr. Massive caps outperformed small caps by 129 foundation factors after the primary month of 2024.

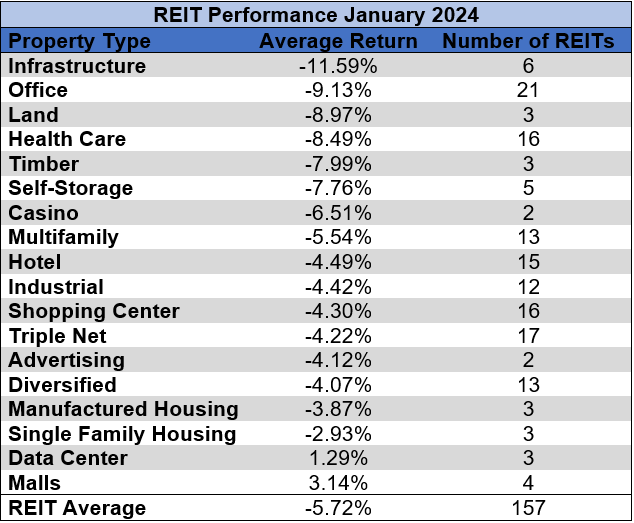

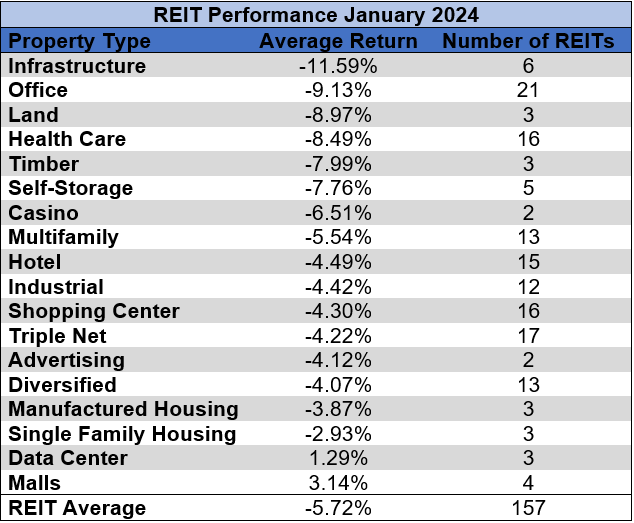

Solely 2 out of 18 Property Varieties Yielded Optimistic Complete Returns in January

88.89% p.c of REIT property varieties averaged a destructive whole return in January. There was a 14.74% whole return unfold between one of the best and worst performing property varieties. Malls (+3.14%) had been the highest performing property sort for the twond month in a row, adopted Information Facilities (+1.29%). All different property varieties averaged a destructive whole return.

Infrastructure (-11.59%) was once more the worst performing property sort in January, because the share value of CorEnergy Infrastructure Belief (OTCPK:CORR) (-22.69%) continued to plummet. Infrastructure REITs SBA Communications Company (SBAC) (-11.76%) and Energy REIT (PW) (-10.73%) additionally noticed double-digit destructive whole returns within the first month of the yr.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

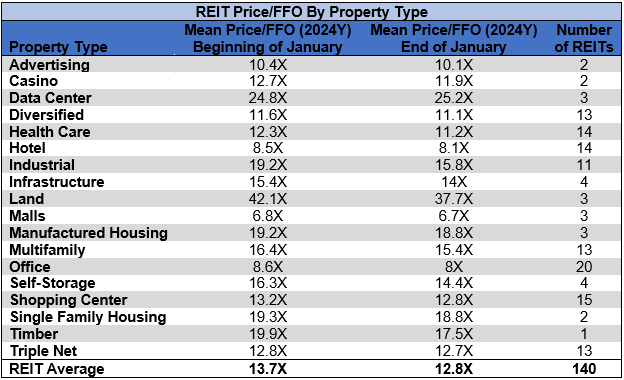

The REIT sector as an entire noticed the common P/FFO (2024Y) lower 0.9 turns in January from 13.7x all the way down to 12.8x. 5.6% of property varieties averaged a number of growth and 94.4% noticed a number of contraction. Land (37.7x), Information Facilities (25.2x), Single Household Housing (18.8x) and Manufactured Housing (18.8x) at present commerce on the highest common multiples amongst REIT property varieties. Malls (6.7x), Workplace (8.0x) and Lodges (8.1x) all common single digit FFO multiples.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

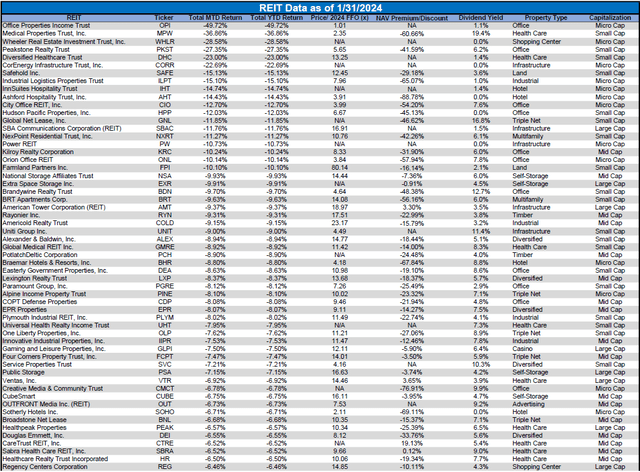

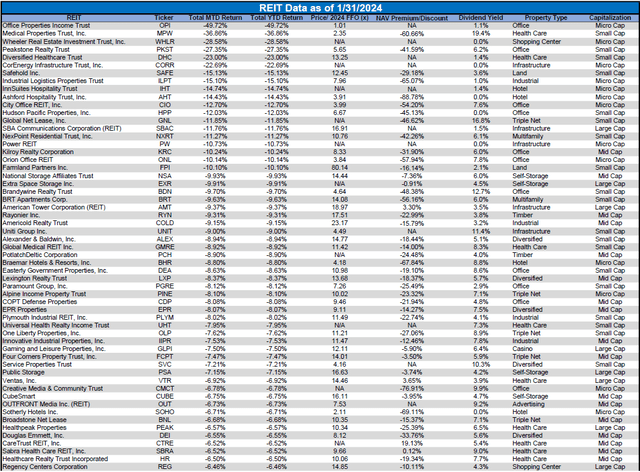

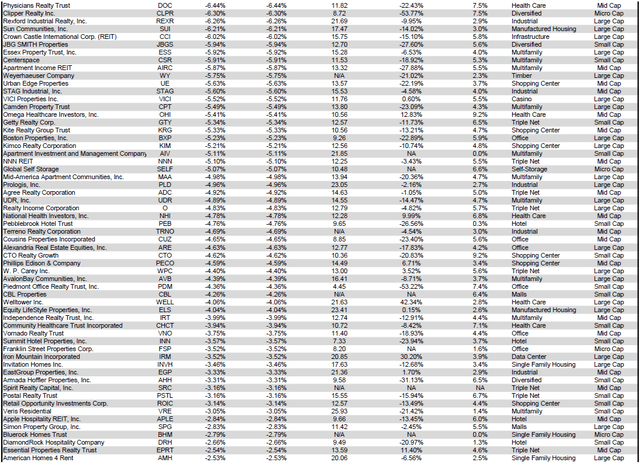

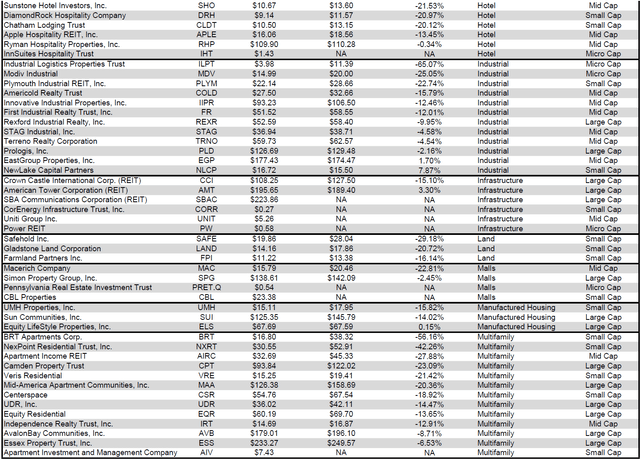

Efficiency of Particular person Securities

Spirit Realty Capital (SRC) was acquired by Realty Revenue (O) on January 23rd in an all-stock transaction. Spirit Realty Capital shareholders acquired 0.762 shares of O for every share of SRC held. SRC’s most well-liked shares now commerce beneath the ticker image (O.PR).

Pennsylvania REIT (OTC:PRETQ) (+17.33%) was the highest performing REIT for the twond month in a row because it continued to rise as a result of anticipated proceeds to frequent and most well-liked shareholders in PREIT’s chapter. Though PREIT has had back-to-back months with very sturdy returns, it has carried out terribly over an extended time interval, together with a -60.68% whole return in 2023.

Workplace Properties Revenue Belief (OPI) (-49.72%) lower the quarterly frequent dividend from $0.25/share to $0.01/share on January 11th and the share value plummeted on the information. This -96% dividend discount adopted a -54.5% lower in April 2023 from $0.55/share to $0.25/share.

Solely 9.55% of REITs had a constructive whole return in January. Throughout January 2023, the common REIT had a robust +11.77% return, whereas REITs had a a lot rougher begin to 2024 with a -5.72% whole return.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

For the comfort of studying this desk in a bigger font, the desk above is obtainable as a PDF as well.

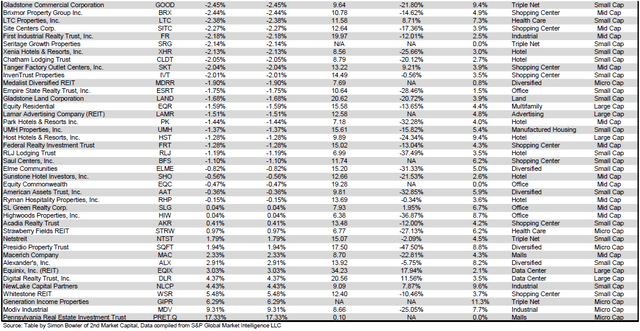

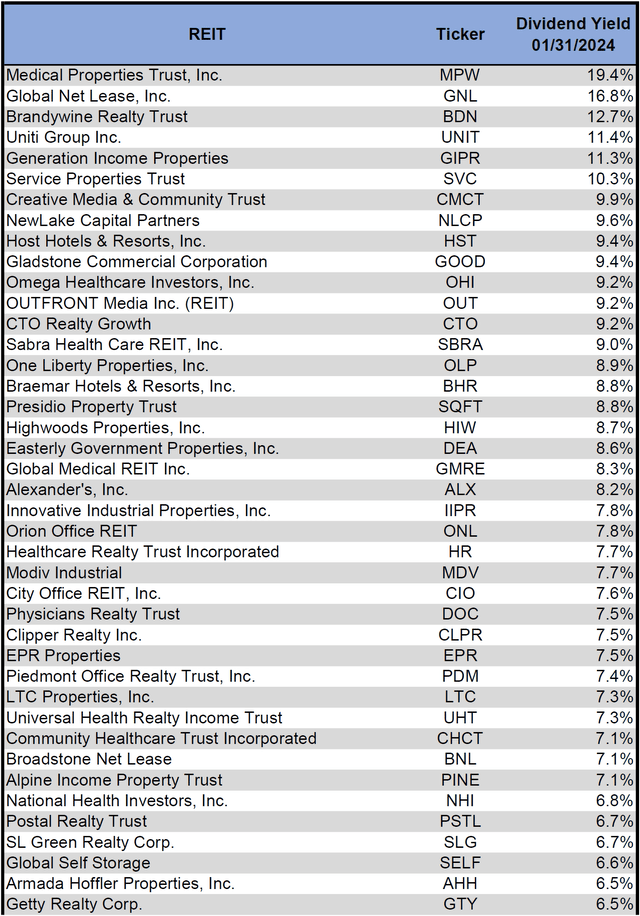

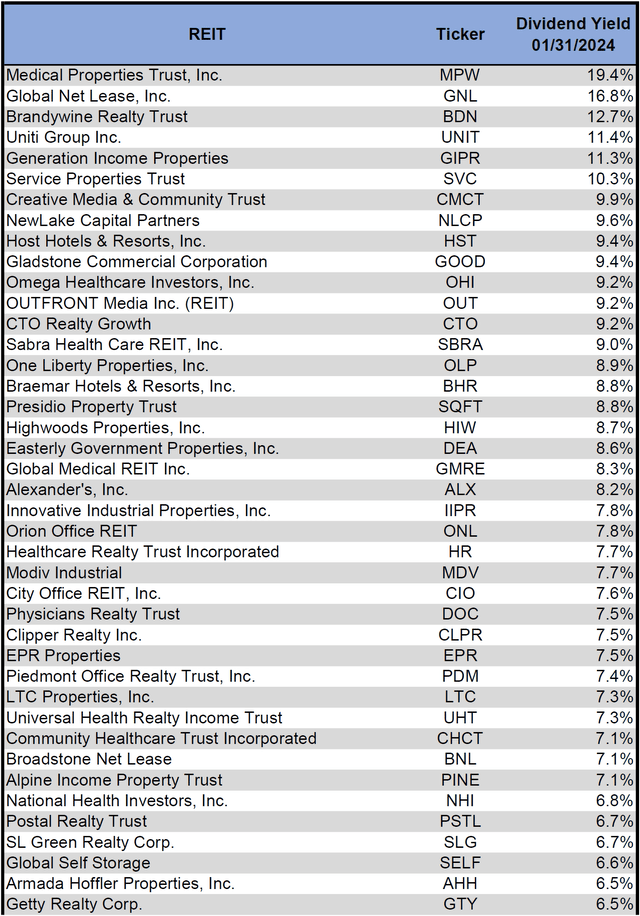

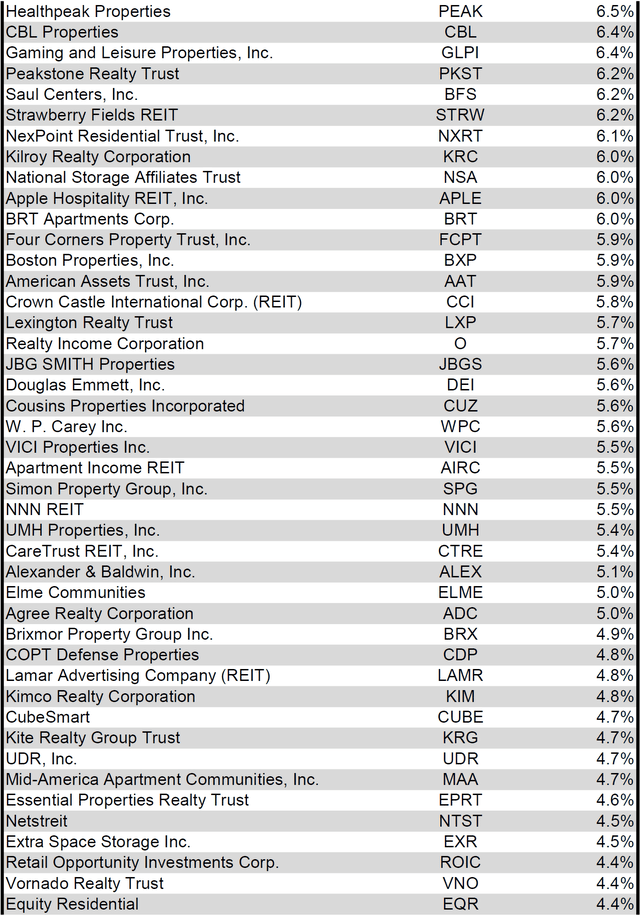

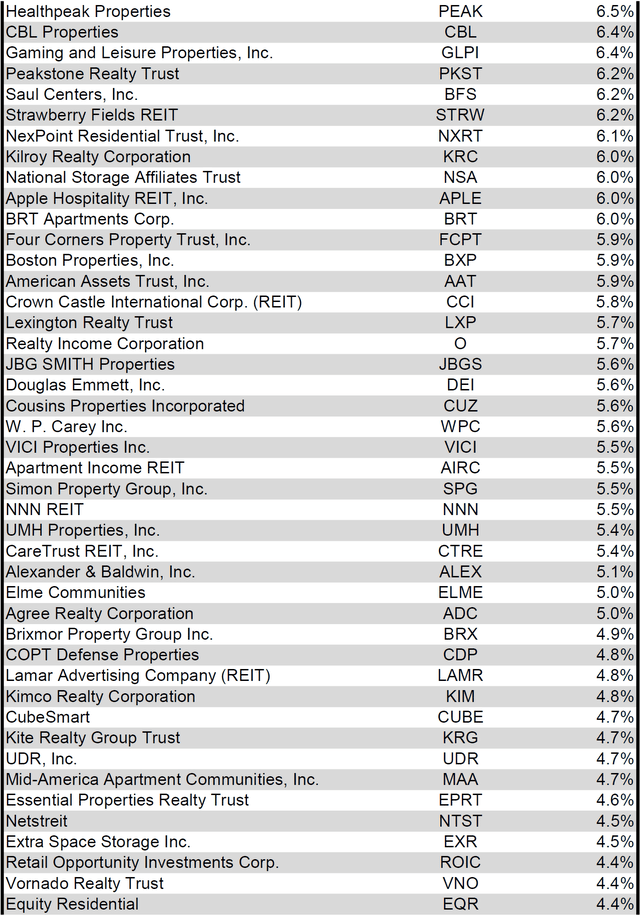

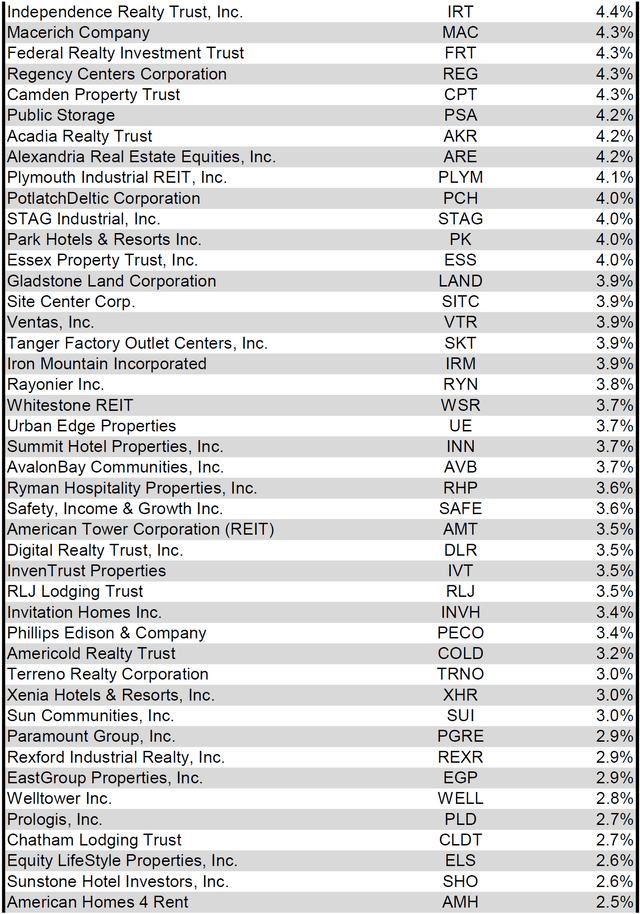

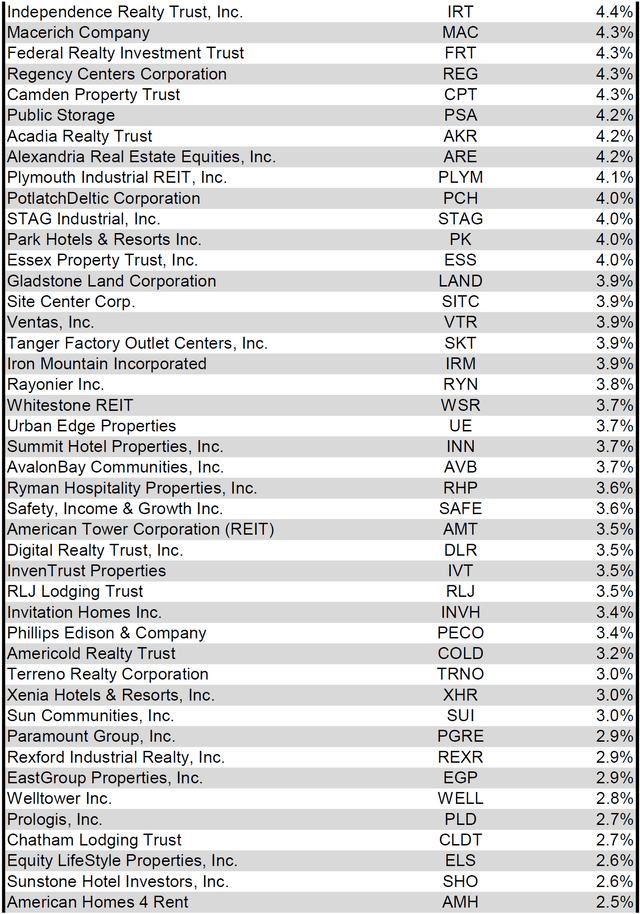

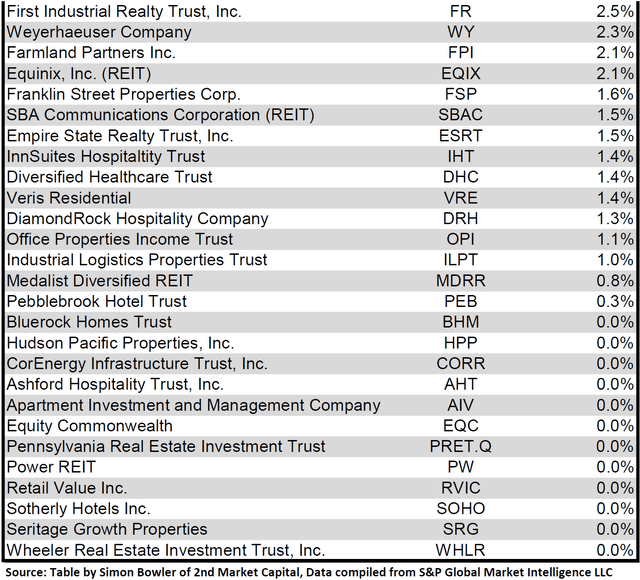

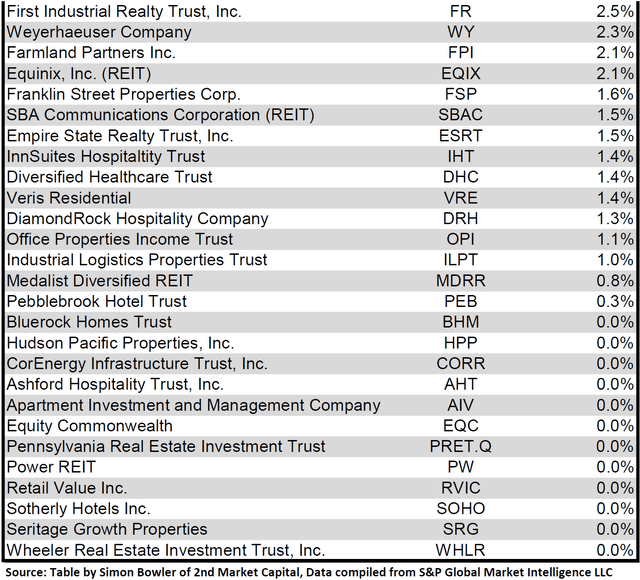

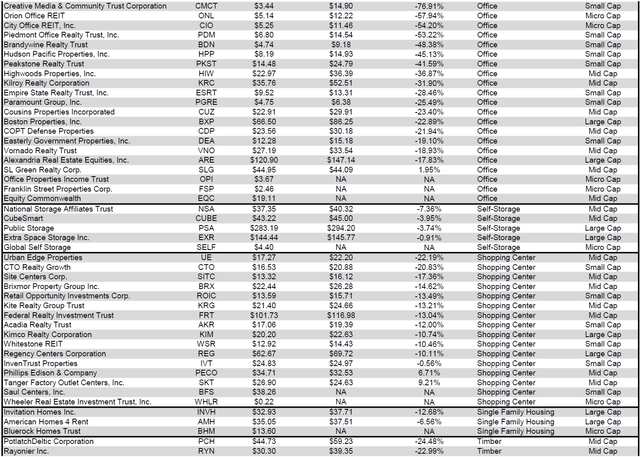

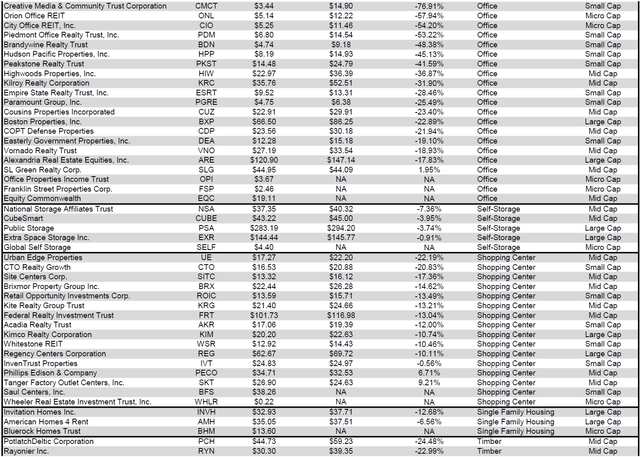

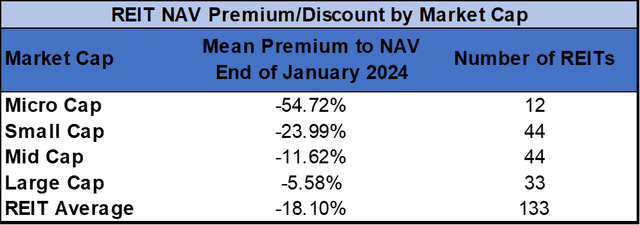

Dividend Yield

Dividend yield is a crucial element of a REIT’s whole return. The significantly excessive dividend yields of the REIT sector are, for a lot of buyers, the first cause for funding on this sector. As many REITs are at present buying and selling at share costs properly beneath their NAV, yields are at present fairly excessive for a lot of REITs inside the sector. Though a very excessive yield for a REIT might typically replicate a disproportionately excessive threat, there exist alternatives in some instances to capitalize on dividend yields which might be sufficiently engaging to justify the underlying dangers of the funding. I’ve included beneath a desk rating fairness REITs from highest dividend yield (as of 01/31/2024) to lowest dividend yield.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

For the comfort of studying this desk in a bigger font, the desk above is obtainable as a PDF as well.

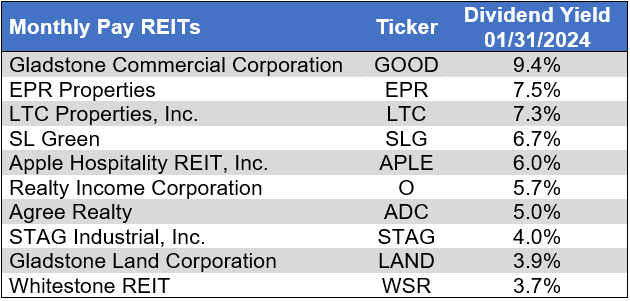

Though a REIT’s resolution relating to whether or not to pay a quarterly dividend or a month-to-month dividend doesn’t replicate on the standard of the corporate’s fundamentals or operations, a month-to-month dividend permits for a smoother money stream to the investor. Under is an inventory of fairness REITs that pay month-to-month dividends ranked from highest yield to lowest yield.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

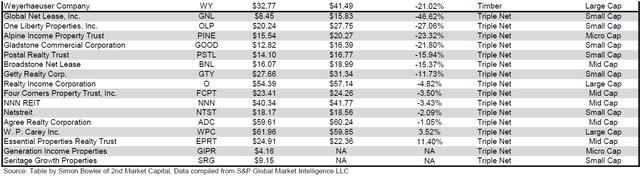

Valuation

REIT Premium/Low cost to NAV by Property Kind

Under is a downloadable information desk, which ranks REITs inside every property sort from the biggest low cost to the biggest premium to NAV. The consensus NAV used for this desk is the common of analyst NAV estimates for every REIT. Each the NAV and the share value will change over time, so I’ll proceed to incorporate this desk in upcoming problems with The State of REITs with up to date consensus NAV estimates for every REIT for which such an estimate is obtainable.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

For the comfort of studying this desk in a bigger font, the desk above is obtainable as a PDF as well.

Takeaway

The big cap REIT premium (relative to small cap REITs) narrowed barely in January and buyers are actually paying on common about 28% extra for every greenback of 2024 FFO/share to purchase massive cap REITs than small cap REITs (16.2x/12.7x – 1 = 27.6%). As could be seen within the desk beneath, there may be presently a robust constructive correlation between market cap and FFO a number of.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

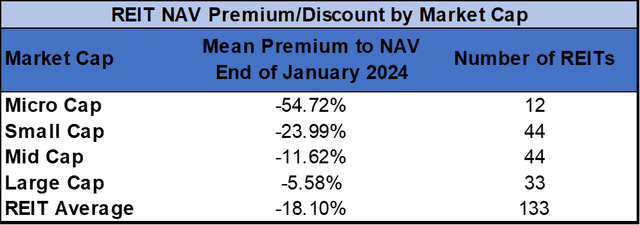

The desk beneath exhibits the common NAV premium/low cost of REITs of every market cap bucket. This information, very like the info for value/FFO, exhibits a robust, constructive correlation between market cap and Worth/NAV. The common massive cap REIT (-5.58%) trades at a single-digit low cost to NAV. Mid cap REITs (-11.62%) commerce at a double-digit low cost to NAV, whereas small cap REITs (-23.99%) commerce at about 3/4 of NAV. Micro caps on common commerce at lower than half of their respective NAVs (-54.72%).

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P World Market Intelligence LLC. See essential notes and disclosures on the finish of this text

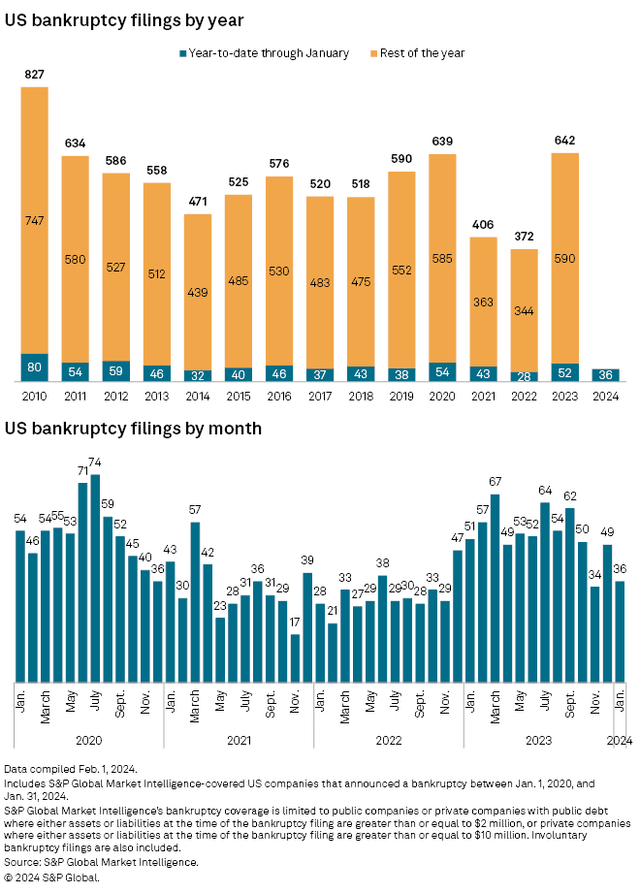

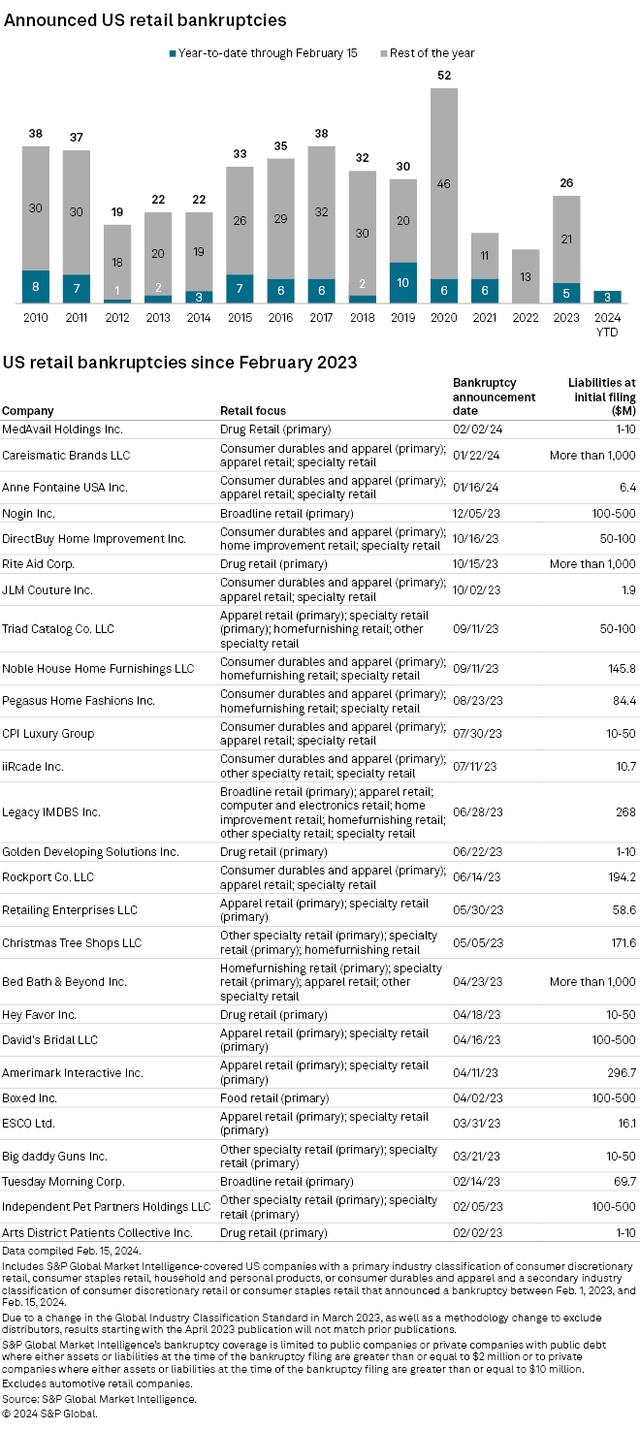

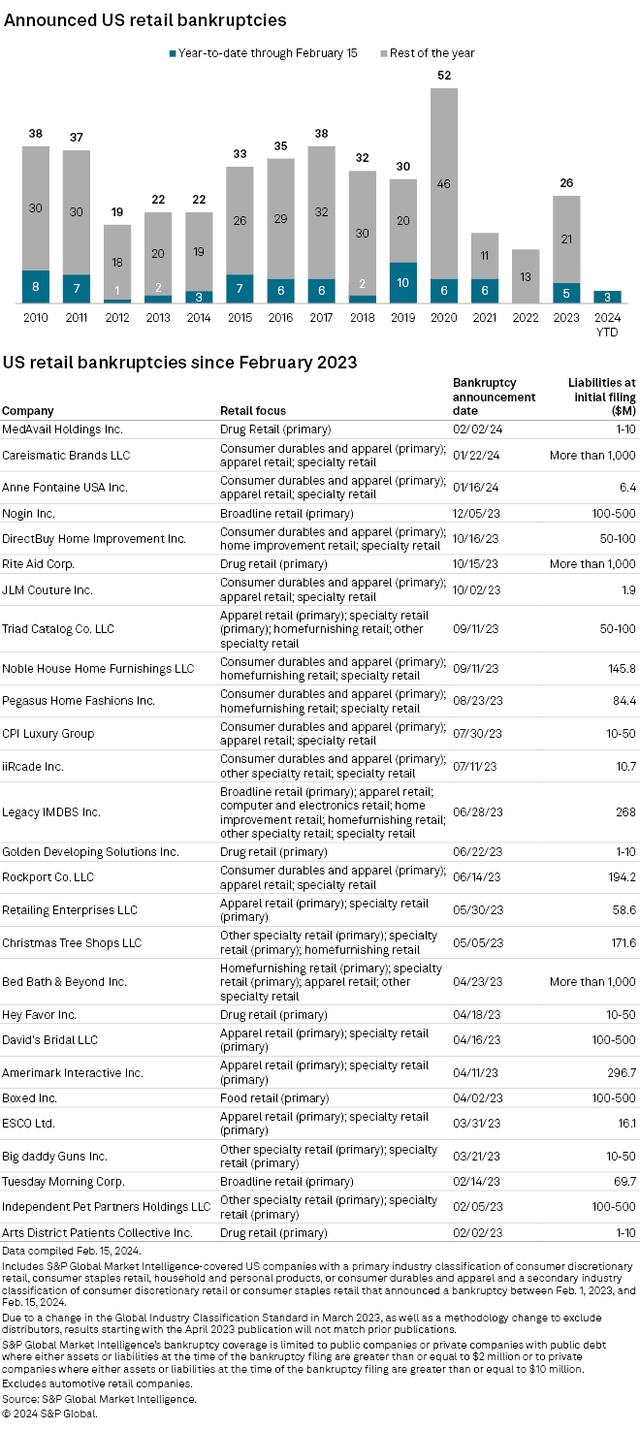

In January, the tempo of chapter filings decelerated and snapped the 15-month streak of year-over-year will increase in filings. It’s value carefully watching information over upcoming months to find out whether or not the upward pattern in bankruptcies has really begun to reverse or whether or not January’s drop was merely an irregular information level amongst a continued uptrend.

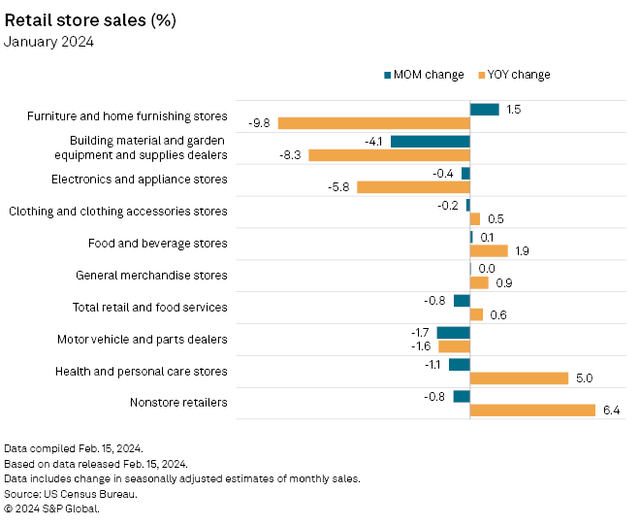

Trying particularly at retail bankruptcies, there have been twice as many in 2023 as there have been in 2022. Nonetheless, 2023 nonetheless noticed fewer retail bankruptcies than any yr from 2015-2020. There have been solely 2 bankruptcies in January and 1 within the first half of February. These 3 YTD retail bankruptcies signify an enchancment from 5 throughout the identical time interval final yr. Retail fundamentals have largely held up fairly properly regardless of cracks rising within the financial system. Attributable to very modest new provide in most markets, retail landlords have seen wholesome demand for his or her rentable area. Tenant bankruptcies and retailer closings could be very damaging for retail landlords, so how these metrics pattern all through 2024 will seemingly affect the efficiency retail REITs.

Supply: S&P World Supply: S&P World

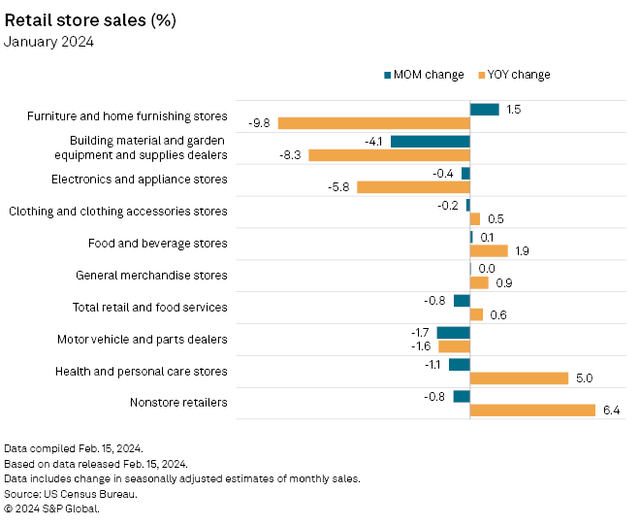

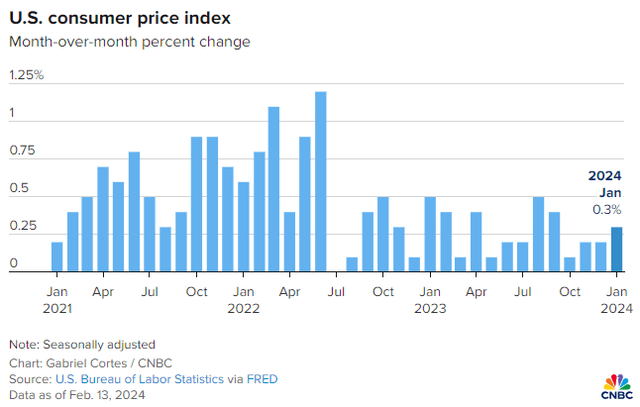

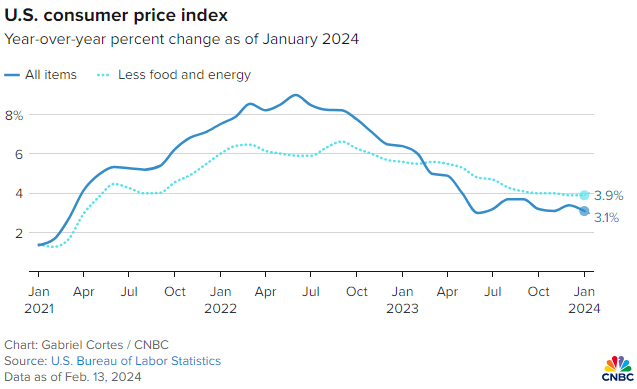

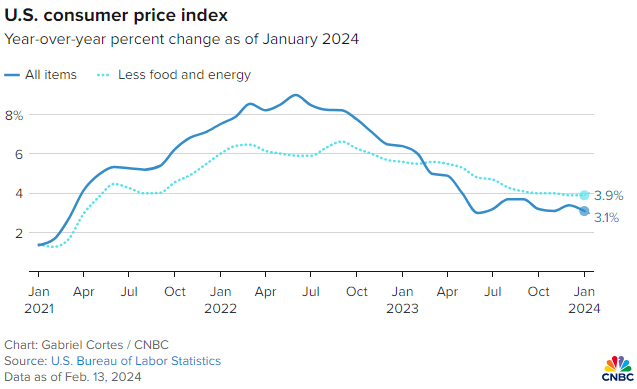

There stays nice uncertainty relating to each the energy of the financial system and the way forward for charges because of very combined current financial information. Retail gross sales fell sharply (-0.8%) in January, indicating a weakening shopper, however hiring remained strong (+353,000 jobs). A continuation of the disinflation pattern appears much less sure after January’s unexpectedly excessive month-over-month will increase in CPI (+0.3%), core CPI (+0.4%), PPI (+0.3%) and core PPI (+0.5%). If the inflation fee turns into entrenched above the Fed’s 2% annual goal and even worse begins to reaccelerate, the extremely anticipated a number of Fed charges cuts projected for the twond half of 2024 might not really materialize.

Supply: Chart by CNBC. Information from Bureau of Labor Statistics Supply: Chart by CNBC. Information from Bureau of Labor Statistics

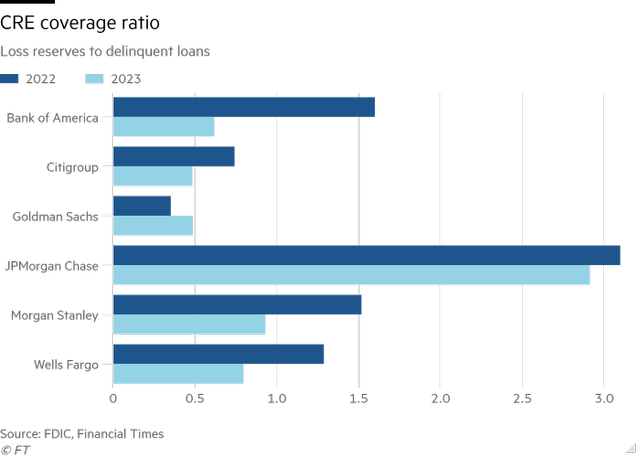

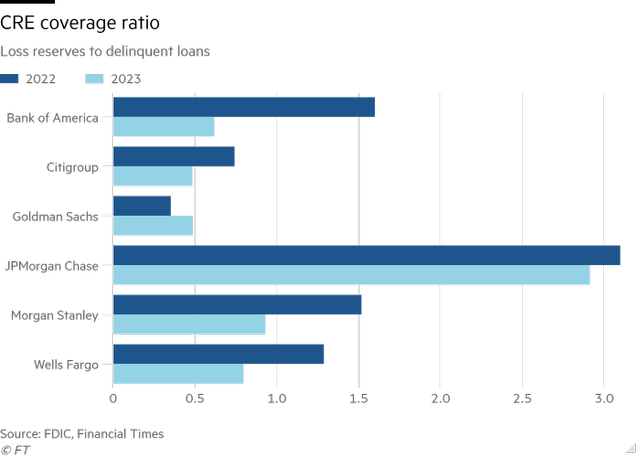

Though many REITs are properly capitalized, there are rising troubles general throughout business actual property, and it’s more and more straining the ratio of loss reserves to delinquent loans at US banks. General, this ratio declined from 2.20 in 2022 all the way down to 1.4 in 2023. Massive US banks (Financial institution of America (BAC), Wells Fargo (WFC), Citigroup (C), Goldman Sachs (GS), Morgan Stanley (MS) and JPMorgan Chase & Co. (JPM)) have seen this ratio drop from 1.6 all the way down to 0.9 for loans through which the borrower is 30+ days late on a number of funds. Financial institution of America noticed probably the most extreme deterioration of this ratio in 2023. Citigroup and Goldman Sachs now have ratios beneath 0.5. A notable exception among the many huge banks is JPMorgan Chase & Co., which nonetheless has a really wholesome CRE protection ratio. It is very important observe that not all delinquent loans will default in fact, however such low protection ratios actually add better threat.

Supply: FDIC, Monetary Occasions

With combined financial information and a few rising dangers inside business actual property, the unfold between one of the best performing REITs and worst performing REITs in 2024 will seemingly be very large. Fundamentals and valuations fluctuate considerably throughout REIT property varieties in addition to inside every property sort. Cautious evaluation at each ranges is essential. Substantial alpha could be achieved in a REIT portfolio by way of each property sort allocation and particular person REIT choice.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.