The decrease than anticipated borrowing numbers from the Treasury is resulting in:

- Shares shifting larger

- Bond costs shifting larger/yields decrease, and the

- USD to the draw back.

Trying on the US inventory market, the NASDAQ index is now up 163 factors or 1.05%. The S&P index is up 33.81 factors and trades at a brand new document excessive degree. The Dow Industrial Common is up 200 factors or 0.52%.

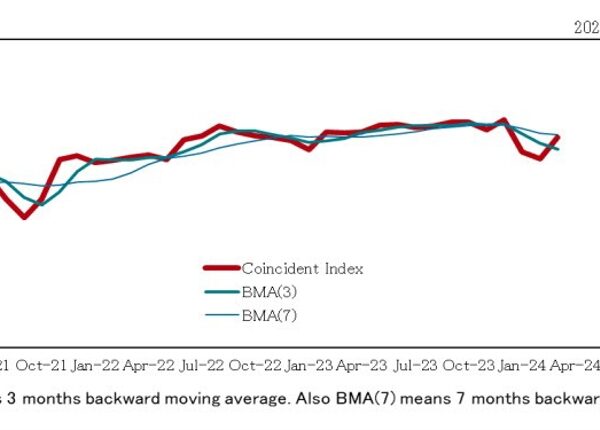

Trying on the US debt market:

- 2-year yield 4.311% -5.3 foundation factors

- 5-year yield 3.972% -8.9 foundation factors

- 10- yr yield 4.064% -9.6 foundation factors

- 30-year yield 4.306% -8.3 foundation factors

Trying on the foreign exchange market:

- The EURUSD – which bounced off its 50% midpoint at 1.07936, is backup trying to check it 200 day shifting common 1.08420. The excessive value it simply reached 1.0840. A transfer above the 100-day shifting common opens the door for additional upside momentum.

EURUSD stalled on the 50% and is trying to check the 50%

- The USDJPY is falling under its 100-day shifting common at 147.575. The low value simply reached 147.25. The following goal space comes between 146.96 and 147.067.

The GBPUSD bottomed close to its 50% (just like the EURUSD) and has now moved up the 200 and 100-hour MA at 1.2703 to 1.27087. Patrons take again management because the ups and downs proceed for that pair.

The USDCHF has moved all the way down to retest the important thing draw back goal at 0.86059. That degree is residence to the low from earlier as we speak and close to the lows from January 17 and January 24 too (see pink numbered circles on the chart under).

USDCHF falls to check the low flooring at 0.86059