The primary-quarter GDP report confirmed a lot deceleration and missed estimates by such a large margin that stagflation fears are more and more creeping into Wall Road chatter.

However the headline variety of 1.6% progress was weighed down by unstable components like a wider commerce deficit and slower stock restocking, which masked how strong client demand continues to be, mentioned Wells Fargo economists in a Thursday word titled “Wolf in Sheep’s Clothing: Soft GDP Hides Surging Spending.”

To make sure, shoppers are spending much less on items, and the GDP report confirmed that outlays on big-ticket sturdy items contracted at a 1.2% annualized tempo, in keeping with the word. However that was greater than offset by a surge in spending on companies.

“Like a relief pitcher in the late innings, services spending came in throwing heat in the first quarter with a blistering 4.0% annualized growth rate—the fastest surge in consumer services spending since the stimulus-fueled binge in 2021,” wrote economists Tim Quinlan and Shannon Seery Grein.

Excluding 2020 and 2021, when the pandemic lockdown and reopening skewed knowledge, progress in companies spending has solely topped 4% 3 times within the final 20 years, they added. It occurred as soon as in 2014 and twice in 2004.

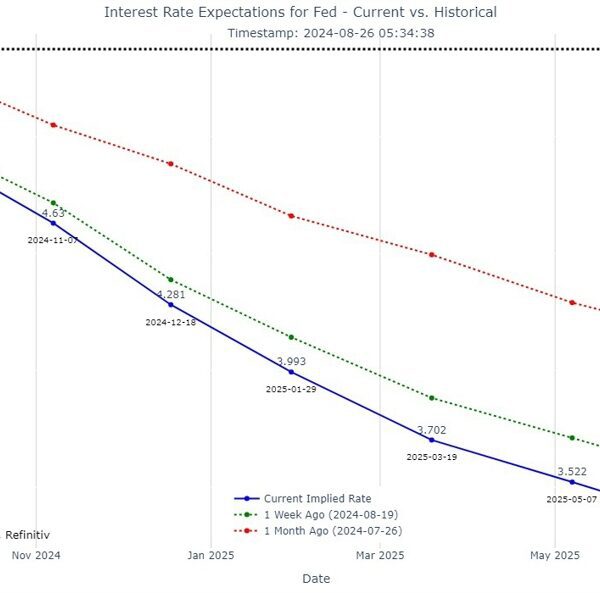

“Higher rates are intended to cool consumer demand; the trouble for the Fed is: it’s not working,” they mentioned.

The truth is, demand stays so sturdy in companies that the 5.1% worth enhance within the sector outpaced the broader core fee of three.7%, which was already an uptick from the prior quarter.

In the meantime, actual disposable incomes noticed slower progress within the quarter, however Individuals continued to spend at a sooner clip, sending the non-public financial savings fee to the bottom because the finish of 2022, the word mentioned.

However commerce deficit and stock knowledge obscured the extra strong client figures. Stripping out the commerce affect alone would have put the first-quarter report according to forecasts, Wells Fargo mentioned.

One other gauge of underlying home demand that excludes the commerce hole, inventories and authorities spending rose 3.1%.

“The last three quarterly prints for this measure have all come in at 3.0% or higher, signaling healthy and stable growth,” Wells Fargo concluded. “Don’t underestimate this economy.”

The financial institution’s word represents considerably of a counter-narrative to the gloomy reactions elsewhere.

EY chief economist Gregory Daco told Fortune earlier that the GDP report not solely undercuts speak of a re-accelerating “no landing” economic system, however he warned there’s additional draw back threat if inflation stays cussed, eroding incomes and protecting monetary situations tight.

David Russell, world head of market technique at TradeStation, additionally advised Fortune that stagflation is a rising menace. “If inflation isn’t getting better with such weak growth, you have to wonder if the trend toward lower prices will continue.”