The U.S. financial system is sizzling, and China’s is so not.

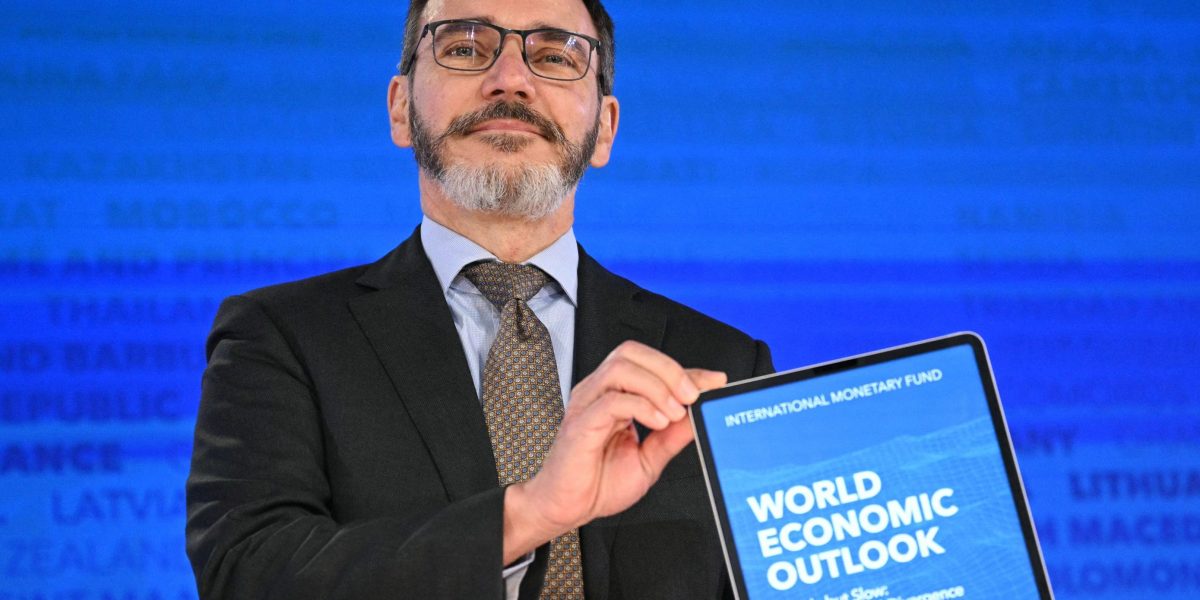

The U.S. is on monitor to grow 2.7% this year, double the speed of the subsequent closest nation within the G7, the grouping of a few of the world’s most superior economies, in accordance with the Worldwide Financial Fund’s newest World Financial Outlook. Estimated U.S. financial development for the yr is up from the two.5% development it skilled in 2023, and 0.6 share factors greater than the IMF’s earlier calculation.

Behind the stunning development is powerful consumer demand that has buoyed the U.S. financial system regardless of the setback of COVID-19 and geopolitical disturbances akin to Russia’s invasion of Ukraine, in accordance with Tuesday’s report.

“Astonishingly, the US economy has already surged past its prepandemic trend,” economists for the IMF wrote.

In the meantime, China’s often gangbusters financial system, whereas having lately reported strong first quarter numbers, may very well be unsteady within the long-run, with the IMF projecting the nation’s development to sluggish to 4.6% for the yr, in comparison with 5.2% in 2023.

China, which has for months been coping with a real-estate crisis, may exacerbate its financial issues by failing to handle them instantly, in accordance with the report.

“In the absence of a comprehensive restructuring policy package for the troubled property sector in China, a larger and more prolonged drop in real estate investment could occur, accompanied by expectations of future house prices declining, reduced housing demand, and a further weakening in household confidence and spending, with implications for global growth,” the report stated.

Whereas the U.S. is main the world in development, its efficiency within the years to return is unsure as still-elevated inflation numbers have forged doubt on whether or not the Federal Reserve would minimize charges as expected by the top of the yr.

On Tuesday, Fed Chairman Jerome Powell scaled again his earlier outlook on price cuts. Powell stated the new inflation measures, together with a CPI of three.5% in March (a 0.3% share level improve from February), have “clearly not given us greater confidence,” including that the information as a substitute “indicate that it is likely to take longer than expected to achieve that confidence,” the Wall Road Journal reported.

The IMF echoed Powell’s concern within the World Financial Outlook, stating that central banks worldwide want to make sure that “inflation touches down smoothly.” Though many traders and market onlookers had anticipated a number of price cuts for the yr, inflation has modified the calculation for the Fed.

“The exceptional recent performance of the United States is certainly impressive and a major driver of global growth,” the IMF report learn. “But it reflects strong demand factors as well, including a fiscal stance that is out of line with long-term fiscal sustainability.”