There’s a raging debate about US inflation proper now and whether or not it will likely be sticky. However extra importantly, there is a debate in regards to the inflation regime that we’re in proper now. We spent 20 years earlier than covid in an period of disinflation and lots of imagine we’re in a brand new period of upper inflation.

US buyers are typically overly-focused on the US and US financial historical past, with a blind spot in the direction of what’s occurring in the remainder of the world. Usually, the worldwide sign is the one which cuts by means of the noise. Bear in mind, it wasn’t simply the US in a disinflationary interval earlier than covid, it was the entire world.

So what’s occurring in the remainder of the world with inflation proper now:

- UK CPI 3.4% y/y vs 3.5% anticipated and 4.0% prior

- German HICP 2.3% y/y vs 2.4% anticipated and a pair of.7% prior

- Eurozone HICP 2.4% vs 2.6% anticipated and a pair of.6% prior

- Canada March CPI 2.8% y/y vs 3.1% anticipated. BOC core 2.1% y/y

- Mexico March core CPI 0.44% m/m vs +0.51%. Headline 4.42% vs 4.50% y/y anticipated

- China March CPI +0.4% y/y vs +0.7% prior, together with -0.5% m/m

Distinction that with the US, which has had three excessive inflation studies in a row together with in Wednesday’s report, which rose 3.5% y/y in comparison with 3.4% anticipated.

Regardless of the US setback, more and more imagine there’s an rising image of a return to the kind of inflation that dominated the primary 20 years of the century. The counter-argument is that globalization is in retreat however I do not see it that manner. Globalization is slowing however the dividends are nonetheless being collected and given the present slowdown in China, it is exporting as a lot deflation as ever.

It is also apparent to me that AI, automation and robotics can be deflationary forces (although not in commodity markets initially).

Why is the US operating in opposition to the pattern?

A number of issues I am enthusiastic about:

1) Fiscal spending

The US hasn’t pulled again on fiscal spending within the post-covid interval. The Federal authorities is operating deficits at 6-7% of GDP as the cash from the IRA and CHIPS Act continues to work by means of the economic system in 2024 and 2025.

2) US shoppers personal shares

Individuals are a lot likelier to carry equities of their financial savings portfolios than nearly anybody. Evidently, it has been an unbelievable bull market and given the wealth in America already, it is left shoppers flush. Add in 30-year mounted mortgages, pandemic handouts and a tigher labor market and the US has been supercharged.

Nice chart from Jim Bianco

3) Housing knowledge skews

The Fed’s Goolsbee spoke at length this month about quirks in US housing knowledge that could possibly be skewing the image. Market-based rents have fallen from the peaks however that hasn’t labored its manner into the CPI but. It ought to however the numbers have stayed stubbornly excessive. It is one thing folks can be watching very rigorously and I fear that there’s loads of pent-up demand from US housing in the long run.

4) Healthcare

What makes the US distinctive from many of the developed world? Personal well being care. Be aware the elements that had been upside drivers within the newest Dallas Fed Trimmed PCE report (month-over-month annualized modifications):

- Internet medical health insurance +15.5%

- Doctor providers +1.8%

- Monetary service fees, charges, and commissions +3.5%

- Nonprofit hospitals’ providers to households +3.8%

- Authorities hospitals +3.8%

- Electrical energy +4.0%

- Motorized vehicle upkeep and restore +4.8%

- Different bought meals +4.1%

- Dental providers +5.3%

Usually these numbers reset on the flip of the 12 months so there could possibly be one thing of a one-off right here that is not captured by seasonal changes however they is also a cussed supply of inflation that differentiates the US from elsewhere.

Ultimately although, it’s going to normalize and we’ll discover ourselves again in a low-inflation period. For now, inflation scares are proving to be alternatives to lean into that theme however with these elements, it’s going to take a while for US inflation to converge to the remainder of the world. US fiscal spending will keep excessive by means of 2025 however after that it’s going to gradual, maybe dramatically relying on the outcomes of the US election.

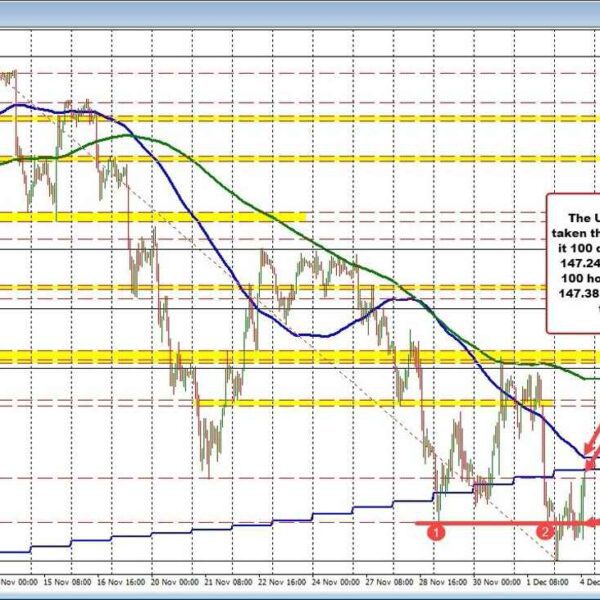

Within the meantime, we should still be within the center innings of the US greenback bull market. Because the divergence persists and different central banks decrease charges, the greenback has ample room to out-perform.