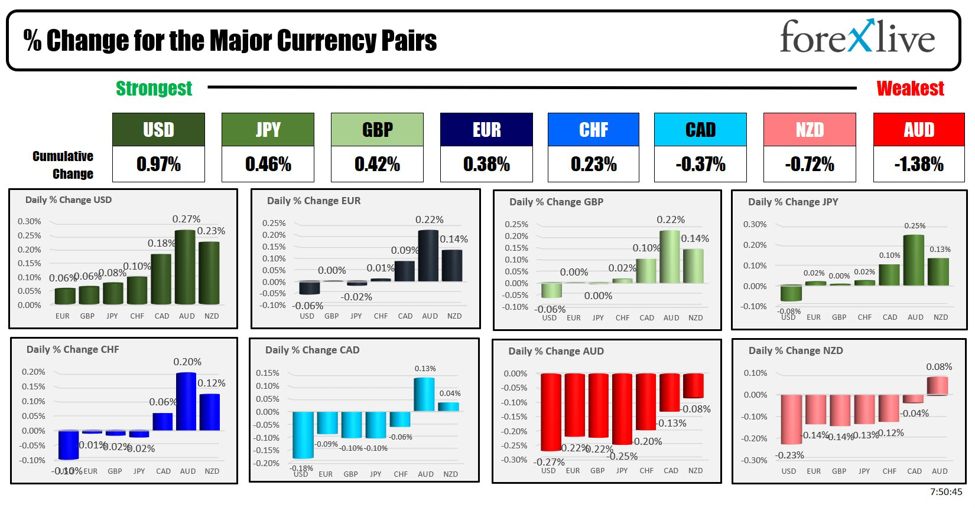

The strongest to the weakest of the major currencies

As the North American session gets underway, the USD is the strongest and the AUD is the weakest.

Overnight, Bank of Japan board member Seiji Adachi spoke and emphasized that if excessive yen falls impact inflation, a policy response becomes an option. He noted that frequently changing monetary policy to stabilize forex moves could lead to significant rate changes, causing disruptions in household and corporate investment. Short-term forex moves should not dictate monetary policy as it affects price stability. Prolonged yen depreciation affecting price targets could prompt policy action. Japan’s economy shows moderate recovery with steady consumption in services but faces uncertainties. Adachi stressed maintaining accommodative financial conditions until the price goal is achieved, avoiding premature rate hikes. Focusing too much on downside risks may lead to rapid inflation acceleration, necessitating swift rate hikes, harming the economy. Adjusting monetary support in stages is crucial, as underlying inflation trends towards 2%. Reducing bond buying should also be gradual to avoid economic damage. Consumer inflation is slowing but expected to re-accelerate from summer to autumn, with potential yen declines quickening the need for interest rate hikes.

The JPY strengthened on the comments but over the last few hours has weakened with the USDJPY now in positive territory. The lows for the day tested the 100-hour MA and that helped to stall the fall (after a brief dip below the MA level).

The USDJPY fell to the 100 hour MA and bounced higher

The German preliminary CPI inflation data was released and showed numbers near expectations, but higher than prior month. The ECB is on track to cut rates next week when they announce their rate decision:

- CPI Prelim MoM for May: Actual 0.1%, Reuters Poll 0.2%, Prior 0.5%

- CPI Prelim YoY for May: Actual 2.4%, Reuters Poll 2.4%, Prior 2.2%

- HICP Prelim MoM for May: Actual 0.2%, Reuters Poll 0.2%, Prior 0.6%

- HICP Prelim YoY for May: Actual 2.8%, Reuters Poll 2.7%, Prior 2.4%

US weekly mortgage applications were already released in the US todayand showed sharp declines in all the measures:

- MBA Mortgage Applications for May 24: Actual -5.7%, Prior 1.9%

- Mortgage Market Index for May 24: Actual 190.3, Prior 201.9

- MBA Purchase Index for May 24: Actual 138.4, Prior 140.0

- Mortgage Refinance Index for May 24: Actual 463.8, Prior 536.9

- MBA 30-Yr Mortgage Rate for May 24: Actual 7.05%, Prior 7.01%

Here is the summary of the economic events scheduled for today:

- 10 AMET: Richmond Federal Reserve Manufacturing Index for May

- 11 AM ET: Atlanta Fed Survey of Business Uncertainty for May

- 1 PM ET: US Treasury auctions off 7-year notes

- 1:45 PM ET: Speech by Federal Reserve Bank of New York President John Williams

- 2 PM ET: Beige Book release

- 7 PMET: Speech by Atlanta Fed President Raphael Bostic

Traders are awaiting Friday’s release of the monthly personal consumption expenditures price index (PCE), the Fed’s preferred inflation gauge. This figure could influence policymakers’ views on price gains. Recent signs of persistent inflation have led to many Fed officials to suggest they need more evidence of cooling prices before lowering rates from their current two-decade highs

The S&P 500 futures, Dow Jones Industrial Average and the Nasdaq all are lower in the premarket (=-0.60 to -0.70%) after mixed results yesterday saw the Nasdaq extend – and close – at another record level, while the Dow fell and the S&P was near unchanged. The majority of Asian exchanges were pointing lower while European bourses were trending south midday as well. Oil is higher and above $80. .

A snapshot of the other markets as the North American session begins shows

- Crude oil is trading up $1.14 or 1.47% at $78.86. At this time Friday, the price was at $78.86.

- Gold is trading down $3.58 or -0.16% at $2347.14. At this time Friday, the price was higher at $2347.14

- Silver is trading down five cents or -0.17% at $31.58. At this time Friday, the price was at $31.58

- Bitcoin currently trades at $68,232. At this time Friday, the price was trading at $68,232

- Ethereum is trading at $3894.30. At this time Friday, the price trading at $3894.30

In the premarket, the snapshot of the major indices are lower after the NASDAQ index closed at another record high yesterday (and above 17,000 for the first time). The Dow industrial average continued its decline after last week closing for the first time above 40,000. ConocoPhillips is buying Marathon oil.

- Dow Industrial Average futures are implying a decline of -206 points yesterday, the index fell -216.73 points or -0.55% at 38852.87

- S&P futures are implying a decline of -28.04 points. Yesterday, the index rose 1.32 points or 0.02% at 5306.03

- Nasdaq futures are implying a decline of -108 points. Yesterday, the index rose 99.09 points or 0.59% at 17019.88

European stock indices are trading lower today in the US morning snapshot:

- German DAX, -0.70%

- France CAC , -1.18%

- UK FTSE 100, -0.40%

- Spain’s Ibex, -0.80%

- Italy’s FTSE MIB, -1.0% (delayed 10 minutes). For the week the index is down -2.88%

Shares in the Asian Pacific markets were mostly lower:

- Japan’s Nikkei 225, -0.77%

- China’s Shanghai Composite Index, +0.08%

- Hong Kong’s Hang Seng index, -1.83%

- Australia S&P/ASX index, -1.30%

Looking at the US debt market, yields are trading higher ahead of the seven year note auction at 1 PM ET:

- 2-year yield 4.968%, +1.1 basis points. At this time yesterday, the yield was at 4.920%

- 5-year yield 4.598%, +2.5 basis points. At this time yesterday, the yield was at 4.506%

- 10-year yield 4.571%, +3.0 basis points at this time yesterday, the yield was at 4.459%

- 30-year yield 4.687%, +3.1 basis points. At this time yesterday, the yield was at 4.576%

Looking at the treasury yield curve spreads remain in negative territory but moved more toward parity (although still quite negative)

- The 2-10 year spread is at -39.4 basis points. At this time yesterday, the spread was at -46.3 basis points.

- The 2-30 year spread is at -27.8 basis points. At this time yesterday, the spread was at -34.5 basis points.

In the European debt market yields in the benchmark 10 year yields are higher:

European benchmark 10 year yields