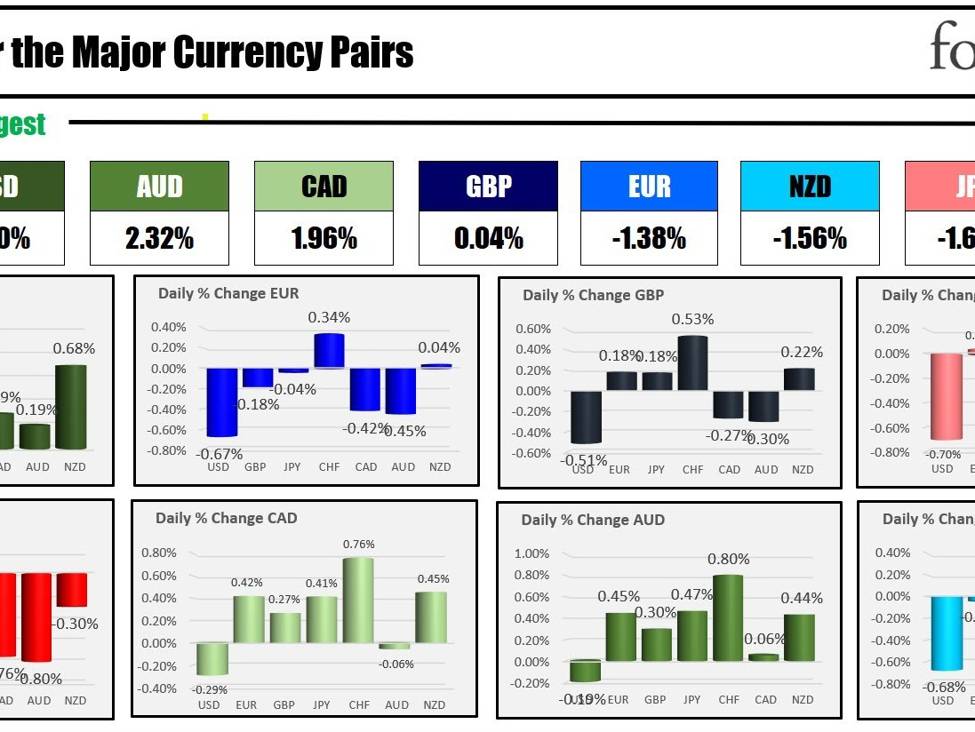

The snapshot of the strongest to the weakest of the majors

As the brand new yr begins, the snapshot of the foreign exchange market is exhibiting the USD is the strongest and the CHF is the weakest. The US shares have moved decrease to start out the yr after strong positive aspects in 2023. The Nasdaq futures are implying a pointy 155 level decline to start out the yr, whereas the S&P is down -28 factors. US yields are larger with 10 yr up almost 10 foundation factors. That’s serving to to push the USD larger.

Bitcoin is buying and selling at a 21-month excessive as markets anticipate the approval of a ETF for the biggest crypto foreign money. There’s a January 10 deadline to approve or reject a ETF utility from Cathie Wooden’s Ark and likewise 21 Shares. Approval would open the door for different choices and that’s serving to the granddaddy of the cryptocurrencies.

Oil is larger as provide disruptions within the Crimson Sea drive ships to divert the area as a result of Iranian-backed Houthi terrorists.

A snapshot of the markets at present exhibits:

- Crude oil is buying and selling up $1.40 or 2.0% at $73.08.

- Gold is buying and selling up $4.66 or 0.22% at $2067.31. Right now Friday, it was buying and selling at $2063.50

- Silver is buying and selling up $0.10 or 0.44% at $23.88. Right now Friday, it was buying and selling at $23.70

- Bitcoin traded sharply larger over the weekend after closing on Friday at $42,072. The present worth trades at $45,452. Right now Friday, it was buying and selling at $42,836

Within the premarket for US shares, the foremost indices are decrease after Friday’s decrease closes to finish the buying and selling yr. IN 2023, the S&P index rose about 24% whereas the Nasdaq index elevated by over 43%. In the present day, the Nasdaq index is down almost -1% in premarket buying and selling main the way in which to the draw back for the three main indices. In danger this week, is the nine-week successful streak for the foremost indices. A snapshot of the market is exhibiting:

- Dow Industrial Common futures are implying a decline of -181 factors. On Friday the index fell -20.56 factors or -0.05% at 37689.55.

- S&P futures are implying a decline of -30.02 factors. On Friday the index fell -13.54 factors or -0.28% at 4769.82

- Nasdaq futures are implying a pointy decline of -165 factors. On Friday, the index fell -83.78 factors or -0.56% at 15011.35

Within the European fairness market, main indices are decrease as properly after strong positive aspects (principally) in 2023:

- German DAX -0.47%

- France CAC -0.72%

- UK FTSE 100 -0.43%

- Spain’s Ibex + 0.35%.

- Italy’s FTSE MIB +0.30% (10 minute delay)

Within the Asian-Pacific market main indices closed blended:

- Japan’s Nikkei 225, -0.22%

- China’s Shanghai composite index , -0.43%

- Hong Kong’s Dangle Seng index, -1.52%

- Australia S&P/ASX +0.49%

Wanting on the US debt market, yields are buying and selling sharply larger to start out the brand new yr:

- 2-year yield 4.316%, +6.6 foundation factors. Friday right now, the yield was at 4.291%

- 5-year yield 3.920% +9.0 foundation factors. Friday right now, the yield was at 3.862%

- 10-year yield 3.951% +9.2 foundation factors. Friday right now, the yield was at 3.871%

- 30-year yield 4.097% +8.0 foundation factors. Friday this time, the yield was at 4.02%

Within the European debt market, the benchmark 10-year yields are larger. with the UK yield up 13.3 foundation factors.

European benchmark 10 yr yields