Pleased Easter Monday.

It’s a vacation in Europe in observance of Easter Monday. So the value motion may be very restricted. The US markets shall be open, nonetheless inclusive of futures, shares and bonds.

The financial calendar is highlighted by the ISM PMI information which shall be launched at 10 AM ET. THe US Manufacturing PMI is predicted to come back in at 48.5 vs 47.8 final. The value index is forecast at 53.3 vs 52.3 final month.

The S&P/World model for PMI shall be launched at 9:45 PM. The flash estimate was at 52.5 and is predicted to stay at that degree.

The US building spending shall be launched at 10 AM ET with a achieve of 0.7% vs -0.2% final month.

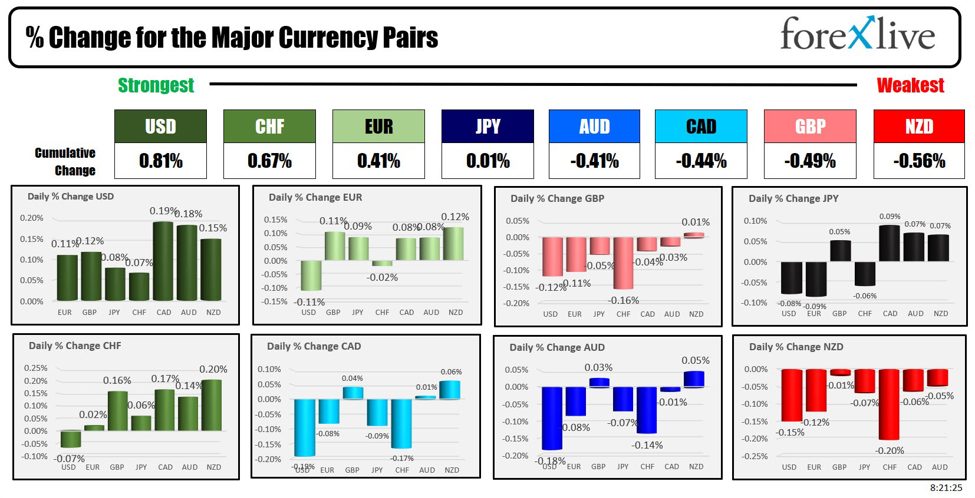

To begin the buying and selling day, the USD is the strongest and the NZD is the weakest.

US shares are blended. Gold is larger. US yields are blended with the longer finish larger after the PCE information on Friday got here in as anticipated, however the Fed officers began to dialing again a number of the hopes for a summer time lower (and collection of cuts) a bit.

A snapshot of the opposite markets because the North American session begins at the moment reveals:

- Crude oil is buying and selling down $0.29 or -0.35% at $82.88. At the moment Thursday, the value was at $82.44

- Gold is buying and selling up $17.26 or 0.78% at $2250.94. At the moment Thursday, the value was at $2214.05

- Silver is buying and selling up eight cents or 0.35% at $25.05. At the moment Thursday, the value was at $24.57

- Bitcoin at the moment trades at $69793. At the moment Thursday, the value was buying and selling at $70,417

Within the premarket, the most important indices are buying and selling decrease at present. On Thursday, the S&P closed at a brand new report excessive. The NASDAQ index fell modestly –

- Dow Industrial Common futures are implying a decline of -1 factors. On Thursday the index rose 47.29 factors or 0.12% at 39807.38

- S&P futures are implying a achieve of 4.25 factors. On Thursday, the index rose 5.86 factors or 0.11% at 5254.34. That was a report excessive shut

- Nasdaq futures are implying a achieve of 37 factors. On Thursday, the index – 20.06 factors or -0.12% at 16379.46

Within the European fairness markets, are closed at present. On Thursday, the most important indices had been blended

- German DAX, rose 0.08% at 18492.50

- France CAC , rose 0.01% at 8205.1

- UK FTSE 100, rose 0.26% at 952.63

- Spain’s Ibex, -0.33%@11074.59

- Italy’s FTSE MIB, -0.03% at 34750.35

Shares within the Asian Pacific markets had been largely larger:

- Japan’s Nikkei 225, -1.40%

- China’s Shanghai Composite Index, +1.19%

- Hong Kong’s Cling Seng index, closed

- Australia S&P/ASX index, closed

Trying on the US debt market, yields are decrease:

- 2-year yield 4.622%, -1.0 foundation factors. At the moment Thursday, the yield was at 4.622%

- 5-year yield 4.237%, +1.8 foundation factors. At the moment Thursday, the yield was at 4.227%

- 10-year yield 4.238%, +3.2 foundation factors. At the moment Thursday, the yield was at 4.218%

- 30-year yield 4.398%, +4.9 foundation factors. At the moment Thursday, the yield was at 4.365%

Trying on the treasury yield curve spreads:

- The two-10 12 months unfold is at – 37.8 foundation factors. At the moment Thursday, the unfold was at -40.0 foundation factors

- The two-30 12 months unfold is at -22.3 foundation factors. At the moment Thursday, the unfold was at -20.2 foundation factors

European benchmark debt markets are closed