In lower than 30 days since their debut, new entrants of spot Bitcoin exchange-traded funds (ETFs), which embrace BlackRock (IBIT), Constancy (FBTC), Ark 21Shares (ARKB), Invesco (BTCO), Bitwise (BITB), Valkyrie (BRRR), Franklin Templeton (EZBC), WisdomTree (BTCW), and VanEck (HODL) have collectively racked up over 200,000 BTC in belongings underneath administration, not counting Grayscale’s transformed fund.

This accumulation signifies a pivotal shift within the crypto funding sphere, reflecting rising investor confidence and curiosity in Bitcoin as an asset class.

There we now have it! The brand new 9 have amassed greater than 200k BTC.

Second-strongest each day U.S. spot circulate since launch yesterday.

Since launch, the overall web influx to U.S. spot ETFs sits at a large 51,134 BTC. pic.twitter.com/6RFugg7jZO

— Vetle Lunde (@VetleLunde) February 9,

Market Leaders In The New Spot ETF Period

With an accumulation of roughly 203,811 BTC, in line with K33 Analysis, BlackRock’s IBIT and Constancy’s FBTC stand out because the leaders, with IBIT holding over 80,000 BTC ($3.7 billion) and FBTC managing greater than 68,000 BTC ($3.2 billion).

Similar information in BTC phrases… pic.twitter.com/999tMR8KVz

— BitMEX Analysis (@BitMEXResearch) February 9, 2024

These figures place these two funds on the forefront of the new spot ETF market, demonstrating their substantial affect within the brief interval since their inception.

Bloomberg ETF analyst Eric Balchunas highlighted the notable efficiency of those spot ETFs, noting their speedy ascent in a market historically dominated by long-established gamers.

Right here’s a take a look at the High 25 ETFs by belongings after 1 month available on the market (out of 5,535 whole launches in 30yrs). $IBIT and $FBTC in league of personal w/ over $3b every and so they nonetheless have two days to go. $ARKB and $BITB additionally made checklist. pic.twitter.com/Yyi1nxukUk

— Eric Balchunas (@EricBalchunas) February 8, 2024

The buying and selling quantity of those new ETFs can also be noteworthy. BlackRock’s IBIT recently outperformed Grayscale’s spot Bitcoin ETF in each day buying and selling quantity, a big feat contemplating Grayscale’s longstanding presence available in the market.

In keeping with the report, BlackRock’s IBIT noticed $301 million on Thursday, which exceeded GBTC’s 290 million. As well as, Constancy’s FBTC additionally confirmed robust efficiency, securing the third spot with a buying and selling quantity of $170 million.

Nonetheless some after hours buying and selling left however seems like BlackRock’s $IBIT is the primary ETF to commerce greater than Grayscale’s $GBTC in a single day.

Whole buying and selling right this moment was type of a dud although at $924 million — first day beneath $1 billion in greenback quantity for the group since launch. pic.twitter.com/JAdFGEEjj6

— James Seyffart (@Jmseyff) February 8, 2024

Bitcoin Newest Value Motion

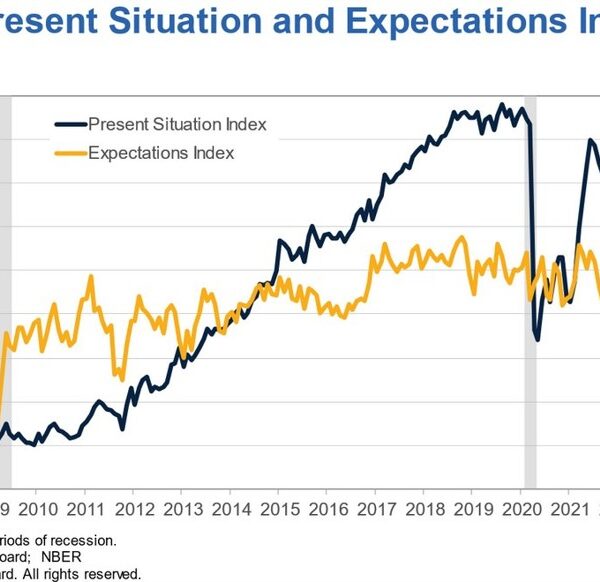

This inflow of funding into spot Bitcoin ETFs coincides with a bullish development in Bitcoin’s market worth. Not too long ago, Bitcoin has seen an upward trajectory, buying and selling above $47,000 and approaching its earlier excessive of $48,000 in January.

This optimistic market motion is mirrored within the each day buying and selling volumes, which have escalated considerably. The notable efficiency of those new spot ETFs and the concurrent rise in Bitcoin’s worth underscores the rising mainstream acceptance of cryptocurrencies as viable funding automobiles.

Analyst Vetle Lunde from K33 Analysis identified that yesterday marked the strongest each day web influx for Bitcoin funding automobiles globally since January 2021. With roughly 4.52% of the circulating BTC provide now held by investment vehicles, the crypto market reveals indicators of maturity and elevated institutional participation.

February 8, 2024 – The strongest each day web influx to BTC funding automobiles since January 19, 2021!

4.52% of the circulating BTC provide is presently held by funding automobiles. pic.twitter.com/Xv8ViqdMeo

— Vetle Lunde (@VetleLunde) February 9, 2024

Featured picture from Unsplash, Chart from TradingView