The Good Brigade

Pricey Fellow Shareholders,

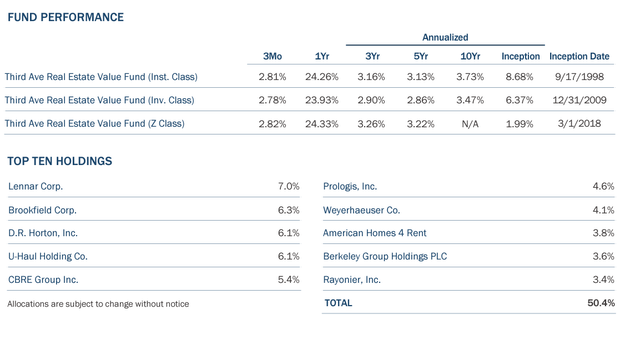

We’re happy to offer you the Third Avenue Actual Property Worth Fund’s (the “Fund”) report for the quarter ended March 31, 2024. For the primary quarter of the calendar yr, the Fund generated a return of +2.81% (after charges) versus -1.11% (earlier than charges) for the Fund’s most related benchmark, the FTSE EPRA NAREIT Developed Index 1.

The first contributors to efficiency through the interval included sure holdings concerned with Residential Actual Property (Lennar Corp. (LEN)(LEN.B), D.R. Horton (DHI), Lowe’s (LOW), and Ingenia Communities (OTC:INGEF)) in addition to the Fund’s place in the popular fairness of the GSEs 3(Fannie Mae and Freddie Mac). However, these good points have been considerably offset by detractors through the quarter, which included the Fund’s investments in self-storage associated enterprises (U-Haul Holding (UHAL)(UHAL.B) and Massive Yellow Plc (OTCPK:BYLOF)) and numerous worldwide holdings (CK Asset (OTCPK:CHKGF)(OTCPK:CNGKY) and Grainger plc (OTC:GRGTF)). Additional particulars on plenty of these corporations, different notable developments, and portfolio positioning are included herein.

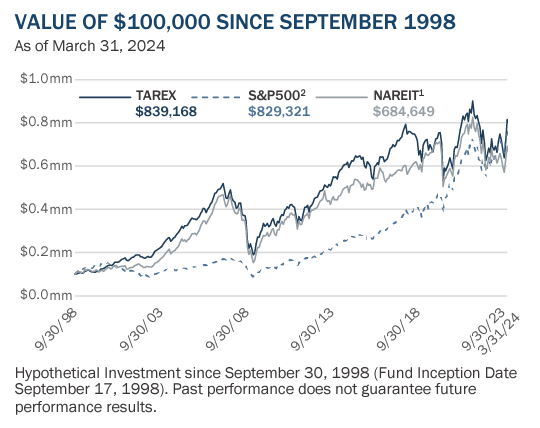

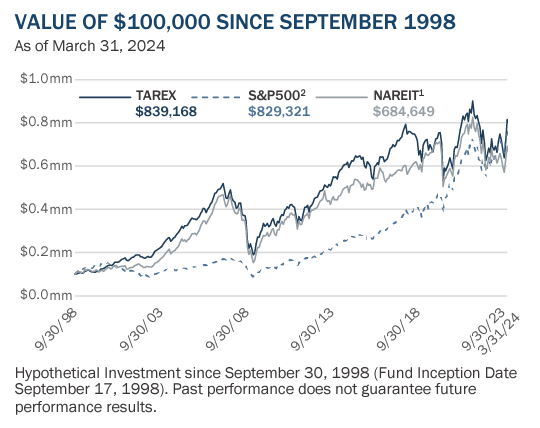

Regardless of the efficiency within the interval, Fund Administration believes the Fund’s long-term outcomes are essentially the most related scorecard. To that finish, the Fund has generated an annualized return of +8.68% (after charges) since its inception, greater than twenty-five years in the past. In consequence, this efficiency signifies that an preliminary funding of $100,000 within the Fund would have a market worth exceeding $838,000 (assuming distributions had been reinvested), or greater than the identical $100,000 could be price had it been positioned right into a passive mutual fund monitoring the Fund’s benchmark (in addition to the S&P 500) over the identical time-period.

The long-term, value-oriented strategy utilized over this span extends past the Actual Property technique, nonetheless. The philosophy is shared throughout the broader funding group at Third Avenue Administration (“Third Avenue” or “the Firm”).

|

Efficiency is proven for the Third Avenue Actual Property Worth Fund (Institutional Class). Previous efficiency is not any assure of future outcomes; returns embody reinvestment of all distributions. Previous efficiency and present efficiency could also be decrease or larger than efficiency quoted above. Funding return and principal worth fluctuate in order that an investor’s shares, when redeemed, could also be price roughly than the unique price. For the latest month-end efficiency, please go to the Fund’s web site at www.thirdave.com. The U.S. Lipper Fund Award for Finest Fairness Small Fund Household is predicated on a evaluation of 185 certified fund administration corporations that have been eligible for the three-year interval ending on 11/30/23. To qualify for Lipper’s Total Small Fund Household Group Award, Small fund household teams should have at the least three fairness portfolios. The group award will probably be given to the group with the bottom common decile rating of its respective asset class outcomes primarily based on the three-year Constant Return measure of the eligible funds. From LSEG Lipper Fund Award© 2024 LSEG. All rights reserved. Used below license. |

Notably, Third Avenue acquired recognition for this distinctive strategy through the quarter, profitable the Finest Fairness Small-Dimension Fund Household Group Over Three Years on the 2024 United States LSEG Lipper Fund Awards. The Fund Household Awards acknowledge Fund Firms which have excelled at delivering constantly sturdy risk-adjusted efficiency relative to their friends firm-wide.

From Fund Administration’s perspective, this recognition represents Third Avenue’s steadfast dedication to delivering superior long-term outcomes to our shoppers. It additionally reinforces our view that an actively managed fund, backed by a sound technique, strong course of, and aligned portfolio administration group, holds sturdy prospects to outperform over the lengthy term-the main focus throughout the Third Avenue Worth, Small-Cap, and Actual Property methods.

Exercise

In The Coming Wave: AI, Energy, and the twenty first Century’s Biggest Dilemma, co-authors Mustafa Suleyman and Michael Bhaskar discover the probabilities of Synthetic Intelligence (“AI”), artificial biology, robotics, and the necessity to “contain” their speedy progress. Whereas views on these issues range significantly, Suleyman’s perception is especially wanted as he not solely co-founded AI-pioneer DeepMind (which was bought by Google in 2014) however was lately appointed because the CEO of Microsoft’s AI division.

Throughout the work, readers are offered with a number of thought-provoking functions, in addition to the rationale for correct oversight longer-term. Nonetheless, the co-authors define two near-term requirements arising from generative AI and the developments in large-language fashions (“LLM”), together with (i) an unlimited quantity of capital to construct out the information facilities to help the AI ecosystem and (ii) a “colossal” quantity of energy to function this infrastructure. In reality, McKinsey & Firm has put extra concrete figures round these expectations extra lately by estimating that information heart demand will improve by 10% per yr by way of 2030 and require 18 Gigawatts of incremental power-more than is utilized by all the sector right this moment.

Concurrently, the accessible provide of knowledge heart house has declined to close record-low ranges as among the family names within the know-how house (i.e., Amazon, Microsoft, Google, Oracle, et al.) have leased capability at the side of the enlargement of their hyperscale computing and “cloud offerings”. In consequence, emptiness charges for information facilities within the prime markets throughout the U.S. had declined to roughly 3.0% on the finish of 2023, per Inexperienced Road Advisors, whereas rental charges (as measured by the income paid per accessible foot excluding energy prices) have elevated by greater than 10% over the previous yr.

Together, these shifts seemingly kind one of the crucial compelling narratives within the broader actual property house. Nonetheless, the Fund doesn’t have any direct investments in “pure play” information heart Actual Property Funding Trusts (“REITs”) presently. Whereas such a posture could seem counterintuitive, it’s pushed by a extra cautious stance referring to the supply-demand dynamic over the medium time period with the quantity of development approaching 40% of current inventory in “primary U.S. markets” per JLL Analysis. As well as, Fund Administration is cognizant of the (i) ongoing upkeep prices and affect on long-term profitability, (ii) menace of obsolescence danger as course of automation evolves, and (iii) prevailing valuations with free money stream 4 yields estimated at 2.5% on the finish of the quarter, on common, implying a “payback period” of many many years.

That isn’t to say the Third Avenue Actual Property Worth Fund has been overlooked of the information heart revolution. As an alternative, the Fund is just uncovered to different components of the worth chain, which supply a vastly completely different elementary proposition in Fund Administration’s view, together with:

- Powered-Shells: In sure circumstances, information facilities are leased as “powered-shells” whereby the property proprietor delivers the constructing and required energy must a data-center operator below a long-term lease. The operator is then answerable for the inside fit-out, leasing, and energy prices of the ability. For example, the Fund’s long-time holding SEGRO plc (OTCPK:SEGXF) (the biggest proprietor of business and logistics properties within the UK and continental Europe) controls the Slough Buying and selling Property in West London, the place a number of industrial amenities have been transformed to information facilities, now forming the second largest cluster globally. Not like the information heart REITs, nonetheless, SEGRO limits the “capital at risk” whereas nonetheless capturing premium rents for the attributes of this location relative to various makes use of.

- Larger-and-Higher-Use Alternatives: As the situation of knowledge facilities disperse from key hubs given the decreased emphasis on connectivity for LLM-centric amenities and higher give attention to energy entry, different actual property house owners are more and more discovering higher-and-better-use (“HBU”) alternatives by repositioning areas to accommodate information heart growth. For example, Fund holding Prologis (the biggest proprietor of business and logistics and industrial properties globally) has recognized roughly 60 areas inside its portfolio appropriate for hyperscale development-20 of which Prologis expects to begin build-to-suit tasks within the subsequent three years. The identical might be stated for 5 Level Holdings (FPH) (the main land developer in coastal California), which offered a 42-acre land parcel in Orange County meant for a knowledge processing hub final yr. On this case, the land sale realized roughly $240 million of gross proceeds, implying greater than $5 million per acre.

- Information Middle Providers: As information facilities have advanced into a definite sub-set of many actual property mandates, the providers supplied for “more traditional” property varieties have expanded into this area of interest sector. In consequence, among the main actual property providers corporations (together with Fund holdings CBRE Group, JLL, and Savills plc (OTCPK:SVLPF)) have devoted groups with the capabilities to help amenities administration, leasing, advisory, funding gross sales, and different options. Such exercise requires restricted capital funding however can generate significant recurring revenues and transactional charges. For instance, CBRE manages roughly 700 information facilities globally and has suggested on greater than $6.0 billion of knowledge heart transactions.

- Vitality Options: As McKinsey & Firm has famous, “the use of renewable energy is a critical component of the hyperscalers’ strategy” and “to reach carbon-free energy goals, data center owners are signing power purchase agreements with suppliers of renewable energy.” Only a few enterprises appear higher positioned to capitalize on this shift than Fund holding Brookfield Corp. (BN). Put in any other case, the corporate controls one of many largest portfolios of renewable energy globally by way of its energy subsidiary (Brookfield Renewable (BEPC)) with roughly 3.3 Gigawatts of very strategic hydro, photo voltaic, wind, and on-site era amenities. Though the corporate has already assembled one of many bigger network-dense information heart portfolios globally by way of its Infrastructure subsidiary, it appears probably that Brookfield will more and more enter into Most well-liked Buy Agreements (“PPA’s”) with different information heart operators as they safe renewable energy sources, typically at premium costs.

Even with these exposures, Fund Administration intends to intently monitor the evolving panorama for different associated opportunities-while factoring in an ample margin-of-safety given the speedy adjustments typically related to such swift adoption (e.g., “5G”). Within the meantime, Fund Administration continues to search out very compelling alternatives in area of interest residential platforms that appear fairly sturdy in nature. Alongside these strains, the Fund added to its holdings within the frequent inventory of Solar Communities, Inc. (SUI) (“Sun Communities” or “Sun”) and Grainger plc (OTC:GRGTF) (“Grainger”) through the quarter.

Solar Communities is a U.S.-based REIT that’s the largest single proprietor of Manufactured Housing (“MH”) and Leisure Car (“RV”) communities in North America. The corporate can also be the only largest proprietor of coastal marinas within the U.S. by way of its wholly owned Secure Harbor subsidiary. Whereas Grainger is a UK-based actual property working firm (“REOC”) that’s the main proprietor, supervisor, and developer of multi-family properties within the UK-where the multi-family enterprise is coined the private-rental sector or “PRS”. The corporate additionally controls one of many largest PRS pipelines, with plans so as to add 5,600 extra items by way of 2027.

Whereas Solar and Grainger function in numerous jurisdictions, they share a number of key attributes. For example, each corporations are well-capitalized, and management hard-to-replicate platforms centered on reasonably priced segments of the residential markets. As well as, these portfolios are concentrated in areas which have skilled important inhabitants progress extra lately. Additional, every firm has value-enhancing initiatives in place, together with web site conversions (Solar) and focused growth (Grainger). Nonetheless, each corporations appear to commerce at discounted valuations relative to conservative estimates of Web-Asset Worth (“NAV”) for non permanent causes.

In Solar’s case, it appears to have fallen out-of-favor alongside its enlargement into worldwide markets; nonetheless, the corporate has swiftly acted upon a “return to core” technique with the potential to take additional actions to streamline its portfolio and floor worth (e.g., disposition of Park Holidays, positioning Secure Harbor for sector consolidation, et al.). Alternatively, Grainger plans to transform to a REIT throughout 2025. Such a transfer will probably introduce a wider set of potential traders at an fascinating time, as the corporate’s earnings are anticipated to reset at the side of the lease-up of its current property and pipeline. Within the meantime, each Solar and Grainger are experiencing sector-leading fundamentals inside their core portfolios, with same-property revenues having elevated by excessive single-digits on a year-over-year basis-with a near-equal improve in NAV over the identical interval, by Fund Administration’s estimates.

Along with rising these positions, which collectively account for 7.1% of invested capital, the Fund additionally acquired particular dividends from its U.S.-based timber holdings (Weyerhaeuser (WY) and Rayonier (RYN)) and offered its place in 5 Level Senior Unsecured Notes after collaborating in an change provide through the interval. The Fund additionally decreased its positions in Wharf Holdings (OTCPK:WARFF)(OTCPK:WARFY) and SEGRO plc, exited InvenTrust Properties (IVT), and prolonged out its hedge associated to the Fund’s Hong Kong Greenback publicity through the quarter.

Positioning

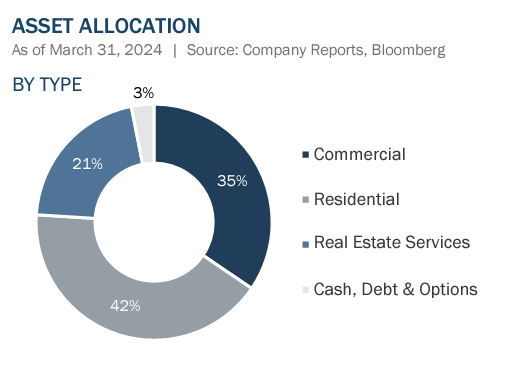

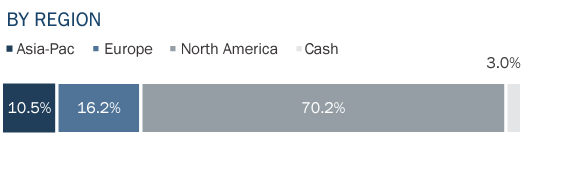

After factoring in the latest exercise, the Fund had roughly 41.5% of its capital invested in Residential Actual Property corporations with sturdy ties to the U.S. and U.Ok. residential markets-where provide deficits stay after years of under-building. Along with close to record-low stock ranges and a current surge in immigration, there additionally stays important demand for single-family product at reasonably priced worth factors (each for-sale and for-rent). Subsequently, these Fund holdings appear positioned to profit from a multi-year restoration in residential development and ancillary actions, significantly as mortgage charges additional subside. On the finish of the quarter, these holdings included a diversified set of companies together with homebuilding (Lennar Corp. and D.R. Horton), timberland possession and administration (Weyerhaeuser and Rayonier), deliberate growth (Berkeley Group (OTCPK:BKGFF)(OTCPK:BKGFY) and 5 Level Holdings), area of interest rental platforms (AMH, Grainger plc, Solar Communities, and Ingenia Communities (OTC:INGEF)), in addition to different ancillary companies (Lowe’s and Trinity Place Holdings (TPHS)).

The Fund additionally had 34.5% of its capital invested in Business Actual Property enterprises which might be concerned with choose segments of the property markets. On the present time, these holdings are primarily centered on corporations capitalizing on secular traits, together with structural adjustments driving extra demand for industrial properties, self-storage amenities, and last-mile success (Prologis, U-Haul, SEGRO plc, First Industrial, Massive Yellow (OTCPK:BYLOF), and Nationwide Storage (NSA)) in addition to extra diversified companies engaged in “long-term wealth creation” (Brookfield, CK Asset Holdings, and Wharf Holdings). In Fund Administration’s view, every of those enterprises could be very well-capitalized, their securities commerce at reductions to private-market values, they usually appear able to offering compelling “real” returns-primarily by rising rents, enterprise growth actions, and by making opportunistic acquisitions.

An extra 20.9% of the Fund’s capital is invested in corporations engaged in Actual Property Providers. These actual estate-related companies are usually much less capital-intensive than direct property possession and have traditionally supplied a lot larger returns on capital over the course of a cycle-provided they’ve favorable positioning inside their respective segments. This present day, these holdings embody franchises concerned with brokerage and property administration (CBRE Group, Savills plc, and JLL), funding administration (Brookfield Asset Administration), in addition to mortgage and title insurance coverage (FNF Group, Freddie Mac, and Fannie Mae).

The remaining 3.1% of the Fund’s capital is in Money, Debt & Choices. These holdings embody U.S.-dollar-based money and equivalents, short-term Treasuries, and hedges referring to sure international foreign money exposures (Hong Kong Greenback).

The Fund’s allocations throughout these numerous enterprise varieties are outlined within the chart under, together with the publicity by geography (North America, Europe, and Asia-Pacific).

Fund Commentary

Through the quarter, Morningstar reported that the quantity of capital invested in “passively managed” U.S. Mutual Funds and Trade-Traded Funds (“ETFs”) exceeded the quantity invested in “actively managed” U.S. Mutual Funds and ETFs for the primary time. The turning level spurred quite a lot of consideration and related media. However, there was one other Morningstar report printed within the quarter that additionally acquired important curiosity: Energetic Vs. Passive Funds by Funding Class – What are the percentages of succeeding with energetic funds vs. passive funds?

Throughout the evaluation, Morningstar concluded that “less than half” of actively managed methods outperformed the passive choices inside their classes for the 2023 calendar year-with the bottom “success rate” in actively managed large-cap fairness funds. In distinction, Morningstar famous that (i) 55% of actively managed actual property funds outperformed their passive friends in 2023 and (ii) greater than half of actively managed actual property funds outperformed passive methods over the previous decade, leaving it as “the only category group whose 10-year success ratio exceeds 50%”.

Regardless of this help for an actively managed strategy inside actual property securities, fund flows to actual property mutual funds and ETFs (“listed real estate”) have adopted broader market traits, favoring passive methods over actively managed funds in recent times. In reality, it’s estimated that roughly 55% of the capital invested in actual estate-dedicated methods was allotted to passively managed funds at year-end, with the Vanguard Actual Property ETF (“VNQ”) accounting for the biggest single technique (energetic or passive).

There isn’t any denying that the charges on most passive methods (together with the VNQ) are decrease than most energetic methods (together with the Actual Property Worth Fund). Nonetheless, the entire expense ratio solely represents one issue within the potential return equation. In our opinion, diligent capital allocators additionally take into account portfolio composition, in addition to determine different components that would result in a divergence within the efficiency of an actively managed technique relative to a passive fund.

To the extent that one was evaluating the Third Avenue Actual Property Worth Fund with such a mindset, Fund Administration would be aware the emphasis on the next 4 gadgets because it pertains to portfolio composition:

- Actual Property Working Firms: The Fund favors REOCs versus REITs since REOCs can retain their money stream to reinvest within the enterprise and self-finance additional enlargement. Alternatively, REITs are required to distribute most of their earnings as dividends, thus leaving them extra dependent upon the capital markets to develop. On the finish of the latest quarter, roughly 71% of the Fund’s capital was comprised of REOCs versus solely 9% for the VNQ. Additional, the dividend payout ratio for the Fund’s holdings was lower than half of that for the VNQ constituents, on common, on the finish of the identical interval.

- Selective Exposures: Third Avenue’s versatile mandate permits the Fund to (i) spend money on a wider set of companies together with among the premier business, residential, and repair platforms in each the U.S. and worldwide markets in addition to (ii) sidestep sure corporations, sectors, or areas that appear to be going through secular challenges or commerce at elevated multiples. In consequence, the Fund has roughly two-thirds of its capital invested in structurally supported residential and actual property providers companies, whereas the VNQ has lower than 20% of its capital invested in such companies. The remaining one-third of the Fund’s publicity is comprised of very choose areas of the business actual property markets, with none direct publicity to information heart or cell tower REITs, which accounted for greater than 21% of the VNQ at quarter-end.

- Properly-Capitalized Issuers: The Fund’s capital is concentrated in issuers that not solely personal high-quality property, however ones which might be financed with modest quantities of leverage. From our expertise, well-financed companies similar to these cannot solely navigate by way of tougher markets, thus preserving worth, however are additionally positioned to make value-enhancing investments when capital is scarce, thereby rising extra precious. For perspective, the common loan-to-value ratio for the portfolio holdings was lower than 20%, on common, on the finish of the quarter. As well as, the fairness investments within the Fund had leverage ranges that have been 40% lower than the VNQ constituents, on common, as measured by the entire debt to property ratio on the finish of the identical interval.

- Discounted Valuations: With a long-term, value-oriented strategy, the capital within the Fund is concentrated within the securities of companies that appear to be buying and selling at modest valuations relative to their private-market values or company web price. For example, the portfolio was buying and selling at a 12% low cost to our conservative estimates of NAV at quarter-end, when seen within the mixture. Put in any other case, the price-to-book ratio for the fairness holdings within the Fund was 1.3 occasions at quarter-end, on common, relative to the VNQ constituents at 2.4 occasions, on common.

A diligent evaluation of an energetic technique would additionally take into account sure qualitative features of the group and course of. In that regard, Fund Administration would be aware that the devoted Actual Property group at Third Avenue has greater than 20 years of expertise in listed actual property, on common, and follows a strong (and repeatable) course of that has been developed over the previous 15 years. The Portfolio Administration group additionally has important private capital invested within the technique, aligning pursuits with different Fund traders, with out competing methods to market or handle.

Fund Administration acknowledges that every one of this stuff can’t be measured in a single single line merchandise. Nonetheless, we imagine that when they’re assessed with the portfolio attributes outlined above, they’re components that improve the percentages of succeeding-leaving the Third Avenue Actual Property Worth Fund as an actively managed technique that needs to be thought-about as a part of any listed actual property allocation within the interval forward.

We thanks on your continued help and stay up for writing to you once more on the finish of the following quarter. Within the meantime, please do not hesitate to contact us with any questions or feedback [email protected].

Sincerely,

Jason Wolf, CFA & Ryan Dobratz, CFA

Necessary DataThis publication doesn’t represent a proposal or solicitation of any transaction in any securities. Any advice contained herein might not be appropriate for all traders. Data contained on this publication has been obtained from sources we imagine to be dependable, however can’t be assured. The knowledge on this portfolio supervisor letter represents the opinions of the portfolio supervisor(s) and isn’t meant to be a forecast of future occasions, a assure of future outcomes or funding recommendation. Views expressed are these of the portfolio supervisor(s) and should differ from these of different portfolio managers or of the agency as an entire. Additionally, please be aware that any dialogue of the Fund’s holdings, the Fund’s efficiency, and the portfolio supervisor(s) views are as of March 31, 2024 (besides as in any other case said), and are topic to vary with out discover. Sure info contained on this letter constitutes “forward-looking statements,” which might be recognized by way of forward-looking terminology similar to “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof (similar to “may not,” “should not,” “are not expected to,” and so on.) or different variations thereon or comparable terminology. As a result of numerous dangers and uncertainties, precise occasions or outcomes or the precise efficiency of any fund could differ materially from these mirrored or contemplated in any such forward-looking assertion. Present efficiency outcomes could also be decrease or larger than efficiency numbers quoted in sure letters to shareholders. Date of first use of portfolio supervisor commentary: April 11, 2024 1 The FTSE EPRA/NAREIT Developed Actual Property Index was developed by the European Public Actual Property Affiliation (EPRA), a standard curiosity group aiming to advertise, develop and signify the European public actual property sector, and the North American Affiliation of Actual Property Funding Trusts (NAREIT), the consultant voice of the US REIT trade. The index collection is designed to replicate the inventory efficiency of corporations engaged in particular features of the North American, European and Asian Actual Property markets. The Index is capitalization-weighted. 2 S&P 500 Index, or Normal & Poor’s 500 Index, is a market-capitalization-weighted index of 500 main publicly traded corporations within the U.S. 3 A government-sponsored enterprise (GSE) is a quasi-governmental entity established to reinforce the stream of credit score to particular sectors of the U.S. economic system. 4 Money stream: Money stream is the after-tax earnings plus depreciation that features as a measure of a agency’s monetary power” (Source: Investopedia) Past performance is no guarantee of future results; returns include reinvestment of all distributions. The above represents past performance and current performance may be lower or higher than performance quoted above. Investment return and principal value fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. For the most recent month-end performance, please visit the Fund’s website at www.thirdave.com. The gross expense ratio for the Fund’s Institutional, Investor and Z share classes is 1.18%, 1.44% and 1.10%, respectively, as of March 1, 2024. Distributions and yields are subject to change and are not guaranteed. Risks that could negatively impact returns include: overbuilding and increased competition, increases in property taxes and operating expenses, lack of financing, vacancies, environmental contamination and its related clean-up, changes in interest rates, casualty or condemnation losses, and variations in rental income. The fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 800-443-1021 or visiting www.thirdave.com. Learn it rigorously earlier than investing. Distributor of Third Avenue Funds: Foreside Fund Providers, LLC. Present efficiency outcomes could also be decrease or larger than efficiency numbers quoted in sure letters to shareholders. Third Avenue provides a number of funding options with distinctive exposures and return profiles. Our core methods are at the moment accessible by way of ’40Act mutual funds and customised accounts. If you want additional info, please contact our Relationship Supervisor. |

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.