None of how the market is acting today in reaction to the lack of a strong 50 basis point signal from Waller should be a surprise.

Here is what I wrote back in June:

It’s been awhile since we’ve had a ‘normal’ rate cutting cycle so it’s worth a reminder about what happens and what always happens:

The market turns into a whiny teenager. It starts kicking-and-screaming

for rate cuts, with equities bleeding on anything that isn’t overtly

dovish.

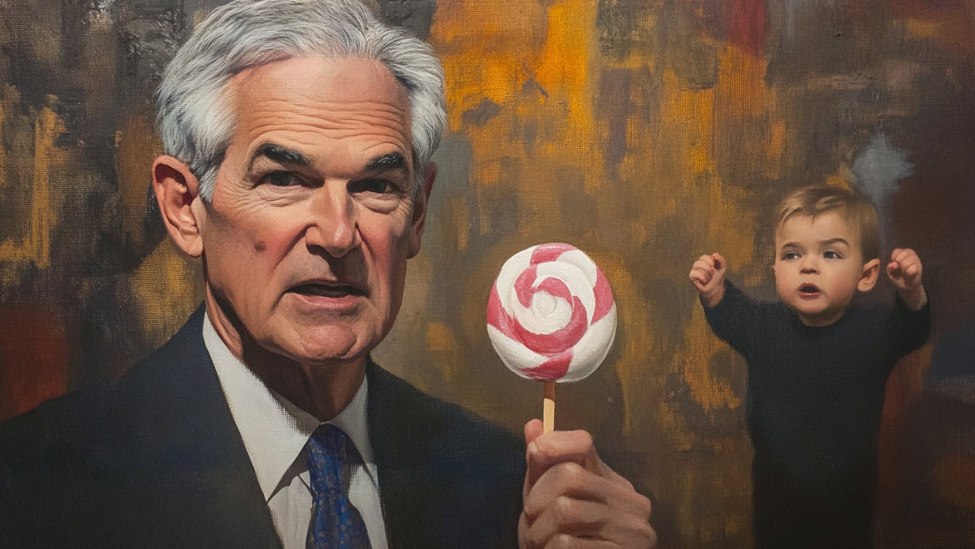

If you don’t like that reference, then consider it like a toddler that wants a candy. They always want more and they want it right now. As the father of four young kids, there is no pleasing them.

This is exactly how markets behaved in 2008, in 2016 when rate hikes came too soon and how they behaved during the taper tantrum. The episode in 2019 was slightly less because Powell was seen as easing pre-emptively.

Fed funds target rate history: