Songsak Rohprasit | Second | Getty Photos

The tax deadline is approaching and a few filers are turning to chatbots powered by artificial intelligence for assist with returns.

However taxpayers needs to be cautious of generative AI — which makes use of synthetic intelligence to create content material — for tax recommendation, consultants say.

Practically 1 in 5 People would belief ChatGPT, a well-liked AI chatbot from OpenAI, to assessment their earnings taxes, and 14% have used it, in keeping with a February survey of roughly 1,000 U.S. adults from CardRates.com.

One other recent survey had comparable findings, with 17% saying they’ve used AI for tax submitting and 45% open to it for future use, a Harris Ballot discovered.

Whereas many consultants are optimistic about the way forward for generative AI and taxes, filers ought to “proceed with caution” when utilizing the software program to file returns, stated April Walker, lead supervisor for tax follow and ethics on the American Institute of CPAs.

Extra from Private Finance:

There’s still time to reduce your tax bill or boost your refund before the deadline

An ‘often overlooked’ retirement savings option can lower your tax bill

Some retirement savers can still get a ‘special tax credit,’ IRS says

“We caution users against using ChatGPT for financial advice, as they should seek a professional instead. This activity actually goes against our usage policies,” a spokesperson from OpenAI informed CNBC.

AI chatbots ‘aren’t prepared for prime time’

This season, taxpayers have a number of choices for AI-powered steerage, together with software program like ChatGPT, together with chatbots from TurboTax, H&R Block and the IRS.

In 2022, the IRS rolled out voice and chatbots to assist reply fundamental fee and assortment discover questions. The company has since expanded its use of AI-driven know-how.

For the reason that January 2022 rollout, the IRS used chatbots to assist greater than 13 million taxpayers and helped arrange about $151 million in fee agreements, the agency announced in September.

Pranithan Chorruangsak | Istock | Getty Photos

In the meantime, TurboTax has unveiled the generative AI-powered “Intuit Assist” chatbot. The was chatbot was designed to assist with software program already utilizing AI for “simplified filing” and extra correct returns, in keeping with Karen Nolan, senior communications supervisor at Intuit TurboTax.

Nevertheless, “AI is not completing or filing a tax return in TurboTax,” she stated. “If a TurboTax filer ever has a question about their tax return, they are only a click away from a live tax expert at all times.”

H&R Block, which has used AI for years, additionally introduced a generative chatbot with “AI Tax Assist” this season. The software assists the method for DIY filers and the corporate has instructions on the easiest way to make use of it.

“We also have a team of human testers reviewing questions and feedback daily to identify what to add and improve,” an organization spokesperson stated.

Nonetheless, AI chatbots “aren’t ready for prime time,” when submitting tax returns, in keeping with Subodha Kumar, professor of statistics, operations and knowledge science on the Fox College of Enterprise at Temple College.

Kumar has examined AI chatbots together with his college students and located the software program works for common tax questions, however usually offers flawed solutions for extra particular prompts.

For instance, filers might not get correct solutions to tax questions from ChatGPT as a result of its coaching is “general purpose” reasonably than tax-specific, he stated.

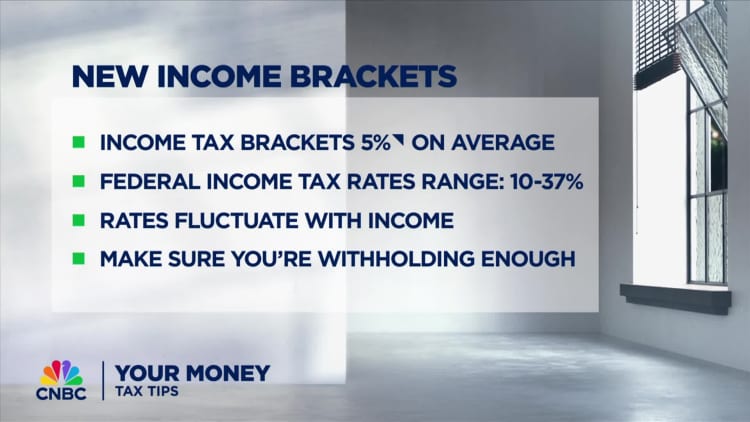

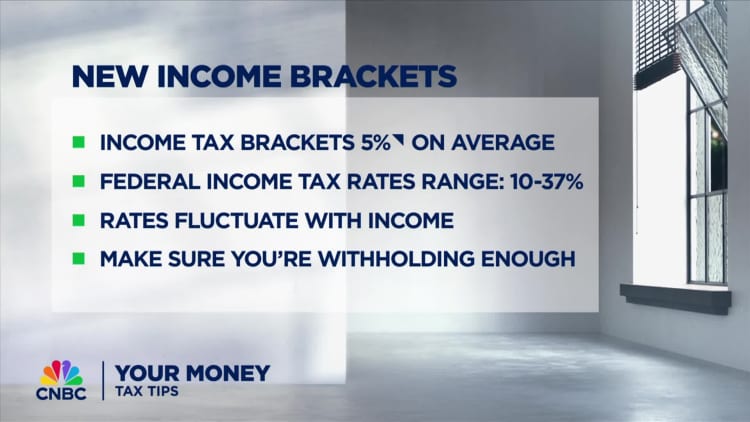

Plus, the information is not absolutely up to date, with totally different information cutoff dates, relying on which model of ChatGPT you are utilizing. The most recent AI mannequin is GPT-4 Turbo, and offers solutions with context as much as April 2023. That might be a problem with yearly inflation adjustments, tax adjustments from Congress and the IRS.

Nevertheless, with fashions particularly skilled for tax, Kumar expects a “big leap” from tax-specific AI chatbots by subsequent season.

Defend your self from knowledge ‘leakage’

Whereas consultants agree that AI chatbots aren’t prepared for customized tax suggestions, there’s nonetheless an opportunity for training.

“I think there are opportunities to use tools like that in a generalized context,” stated Michael Prinzo, managing principal of tax at CliftonLarsonAllen. “It could be an effective tool as long as personal information is protected.”

Specialists warn there might be knowledge safety points when plugging monetary data into ChatGPT or different AI chatbots.

“There could be multiple types of [data] leakage,” defined Spencer Lourens, managing principal of information science, machine studying and synthetic intelligence at CliftonLarsonAllen.

Nevertheless, you can enter a common reality sample of doable earnings sources and tax breaks with out together with delicate private knowledge and counting on the software program for a particular reply.

In fact, it is best to at all times confirm any data obtained from AI-powered chatbots by double-checking the small print on the IRS web site or with a tax skilled, added Walker with the American Institute of CPAs.