Bitcoin remains under immense liquidation pressure at press time. After two days of lower lows, not only did bears reject $63,000 but cratered below May 2024 lows today.

BTC Drop Purging Speculators, Markets Shifting To Spot Trading

Amid the fear gripping the market following this wave of liquidation, one analyst took to X, saying the collapse of bulls this week was necessary. According to Ki Young Ju, the founder of CryptoQuant, a crypto analytics platform, the Bitcoin market has been futures-driven for “a long time.”

Though the degree has been falling from the previous bull run in 2024, Ju thinks the crash was necessary to flush the BTC market from leveraged speculators looking to profit from market volatility and not utilize the solution the network presents.

As of July 4, the founder said the futures-to-spot trading volume ratio versus the 2021 peak was down by 63%. This drop points to a healthier shift in market structure characterized by decreasing reliance on futures contracts and a greater focus on holding BTC, not trading the asset for profit.

Following the Bitcoin flash crash below $54,000, hundreds of millions of leveraged longs were liquidated across multiple platforms. From the drop, many bulls were battered and broken, looking at the numbers.

According to Coinglass, over $323 million worth of leveraged longs were closed when writing on July 5, and only $121 million of shorts forcefully closed.

Most of these positions were initiated on Binance and OKX, two of the world’s largest crypto exchanges supporting spot trading and perpetual futures.

Bitcoin Market Maturing, ETFs Game-changing

In another post, Ju said the shift from futures to spot trading could be because of the impact of spot Bitcoin exchange-traded funds (ETFs). Currently, the founder assesses that roughly a quarter of all capital inflow into spot trading volume is from ETF issuers.

Unlike before, when retailers drove the market, this batch of money is “more mature than ever.” Accordingly, instead of capitulating whenever prices dump, as is the case, these holders will likely hold on as they have more financial muscle to wriggle around, soaking up all pressure.

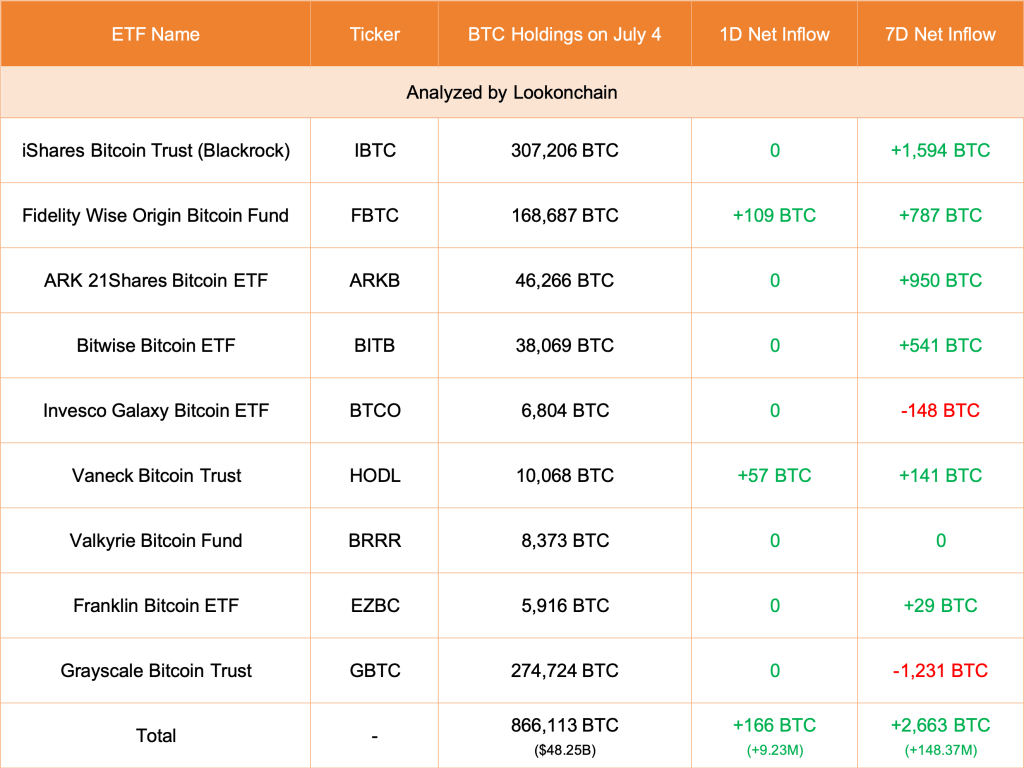

As Bitcoin matures, more institutions and public companies will follow the path of MicroStrategy and Tesla, allocating capital for BTC purchases as they diversify their multi-trillion portfolios. By early July, spot Bitcoin ETF issuers have purchased billions of dollars worth of BTC on behalf of their clients.

However, there have been outflows in light of the current state of price action. According to Lookonchain, as of July 5, all nine ETFs added 166 BTC, with Fidelity leading the back by buying 105 BTC.

Feature image from Canva, chart from TradingView