Trevor Williams

Overview

There are so many different healthcare investments in the sector that I prefer to get my exposure from a fund that can provide instant diversification and provide a steady distribution along the way. abrdn World Healthcare Fund (NYSE:THW) has been one of my selections to achieving this and I’ve previously covered what I’ve liked about it in the past. However, I am starting to see some signs of weakness, particularly with the distribution coverage. What makes THW such an attractive choice is that the fund is diversified and provides a higher than average dividend yield of about 10.7% and distributions are paid out to shareholders on a monthly basis.

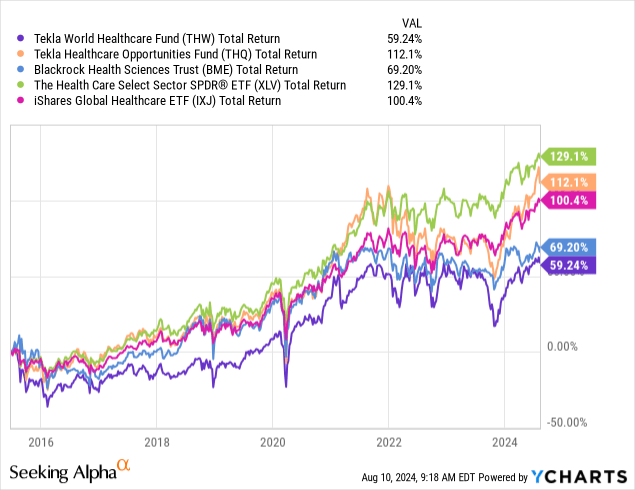

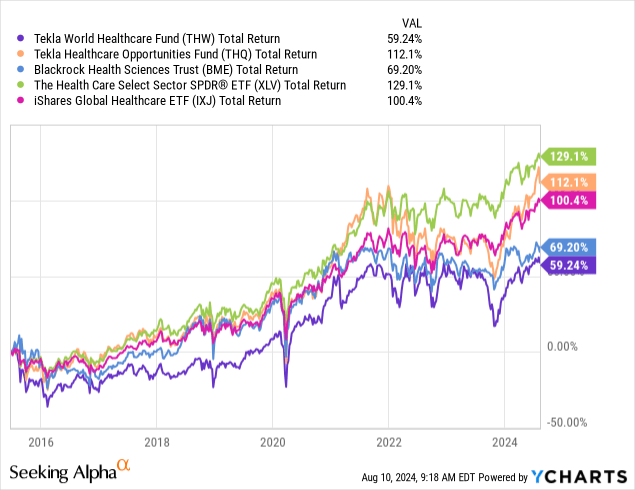

When looking at the performance of THW, we can see that it has underperformed most peers in the healthcare sector. This has led me to question whether or not the income aspect of THW is worth the tradeoff of underperformance. While I would typically be okay with some of a tradeoff, I believe that there is a lot of future growth to be captured from the healthcare sector over the next decade and I am starting to shift my objective towards obtaining the highest total return possible.

Just for some brief context, THW operates as a closed end fund that provides global exposure to the healthcare sector throughout varying sub sectors such as pharmaceuticals, biotech, and even healthcare related real estate investment trusts. The fund has a public inception dating back to 2015 and sports a management fee of 1.25%. THW maintains both equities exposure as well as fixed income investments to help boost the overall yield that can be generated.

Distribution Risk

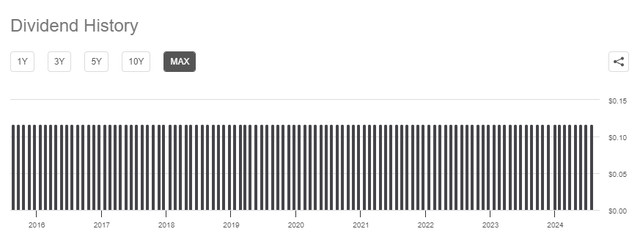

As of the most recently declared monthly distribution of $0.1167 per share, the current dividend yield sits at 10.7%. Since the distributions are issued on a monthly basis, THW can be an attractive choice for investors that may depend on the income generated from their portfolio to fund their lifestyle expenses. Something that THW has on its side is that the distribution has never been cut since the fund’s inception. Therefore, the fund has historically offered investors a place to capture a reliable source of income while maintaining a diverse exposure to the healthcare sector.

This sense of stability has also enabled long term investors to continually growth their income year over year. Despite the lack of raises, the stability could have been taken advantage of by reinvesting those distributions back into THW. By doing this, you would effectively be compounding your distributions and creating a snowball effect of growing income. This process could further be amplified by reinvesting new capital so that the distributions grow at a quicker rate.

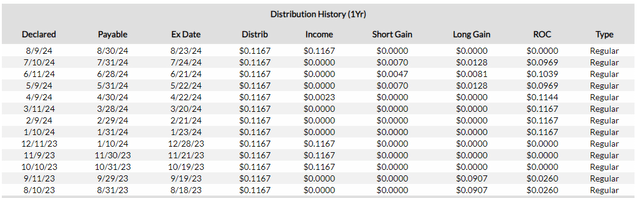

However, the problem I have with the distribution is that it has historically been funded by mostly return of capital. Return of capital in itself isn’t always a negative thing but the excessive use of it can be harmful to the fund’s NAV and future growth. It can also indicate a issue with the underlying strategy and how it ma be failing to generated sufficient returns to fully cover the distribution. Return of capital distribution get taken directly out of the fund’s net assets and as a result, stunts the experienced price growth.

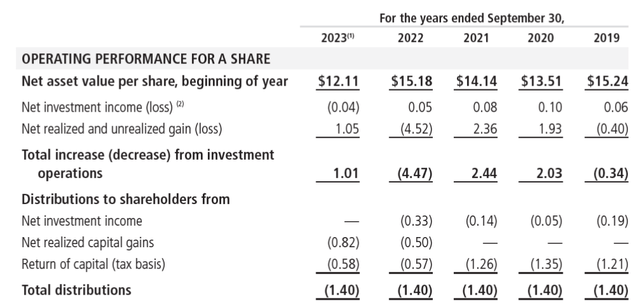

The latest annual report reveals that the fund’s NAV sat at $15.18 per share by the year end of 2021. However, this steadily decreased down to $11.73 per share by the end of 2023. Taking a look at the distribution history over the last year, I assume that that the continued use of return of capital is a contributing factor the the NAV decline. We can see that most of the distributions over the last year consisted of mainly ROC, rather than using the net investment income generated from the underlying assets or net realized gains.

The annual reports over the last five years show that net investment income has never surpassed $0.10 per share. Net investment income can include the dividends, interest, and income received from option writing. Since these totals have never showed any impactful growth, it can indicate an underlying issue with the fund’s strategy. The large majority of THW’s growth comes from net realized gains from buying and selling of the underlying securities within.

I believe that if the distribution was reduced a bit, it would allow the fund to capture more upside growth by retaining a larger portion of earnings. I know that a distribution cut wouldn’t be ideal because of the already established sense of reliability, but continued performance down this path will lead to further NAV deterioration.

Underlying Portfolio Strategy

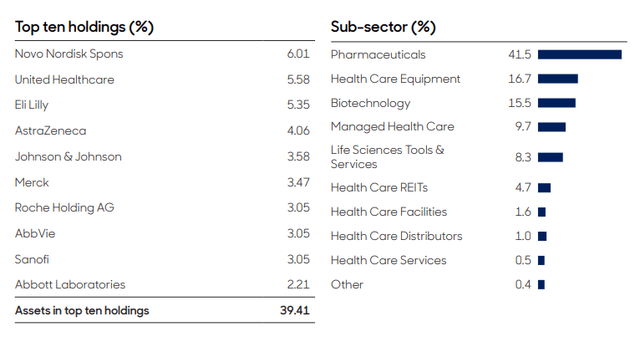

What differentiates THW from its sister fund, abrdn Healthcare Opportunities Fund (THQ), is that THW has an emphasis on maintaining global exposure. According to the fund’s latest fact sheet, exposure to the United States only accounts for 45.9% of the investments within. The breakdown consists of US-based companies that have substantial amounts of revenue coming from international sources, making up 20.9%. This is followed by varying weights of exposure to different countries such as the United Kingdom, Denmark, Switzerland, France, Netherlands, and Ireland.

Another thing that makes THW different is that it maintains exposure to other asset classes besides just equities. For instance, THW has some exposure to fixed income, REITs, and Venture Capital investments. These other asset classes seem to be income centric and could be a contributing factor on why the price performance has been underwhelming throughout THW’s history. We can also see that THW has exposure to interest rate sensitive sub sectors such as health care REITs.

Pharmaceuticals make up the largest area of investment, accounting for 41.5% of the total portfolio makeup. This is followed by exposure to sectors such as health care equipment and biotech, accounting for 16.7% and 15.5% respectively. Therefore, most areas of the healthcare sector are covered with an investment in THW. In terms of top positions, Novo Nordisk (NVO) is the largest position sitting at 6.01%. This is followed by a 5.58% exposure to United Healthcare (UNH) and a 5.35% exposure to Eli Lilly (LLY). The top holdings have shifted a bit from the last time I covered THW. At that time, Eli Lilly was the largest position, followed by United Healthcare. The breakdown of the sub sectors have also shifted a bit as pharma only accounted for 39% of their portfolio and biotech was the second largest sector.

THW also has the inclusion of an option writing strategy to help generated higher levels of income within the fund. However, I previously shared the net investment income results and it doesn’t seem like the option strategy here has really helped amplify the returns over the last few years. In addition, option strategies can usually be implemented as a way for funds to take advantage of cycles of higher market volatility by collecting higher premiums on the options. THW fails to do this with net investment income never showing any meaningful growth, even during high volatility times like we’ve experienced since the pandemic in 2020.

THW can write call options against the underlying equities within but the typical portion size of these options are only 20% of the fund’s net assets. The added downside here is that the option strategy effectively caps the upside price appreciation that can be experienced here. This is because gains from price increases are capped at whatever the strike price is on the underlying asset. I’m willing to bet that if the option strategy was completely eliminated from THW, the distribution would have to be reduced by the overall NAV and price growth experienced here would be a lot more attractive. Therefore, while the inclusion of options have a positive intent, the actual execution has proven to be flawed over time.

Valuation

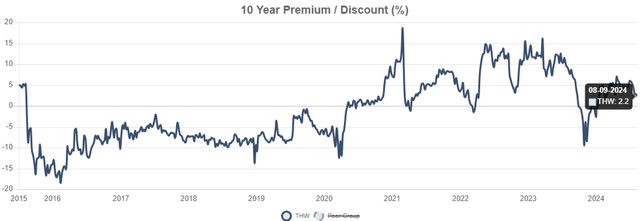

Since THW operates as a closed end fund, the price can vary from the actual value of the underlying assets. As a result, we can see when the price has historically traded at a premium of discount to NAV. Looking at the chart below, we can see that prior to 2020, the fund has frequently traded in the discount to NAVV territory. THW currently trades at a slight premium to NAV of 2.2%. For reference, the price traded at an average premium to NAV of 6.8% over the last three years but I do not see any reasons to justify this premium.

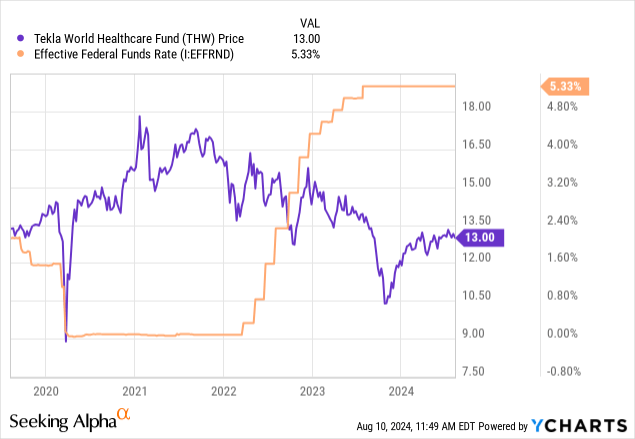

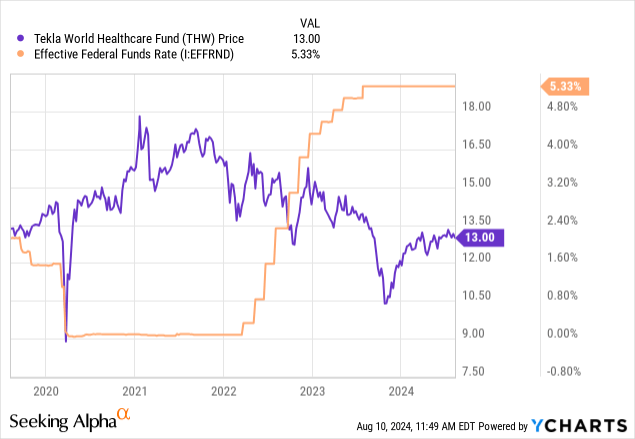

When looking at THW from a price perspective, it has failed to capture a similar growth experienced from the healthcare sector. This isn’t too surprising however since the main focus of THW is on income generation. Therefore, THW will be at an attractive value once the premium comes down and the price trades in the discount territory. Forward looking, I believe that future interest rate cuts may be a positive price catalyst. Looking at the recent history, we can see that THW has shared a unique relationship with the federal funds rate.

When interest rates were cut to near zero levels following the pandemic, the price of THW rapidly appreciated. Conversely, when interest rates were aggressively hiked throughout 2022 and 2023, the price continually retracted to the downside. Higher rates put more financial pressure on companies that held a lot of floating rate debt on their balance sheet. Higher rates have the power to shrink profitability metrics as more earnings need to be dished out towards interest payments and debt reduction, rather than being reinvested back into companies.

The unemployment rate has steadily climbed over the last 12 months and now sits at the 4.3% while the inflation rate simultaneously trends downward over the last couple of months. Additionally, US Presidential elections are upcoming and may cause higher levels of volatility and uncertainty in the markets. The combination of these factors may incentivize the Fed to begin cutting interest rates as early as September. I believe that lower interest rates would be a positive catalyst for growth going forward because lower rates would enable healthcare companies to allocate more capital towards various growth initiatives.

Since interest rates would directly translate to cheaper access to debt capital, healthcare companies could use this capital to fund the research and development of new drugs or products, fund acquisitions, or expand operations with new construction projects or developments. Therefore, I plan to remain very observant at how the fund’s performance will improve one interest rates start to get cut. I currently hold a position in THW but will no longer be reinvesting the distribution or adding new capital for now.

Takeaway

In conclusion, THW’s high yield can be attractive for income investors since the distribution is paid out on a monthly basis and the dividend has never been cut. However, the historical performance of the fund is a bit underwhelming and has caused some concern for the sustainability of the distribution. Over the last twelve months, the majority of the distribution has been funded from return of capital. While I have no issues with this form of distribution, I do believe that excess use and reliance on it is ultimately harmful for NAV and will continue to contribute to the price decline.

The option strategy hasn’t proven to be very useful in generating higher levels of income. Therefore, the options has only limited the upside growth potential experienced. THW trades at a slight premium to NAV but recent performance doesn’t justify this premium. In addition, THW has underperformed peer healthcare focused funds in total return over the last decade. While the the does have a nice level of diversity and the monthly distribution is attractive, I am downgrading my rating to a hold. I plan to maintain my position but will not continue reinvesting those distributions or add any additional capital for now. I plan to observe how the fund’s performance changes or improves when interest rates are cut.