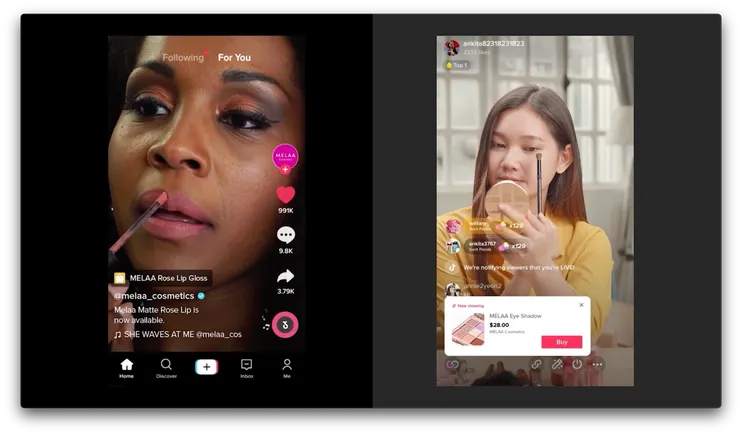

TikTok’s looking to launch its in-app shopping tools in Spain and Ireland, as it continues to press its in-stream shopping push, in the hopes of generating more revenue from the app.

As reported by Bloomberg, TikTok’s hoping to re-start its EU shopping push, after a failed acceleration back in 2022, beginning a bigger push into these two markets.

As per Bloomberg:

“[TikTok] told partners including merchants and creator agencies in recent weeks to get ready for a TikTok Shop debut in the two countries, according to people familiar with the matter. The rollout will be smaller than previously envisioned although preparations are underway to bring the portal to other parts of Europe next year.”

As noted, TikTok had attempted to make a more significant eCommerce push in Europe, branching from the U.K., back in 2022, but was forced to scale back that rollout due to internal conflicts.

Reports suggested that TikTok’s tough working conditions, modeled on its Chinese operations, had not been well received among U.K. staff, which eventually led to the replacement of local management. That then derailed its broader eCommerce push, though lack of consumer interest was also a factor in its decision to scale back.

But now, with in-app spending on the rise, TikTok sees a new opportunity to connect with EU shoppers.

TikTok recently reported that there are now 15 million sellers in the app, in a range of markets, while in the U.K. specifically, TikTok is now the second largest online beauty and wellness retailer.

So there is opportunity there, if TikTok can get it right, and it’s now working to streamline its processes, and build on in-app spending habits, in order to expand on its steadily increasing market share.

Though it’s not growing at the rate that TikTok’s Chinese sister app saw in its homeland.

Douyin, the Chinese version of TikTok, reportedly generated more than $US300 billion in sales in 2023. By comparison TikTok brought in $US3.8 billion in the same period.

What’s more, Douyin’s sales volume has grown rapidly, and is projected to keep rising for some time yet.

As you can see in this chart, Douyin went from generating $US5.8 billion in sales in 2019, to $387 billion just four years later. And when you consider that TikTok’s currently at $US3.8 billion, you can see why parent company ByteDance sees expanded opportunity, but at the same time, Western audiences, in general, remain resistant to social media commerce, and haven’t shown the same interest in buying in-stream that Asian users have.

That’s also reflected on TikTok itself. TikTok users in Singapore, Malaysia, and Indonesia are increasingly adopting its shopping initiatives, but it’s still, seemingly, a harder sell in non-Asian markets.

Why that is, nobody knows, but it seems that many Western consumers are less enamored with buying within social apps, and are more aligned with heading to dedicated shopping portals, like Amazon, for shopping activity.

Case in point: Recently, TikTok launched its own “Deals For You” event to compete with Amazon’s “Prime Day”. But it didn’t catch on.

As reported by ModernRetail:

“For non-Amazon retailers, gross merchandise volume growth in the U.S. rose 3% year over year during the two-day period of Amazon’s Prime Day sale. In contrast, gross merchandise growth was actually down 6% during TikTok’s Deals for You Days event, which ran from July 9 to July 17.”

In the U.S., of course, there may also be some backlash and concern among consumers due to TikTok’s potential links to the CCP, which has also seen the U.S. Government impose a mandatory sell-off bill on the app.

That’s likely made some users more hesitant to upload their payment info, though that would also extend to other Western regions, where TikTok has come under scrutiny over its data sharing and usage activities.

As such, it doesn’t seem like TikTok is ever going to become an eCommerce powerhouse on the same level as Douyin. But it’s certainly going to try, and while I can’t envision this being a transformative shift, the evidence is there that TikTok could still become a bigger retail presence, and a bigger brand consideration, at least in certain sectors.

So will this new EU shopping push yield big results? Probably not, but then again, even smaller scale take-up could still be significant.