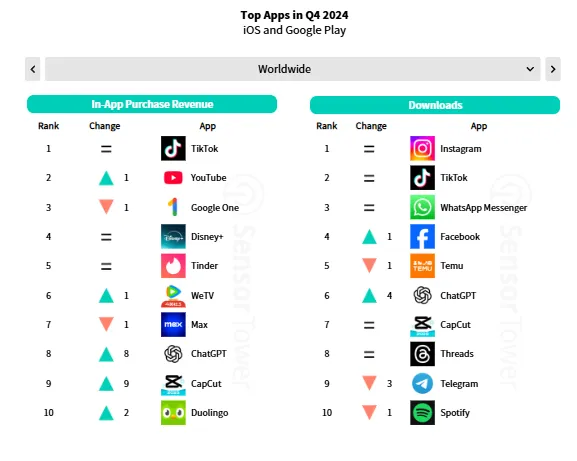

If you had any question as to why the U.S. is such a major focus for TikTok, as it continues to fight for its survival in the region, this new insight, taken from Sensor Tower’s latest “Digital Market Index” report might help:

“In-app purchase revenue in the U.S. rose by $1.47 billion between Q4 2023 and Q4 2024, a larger increase than the rest of the top five markets combined.”

And more specifically:

“Consumers spent a staggering $6 billion on in-app purchases in TikTok (including Douyin in China), up from $4.4 billion in 2023. This was more than double the revenue from any other app or game in 2024.”

In-app spending is where Douyin, the Chinese version of TikTok, makes all of its money, which is why TikTok is also looking to build its eCommerce business.

Though I’m not sure about the combined total above. Maybe this includes Douyin purchases outside of China only, because according to reports, Douyin’s gross merchandise volume (GMV) for 2024 reached 3.5 trillion yuan, or around $US490 billion.

Which is significantly more than what Sensor Tower has suggested here, and Douyin’s ongoing GMV growth has been TikTok’s guiding light, in terms of its own in-stream shopping maximization.

If it can get its TikTok Shop elements right, then the revenue opportunity is massive, and as the above notes show, in-stream shopping is catching on with U.S. users, albeit slower than it did in China.

And it’s the U.S. that’s leading this charge, by a significant margin, which, again, is why TikTok is now fighting tooth and nail to ensure the app remains available to U.S. users.

It’s also working to expand its eCommerce push in other markets, as a hedge against a possible U.S. ban. But the data here shows why the U.S. market, specifically, is a major focus, providing major opportunities, not just in terms of users, but also in regards to driving that next-level income stream.

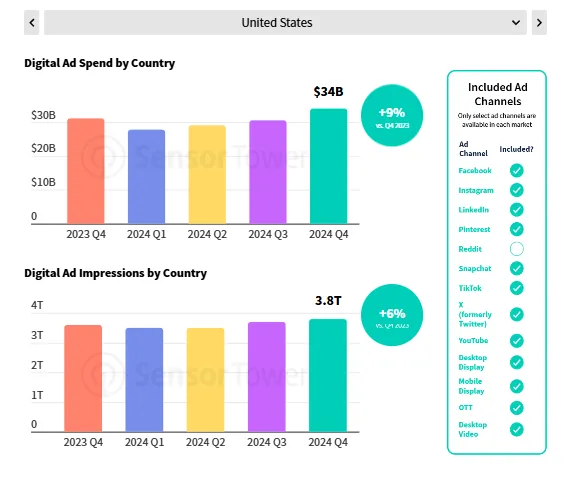

Sensor Tower’s Q4 mobile market overview also includes notes on overall ad spending growth, with Q4 breaking records in the U.S.

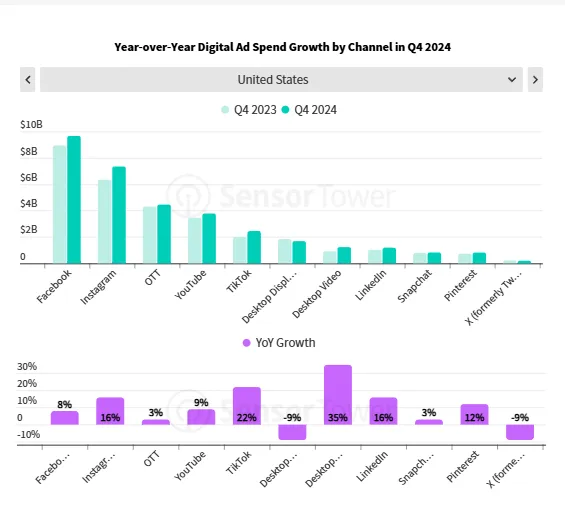

There’s also data on ad spend by channel (where LinkedIn and Pinterest saw notable growth):

As well as a spotlight on retail media advertising.

Some valuable insights, which could help to guide your ad decisions.

You can read Sensor Tower’s full “Q4 Digital Market Index” report here.