FG Commerce Latin

Tilly’s (NYSE:TLYS) is an American attire retailer centered on adolescents and younger folks.

The corporate had a troublesome 2023, with same-store gross sales falling considerably in contrast with 2022 and much more with the 2021 pandemic growth interval.

On the optimistic, the inventory doesn’t appear overvalued in comparison with mean-reverted profitability, and the corporate has no debt and nearly $100 million in money. On the unfavorable facet, the model doesn’t appear to have any particular aggressive benefits in right this moment’s retailing world, and its decade-long CEO has not too long ago left after latest merchandising failures.

I want to cross on Tilly’s, as a play on a possible restoration appears principally already discounted on the inventory, and I am not excited in regards to the firm’s future.

Firm introduction

Tilly’s was based in 1982 in California and went public in 2012. The corporate’s founders nonetheless management about 15% of whole inventory and train management through a two-class construction that provides them 10 votes per share, in comparison with 1 vote for the exchange-traded shares.

The corporate has 260 shops in California (100), Florida, Texas, Arizona (20 every), and 29 different states.

The corporate’s core demographic appears to be adolescents to very younger adults, each girls and boys. The merchandise are within the surfer-skater space, and the corporate’s shops appear to comply with the identical vibe.

Tilly’s retailer inside (Google photographs)

Tilly’s technique appears to delve round assortment, shifting greater than 20 third-party manufacturers (none of which characterize greater than 5% of gross sales) and its personal manufacturers (which collectively characterize 30%) of gross sales.

The corporate prides itself on its merchandising technique, with new stock reaching shops weekly and retailer managers having discretion over which merchandise to order. With most shops concentrated in California, this appears a viable technique.

By way of digital, about 20% of the corporate’s gross sales are on-line. The corporate’s web site and Instagram are comparatively unimpressive.

The web site is licensed (from Salesforce), many merchandise lack a mannequin {photograph}, and the grid appears unordered. Traffic has consistently decreased from 2 million a month at its peak in the course of the pandemic to lower than 700 thousand right this moment. Critics of the web site should not nice, with 1 star in Sitejabber and 2 stars in Trustpilot. Critiques level to the corporate’s chunky and failure-prone web site expertise with funds and exchanging present playing cards and returns. This compares negatively to 3 stars in Yelp, the place the in-store expertise can be included.

The Instagram and TikTok pages appear standard, with few followers, lower than month-to-month web site site visitors, and no campaigns with influencers or KOLs.

General, Tilly’s strikes me as a traditional retailer that follows the normal merchandising-traffic mannequin with some e-commerce. I don’t get the impression that Tilly’s meaningfully engages clients as a model.

Difficult 12 months

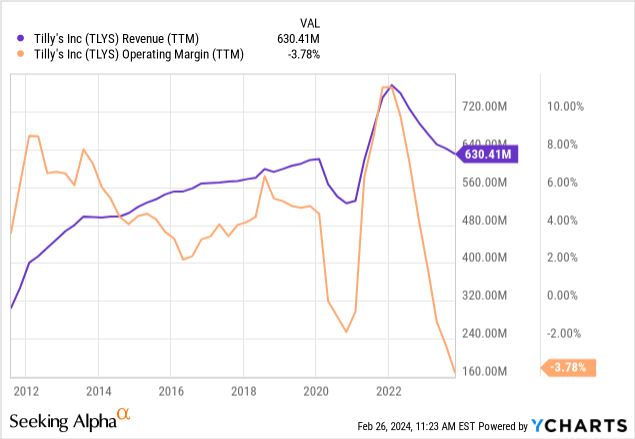

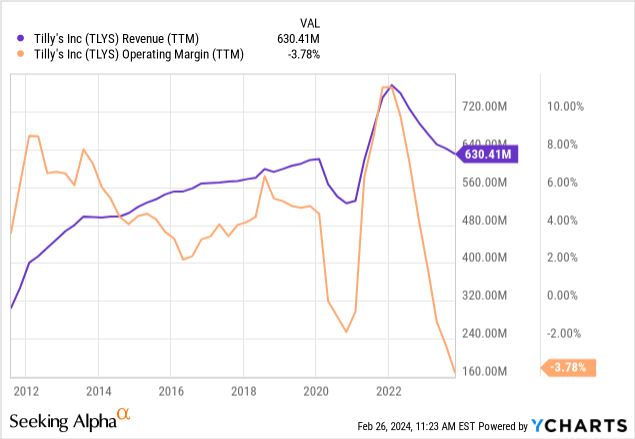

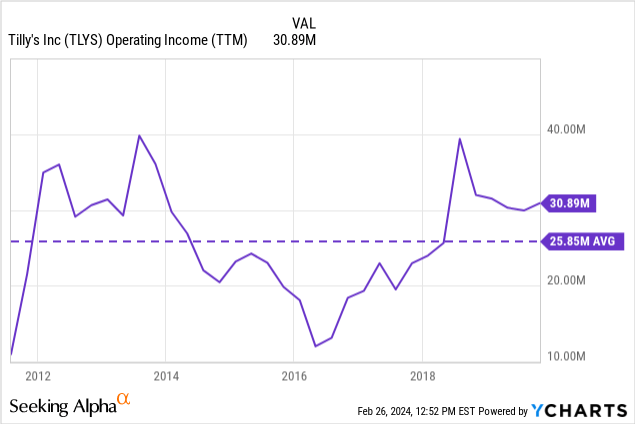

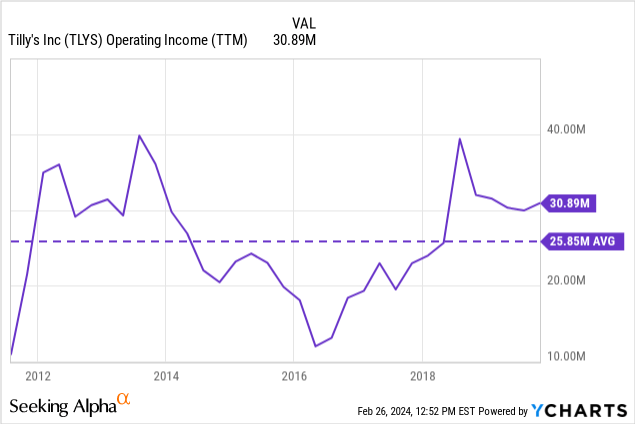

Earlier than the pandemic, Tilly’s was doing simply high quality. The corporate posted constant progress, nearly doubling revenues since IPOing. Its margins weren’t tremendous excessive for a retailer, perhaps indicating an absence of aggressive benefit. Regardless of this, working margins have been comparatively secure, averaging 5%.

Like most attire manufacturers, Tilly’s then went by a interval of document income throughout 2021 and early 2022, solely to lower later.

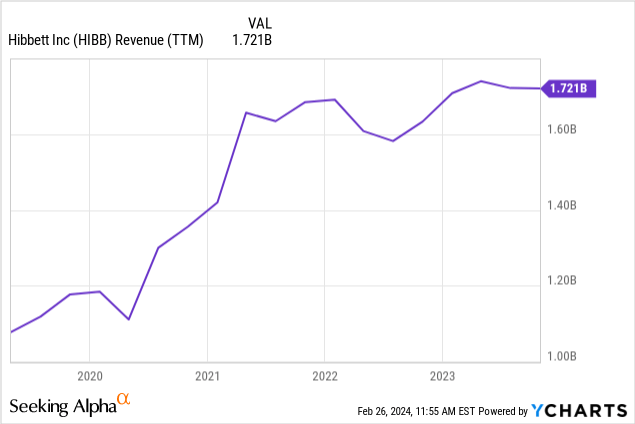

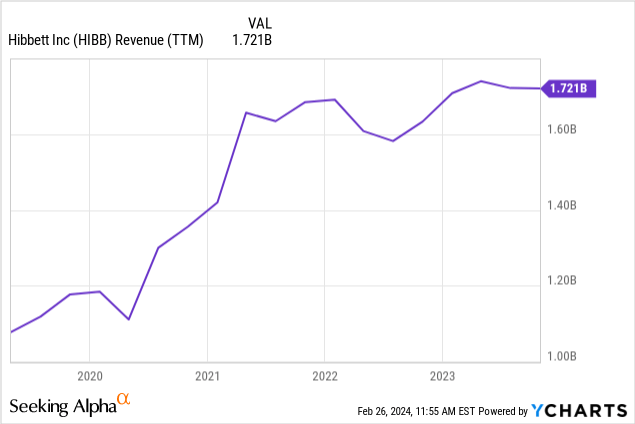

The extent and length of Tilly’s income lower, nearly reaching pre-pandemic ranges, is extra explicit. Some attire retailers have been in a position to climate the post-pandemic challenges slightly higher. One such instance is Hibbett (HIBB), which serves an analogous demographic.

Administration has commented that the corporate’s principal problem is that its goal buyer’s disposable revenue is shrinking due to inflation. Nevertheless, it has additionally admitted (for instance, on its newest earnings name) that it has had a sequence of merchandising flops, with articles that aren’t as interesting whereas others are undersupplied. I imagine the comparability with Hibbett evidences that Tilly’s drawback is extra intrinsic than exterior.

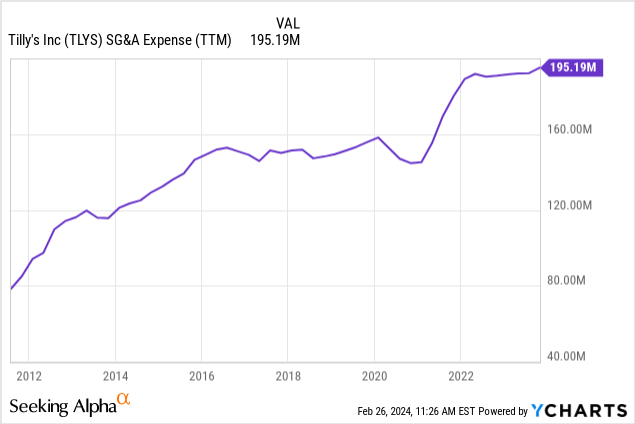

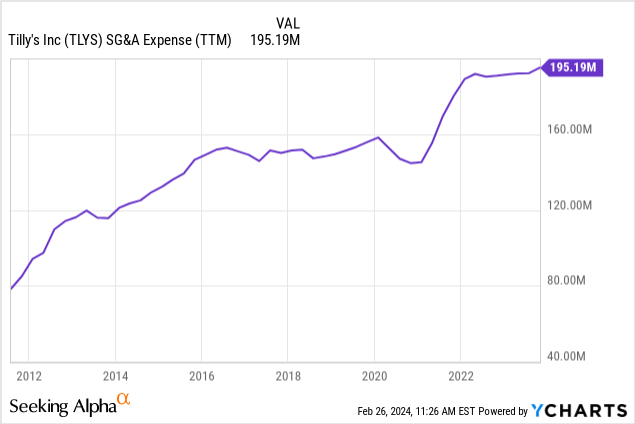

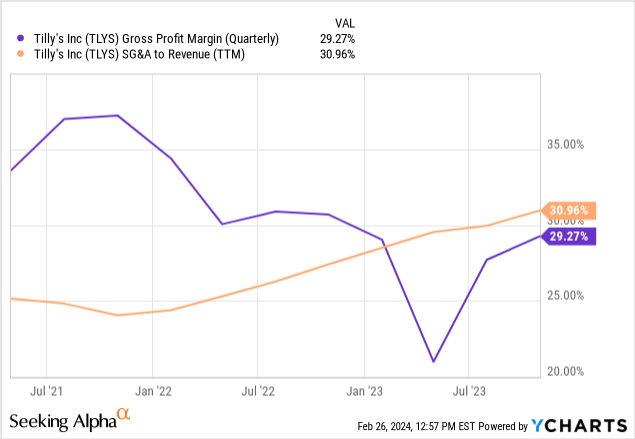

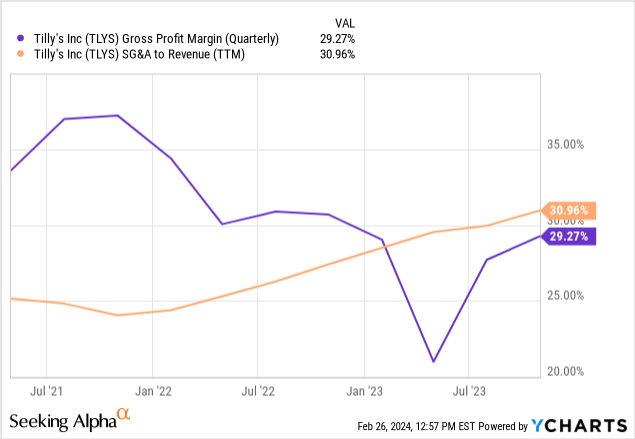

The issue has been compounded on the backside line through SG&A bills which were sticky to the draw back. SG&A is about 50% retailer payroll; one other $25 million represents promoting bills. Retailer lease, success, and merchandise prices go into CoGS, so they do not leverage the SG&A account. That also leaves about $75 million (or greater than 10% of gross sales) as unallocated company bills. This quantity appears extreme.

Restoration and valuation

Tilly’s present market cap is about $220 million, which web of about $100 million in money and short-term investments ends in a $120 million enterprise worth.

We might add again the $200 million in lease commitments that the corporate has to the enterprise worth, however that might additionally require so as to add again the lease prices (round $65 million in yearly funds) to working revenue. I discover this inconvenient and never very helpful.

Pre-pandemic, the corporate was in a position to generate a mean of $26 million in working revenue. If we used the 5% common working margin of the pre-pandemic interval on right this moment’s earnings of $650 million, it could lead to $32 million in working earnings. Each circumstances are engaging in comparison with an EV of $120 million.

Due to this fact, Tilly’s appears very enticing if it will possibly recuperate a number of the profitability it loved in the course of the pandemic. Can the corporate try this?

Final month, the corporate introduced that its decade-long CEO would be stepping down, and that the corporate can be quickly helmed by the co-Founder and Chairman. This might show an inflection level, however I might not wager on it, specifically earlier than seeing any strategic modifications.

The corporate’s gross earnings margins are slowly going again to the long-term common 30%, after heavy discounting to eliminate inventories originally of the 12 months. Nevertheless, SG&A bills are nonetheless above the long-term common gross margins. This means that the restoration ought to come from both gross sales leveraging (decreasing SG&A to revenues) or through a lower in SG&A.

On the income facet, I might not make investments primarily based on an optimistic financial situation, first as a result of the information doesn’t appear to point that, and second as a result of it could be betting on the financial system and never the corporate. The corporate has proven issues to develop on this context, which could be indicative of aggressive and strategic issues, slightly than macroeconomic ones. I do not really feel impressed by the corporate’s bodily or e-commerce operations.

On the business facet, the corporate faces greater than 100 lease choices in fiscal 2024. It might abandon a number of unprofitable shops and recuperate some gross margins (through decrease leases) and a few SG&A margins (through much less retailer payroll). Tilly’s might additionally enhance its company bills, and cut back a number of the $75 million in unallocated prices talked about within the above part.

On this case, I want to attend and see indicators of enchancment earlier than committing capital.

My conclusion is that though Tilly’s a number of to common earnings is enticing, and that the corporate has a robust stability sheet to climate a chronic financial downturn; the corporate’s inventory will not be enticing at these costs as a result of the model appears to be present process aggressive and strategic challenges. Till these are solved, or at the very least the issues are recognized, one mustn’t wager solely on working margins returning to the imply.

For that cause, I want to quickly cross on Tilly’s, on the expense of lacking a restoration on the inventory value, till extra data is accessible.