Nick Timiraos’ piece was in Tuesday morning’s Wall Road Journal, so this isn’t contemporary information. And its not going to shock anybody both.

In short:

- Fed officers will maintain their benchmark federal-funds price regular

- Firmer-than-anticipated inflation within the first three months of the 12 months has doubtless postponed price cuts for the foreseeable future.

- officers are prone to emphasize that they’re ready to carry charges regular … for longer than they beforehand anticipated

-

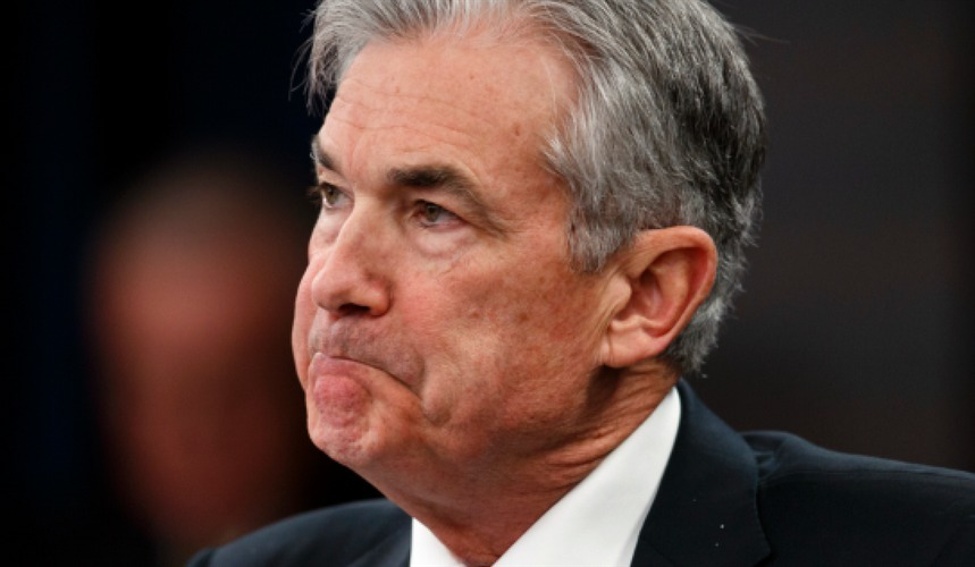

With no new financial projections at this assembly and minimal adjustments anticipated to the Fed’s coverage assertion, Fed Chair Jerome Powell’s press convention would be the primary occasion

On the press convention:

Powell is prone to repeat a message he delivered two weeks in the past, when he stated latest knowledge had “clearly not given us greater confidence” that inflation would proceed declining to 2% “and instead indicate that it’s likely to take longer than expected to achieve that.”

The main target at this assembly might be how Powell characterizes the interest-rate outlook.

The Journal is gated however right here is the hyperlink if you happen to can entry it:

The Federal Open Market Committee (FOMC)’s coverage choice might be launched on Wednesday Could 1 at 2 pm US EDT (1800 GMT) with Fed Chair Jerome Powell following up together with his press convention at 2:30 pm (1830 GMT).

Earlier previews:

- FOMC meet this week: “the most interesting news about this meeting will come on 22 May”

- “Fed has simply run into a brick wall”

- expect a hawkish Fed and Powell

- Fed cuts are not imminent

This text was written by Eamonn Sheridan at www.forexlive.com.