Travel Ink/DigitalVision via Getty Images

Tortoise Power and Energy Infrastructure Fund (NYSE:TPZ) is a closed-end fund, or CEF, that investors can purchase as a method of earning a high level of income from the assets in their portfolios without needing to sacrifice the capital gains potential of an investment in common equities. As regular readers can certainly attest, many of the highest-yielding closed-end funds that we have discussed in this column recently are funds that invest in either speculative fixed-income securities (such as junk bonds) or funds that invest in floating-rate leveraged loans. These are all different kinds of debt securities, and thus there is a limit to the potential capital gains that can be obtained from them. After all, interest rates cannot really go much below 0%, which limits the potential appreciation of any type of bond.

Floating-rate securities generally remain stable over time regardless of interest rates. Thus, the potential capital gains from these securities are limited as well. Tortoise Power and Energy Infrastructure Fund, on the other hand, invests in equity securities and common equities have no theoretical maximum upside. This is something that anyone who is trying to preserve their purchasing power in an inflationary environment should appreciate.

Investors in Tortoise Power and Energy Infrastructure Fund do not really need to sacrifice yield, either. The fund boasts a 7.97% yield at the current price. This is, admittedly, not as attractive as the best fixed-income funds provide, but it is far better than the 1.35% current yield of the S&P 500 Index (SP500):

Indeed, we can see that the yield of this fund is better than that of the major equity indices. The Dow Jones Industrial Average (DJI) is not included in the chart shown above, but that index only has a 2.14% yield at the current level, so it is certainly not better than this fund possesses.

As we can see here, Tortoise Power and Energy Infrastructure Fund’s yield compares fairly well to that of its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Tortoise Power and Energy Infrastructure Fund |

Hybrid-U.S. Allocation |

7.97% |

|

Allspring Utilities and High Income Fund (ERH) |

Hybrid-U.S. Allocation |

7.47% |

|

Bexil Investment Trust (OTCPK:BXSY) |

Hybrid-U.S. Allocation |

7.56% |

|

Franklin Universal Trust (FT) |

Hybrid-U.S. Allocation |

7.41% |

|

John Hancock Tax-Advantaged Dividend Income Fund (HTD) |

Hybrid-U.S. Allocation |

8.05% |

|

Tri-Continental Corp. (TY) |

Hybrid-U.S. Allocation |

3.77% |

|

Virtus Equity & Convertible Income Fund (NIE) |

Hybrid-U.S. Allocation |

8.84% |

As we can see, Tortoise Power and Energy Infrastructure Fund has a higher yield than most of its peers. While it is not the absolute highest-yielding fund that is shown in the chart above, it is not really too far off from the leaders. Overall, its yield should be high enough to appeal to those investors who are seeking to maximize the income that they receive from their portfolios.

As regular readers might remember, we have previously discussed Tortoise Power and Energy Infrastructure Fund, but it has been quite a while. My last article on this fund was published in late January 2021. At the time, I complained about the fund’s low yield, but it was very difficult to find anything with a reasonable yield in the months following the pandemic. It is nice to see that the fund has improved since that time, even as it managed to deliver a respectable performance. As we can see here, the fund’s share price has appreciated by 35.82% since the date that article was published. This is actually not too much worse than the 37.77% gain that the S&P 500 Index (SP500) has delivered over the same period:

This is something that will undoubtedly appeal to most income-focused investors. Many investors are willing to sacrifice some price appreciation in exchange for a higher yield, and the comparative performance of the fund relative to the income is probably close enough to be acceptable for anyone in that category.

However, investors in the Tortoise Power and Energy Infrastructure Fund actually did a lot better than the chart above would suggest. As I stated in a recent article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

When we include the distributions paid out by Tortoise Power and Energy Infrastructure Fund in the above chart, we get a very different picture indeed:

As shown here, over the three years and four months that have passed since we previously discussed this fund, investors in Tortoise Power and Energy Infrastructure Fund have realized a 75.99% total return. This is more than double the total return that was provided by the S&P 500 Index over the same period. Obviously, any income-oriented investor will appreciate this performance.

However, a fund’s past performance is no guarantee of future results. Rather, we need to look at the fund’s assets and market positioning today to make an educated determination of where it will be in the future. The remainder of this article will focus on this.

About The Fund

According to the fund’s website, Tortoise Power and Energy Infrastructure has the primary objective of providing its investors with a very high level of current income. This is interesting given the strategy that the fund employs to achieve its objective. The website does not go into great detail about its strategy, but it does make the following statement:

[The Fund provides] exposure to power and energy infrastructure fixed income securities as well as dividend paying equity securities.

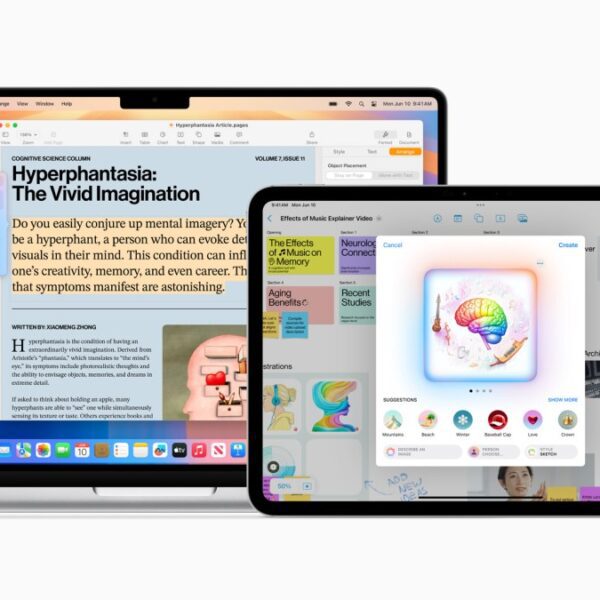

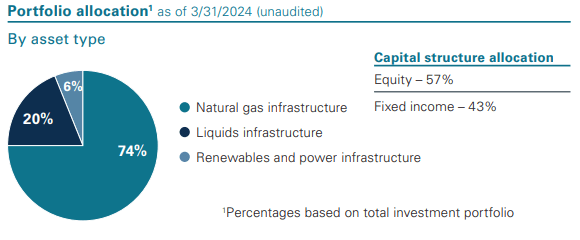

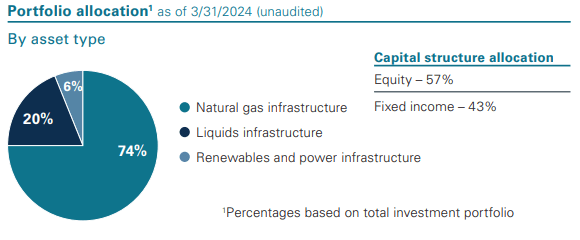

This tells us that Tortoise Power and Energy Infrastructure Fund invests in both fixed-income and common equity securities, which we already deduced from the Morningstar classification assigned to this fund. The fact sheet states that the fund is more heavily weighted to common equities than fixed-income securities right now:

Tortoise EcoFin

As I have stated in numerous previous articles (such as this one):

Common equity is by its very nature a total return vehicle since investors purchase common equity both to receive an income in the form of dividends or distributions as well as benefit from the capital gains that should accompany the growth and prosperity of the issuing company.

Fixed-income securities, on the other hand, are income vehicles. However, we would ordinarily expect a fund that invests the majority of its assets in common equities to be focused on total return (a combination of income and capital appreciation) rather than simply on the provision of current income. This fund’s website implies that it is only trying to maximize income.

The fact that this fund is weighted towards equity instead of debt is a change from the last time that we discussed it. In the previous article on this fund, we saw that Tortoise Power and Energy Infrastructure Fund had 59% of its assets invested in fixed-income securities and 41% invested in common equity. Today, it is almost the opposite of this. This is not really a huge surprise, given the relative performance of common equity compared to fixed-income securities over the past three years:

This chart compares the SPDR S&P 500 Index ETF (SPY) against the Bloomberg U.S. Aggregate Bond Index (AGG) and the Bloomberg U.S. High Yield Very Liquid Index (JNK). In other words, large-cap common stocks against investment-grade and junk bonds. As we can clearly see, common stocks have substantially outperformed bonds over the past three years. Thus, logically, common equities would have seen their relative weighting in the fund increase since our previous discussion even if the fund made no trades at all. Indeed, that could be what has happened here, since the fund only had a 9.72% portfolio turnover in its most recent fiscal year. This low turnover suggests that the fund does have very limited trading activity.

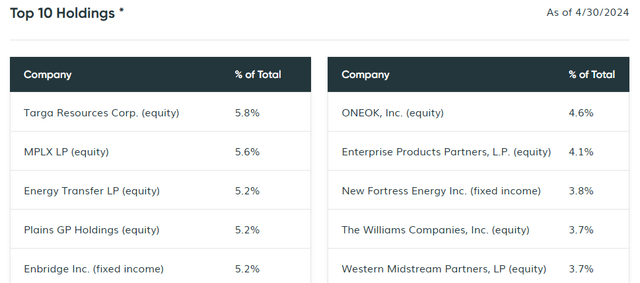

The fact that Tortoise Power and Energy Infrastructure Fund has a current income objective could come from the fact that many of its equity holdings have fairly high yields. Here are the largest positions in this fund as of the time of writing:

Here are the yields of these assets:

|

Company Name |

Current Yield |

|

Targa Resources Corp. (TRGP) |

2.55% |

|

MPLX LP (MPLX) |

8.32% |

|

Energy Transfer LP (ET) |

7.87% |

|

Plains GP Holdings (PAGP) |

6.31% |

|

Enbridge Inc. (ENB) |

9.04% |

|

ONEOK (OKE) |

4.79% |

|

Enterprise Products Partners, L.P. (EPD) |

7.19% |

|

New Fortress Energy Inc. (NFE) |

1.46% |

|

The Williams Companies (WMB) |

4.58% |

|

Western Midstream Partners, LP (WES) |

9.07% |

All of these companies have current yields that are well above those of the large-cap indices, but New Fortress Energy is admittedly not particularly impressive when compared to the Dow Jones Industrial Average. However, the fund is not holding the common stock of New Fortress Energy. As the original chart shows, the fund’s positions in Enbridge and New Fortress Energy are both fixed-income securities issued by these companies. The website does not state which fixed-income securities the fund is holding, however.

The fund’s annual report shows bond positions in securities issued by Enbridge and New Fortress Energy:

|

Issuer |

Maturity Date |

Coupon Yield |

|

Enbridge |

7/15/2077 |

5.50% |

|

New Fortress Energy |

9/30/2026 |

6.50% |

There is no guarantee that these are the corporate bonds shown in the largest positions list, although both of them do account for fairly sizable portions of the fund’s listed total assets. When we consider that the fund has a fairly low annual turnover, though, it seems likely that these are the bonds shown in the largest positions list.

It is curious that the management of Tortoise Power and Energy Infrastructure Fund would opt for Enbridge’s bonds as opposed to its common stock. As of the time of writing, the common stock has a substantially higher yield than the coupon of that bond. The bond is trading discounted to face value, so it has a yield-to-maturity of 5.84% at the current price (94.29% of par value), but even that is substantially less than the yield of the common stock. Surely, it would make more sense for the fund to purchase the common stock and earn a higher income, so it is confusing why the fund would be holding the lower-yielding long-term bonds instead. If the fund’s management expected that the company would encounter financial trouble and thus needed the protection inherent in a bond investment, it would certainly just avoid the company altogether.

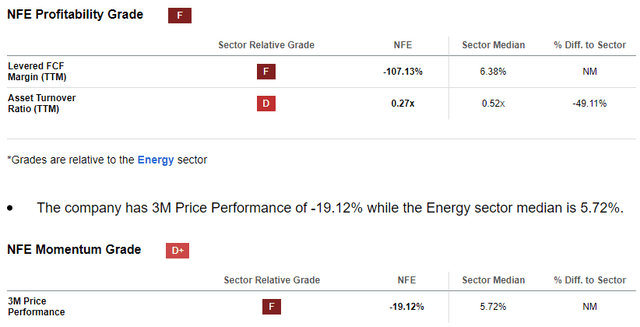

The New Fortress Energy bonds, on the other hand, do make some sense right now. The bond has a substantially higher coupon yield than the common stock, so that works well with the fund’s current income objective. In addition, Seeking Alpha’s Quant Ratings assign a very low score to New Fortress Energy common stock due to poor profitability and momentum:

The company is less profitable than the energy sector as a whole, and the stock is one of the few energy sector companies that has been getting punished by the market over the last three months. The bonds issued by the company should be spared some of the carnage because of the higher claim on the company’s cash flows and the fact that it has to make coupon payments on the bonds regardless. Thus, the fund’s favoritism of New Fortress Energy bonds over that company’s common stock could be a good thing right now.

Leverage

As is the case with most closed-end funds, Tortoise Power and Energy Infrastructure Fund employs leverage as a method of boosting the effective yield and total return that it earns from its assets. I explained how this works in a number of previous articles on other funds. To paraphrase myself:

In short, the fund is borrowing money and using that borrowed money to purchase common equities and fixed-income securities issued by companies that are engaged in the energy infrastructure space. As long as the total return that the fund earns from the purchased assets is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will normally be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally prefer that a fund’s leverage be less than a third as a percentage of its assets for this reason.

As of the time of writing, Tortoise Power and Energy Infrastructure Fund has leveraged assets comprising 18.80% of its portfolio. This is obviously well below the one-third of its assets that I would prefer. However, it is always a good idea to compare a fund’s leverage to its peers to determine whether the fund is using an appropriate level of leverage given its strategy. Here is how the fund compares to its peers:

|

Fund Name |

Leverage Ratio |

|

Tortoise Power and Energy Infrastructure Fund |

18.80% |

|

Allspring Utilities and High Income Fund |

23.10% |

|

Bexil Investment Trust |

10.00% |

|

Franklin Universal Trust |

23.77% |

|

John Hancock Tax-Advantaged Dividend Income Fund |

34.97% |

|

Tri-Continental Corp. |

2.00% |

|

Virtus Equity & Convertible Income Fund |

0.00% |

(All figures from CEF Data.)

As we can see, Tortoise Power and Energy Infrastructure Fund has a level of leverage that is lower than many of its peers. The fund’s leverage is not the lowest that can be obtained, but not all of these funds are using identical strategies. The funds whose strategies are closest to this one are the Allspring Utilities and High Income Fund, the Franklin Universal Trust, and the John Hancock Tax-Advantaged Dividend Income Fund. Of these, Tortoise Power and Energy Infrastructure Fund has the lowest level of leverage.

Thus, it does not appear that the fund is using too much leverage in the pursuit of its objectives. Overall, investors should be able to sleep reasonably well here.

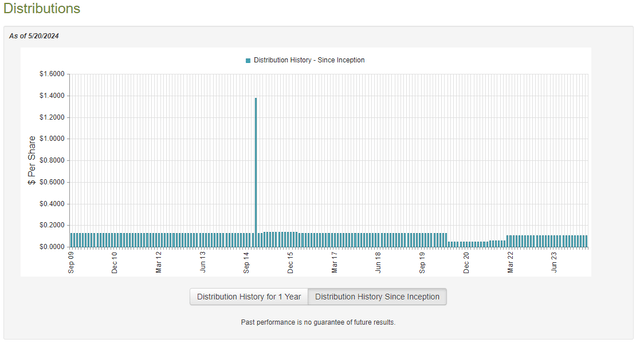

Distribution Analysis

The primary objective of Tortoise Power and Energy Infrastructure Fund is to provide its shareholders with a high level of current income. In accordance with this objective, the fund pays a monthly distribution of $0.1050 per share ($1.26 per share annually). This gives it a yield of 7.97% at the current price.

The fund has not been consistent with its distribution over the years, as clearly seen here:

We can see a large distribution cut back in 2020. Most funds that had investments in energy infrastructure did as well, though. The fund has since been able to mostly restore its distribution, although it is still below the $0.1250 monthly that it had before the pandemic.

The fund has been very consistent with its distribution since 2022, but we still want to ensure that it can actually afford the payout. The annual report for the full-year period that ended on November 30, 2023, should help us with this respect. This is obviously much newer than the financial information that we had available to us three years ago, so it will work very well as an update.

For the full-year period that ended on November 30, 2023, Tortoise Power and Energy Infrastructure Fund received $4,298,202 in dividends and distributions along with $3,313,813 in interest from the assets in its portfolio. However, a sizable portion of this money came from companies that are structured as master limited partnerships, so they are not considered to be investment income for tax or accounting purposes. As such, the fund reported a total investment income of $4,573,399 for the period. It paid its expenses out of this amount, which left it with $1,980,315 available for shareholders. This was not sufficient to cover the $7,779,670 that the fund actually paid out in distributions during the period.

The fund was, fortunately, more than able to make up the difference through capital gains. The fund reported net realized gains of $5,973,783 along with another $1,989,386 net unrealized gains in the full-year period.

Tortoise Power and Energy Infrastructure Fund did see its net assets decline by $2,520,407 after accounting for all inflows and outflows during the period. However, this was only due to a $4,684,221 share buyback. Had the fund not conducted this buyback, its net assets would have increased over the period. Thus, it did technically manage to cover its distributions.

Valuation

Shares of Tortoise Power and Energy Infrastructure Fund are currently trading at an 11.66% discount to net asset value. This is not as attractive as the 13.88% discount that the shares have averaged over the past month. It is still a decent entry point for the fund, however.

Conclusion

In conclusion, Tortoise Power and Energy Infrastructure Fund is a rather unique closed-end fund that invests in both common equity and fixed-income securities issued by pipeline operators and other energy infrastructure companies. The fund has delivered a remarkable performance over the past few years, as it has outperformed the S&P 500 Index by quite a lot while increasing its distribution. The fund shifts between fixed-income and common equities to maximize its returns, which should benefit investors. The yield is also decent, albeit not as good as a pure fixed-income fund can deliver.

Overall, this fund might be worth further investigation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.