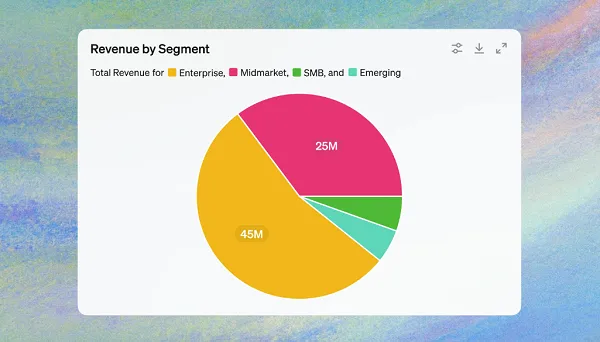

It is robust to assemble a lot conviction in markets this week. 10-year yields within the US are up 3.1 bps to 4.123% in European morning commerce at present. And that comes after a drop yesterday, which adopted an increase on Monday. The push and pull sees yields proceed to maneuver round its 200-day shifting common of round 4.103% presently:

US Treasury 10-year yields (%) every day chart

Within the larger image, the ceiling close to 4.20% and flooring close to 3.80% are key ranges to observe on the chart.

However for now, we’re staying in between that with little or no conviction to essentially check these boundaries. The slight nudge increased in yields at present is protecting the greenback steadier total however buying and selling extra blended. Greenback pairs are largely little modified to this point on the session. The one slight movers are GBP/USD, which is up 0.2% to 1.2627, and USD/CHF, which is up 0.4% to 0.8725 presently.

Going again to the bond market, I wish to spotlight that we do have two upcoming Treasury auctions this week.

The primary can be for 10-year notes later at present after which one other for 30-year notes tomorrow. Contemplating the shortage of key knowledge releases this week, the auctions would possibly find yourself driving the strikes within the bond market within the periods to come back.